| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3917390050 | Doc | 33.1% | CN | US | 2025-05-12 |

| 3917400095 | Doc | 60.3% | CN | US | 2025-05-12 |

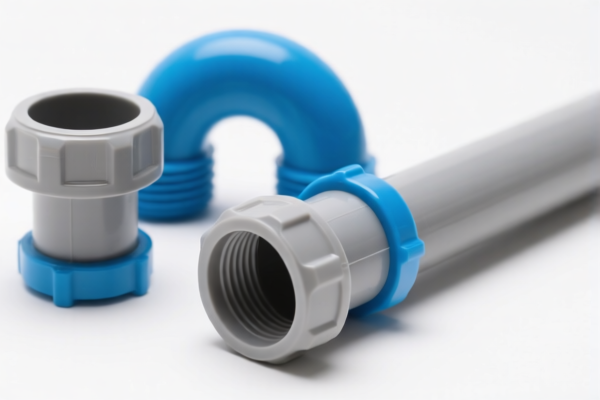

Product Classification: Plastic Building Pipe Fittings (Other)

HS CODE: 3917.39.00.50 and 3917.40.00.95

🔍 Classification Overview

- HS CODE 3917.39.00.50: "Other plastic pipe fittings"

- HS CODE 3917.40.00.95: "Plastic pipe fittings (other types)"

Both classifications fall under Chapter 39 (Plastics and articles thereof) and Heading 3917 (Plastic pipes, tubes, and hoses, of plastics, whether or not fitted with couplings, and other plastic pipe fittings).

📊 Tariff Breakdown (as of now)

HS CODE 3917.39.00.50

- Base Tariff Rate: 3.1%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 33.1%

HS CODE 3917.40.00.95

- Base Tariff Rate: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.3%

⚠️ Important Notes

- April 11, 2025 Special Tariff: A 30% additional tariff will be imposed on both classifications after April 11, 2025. This is a time-sensitive policy and must be accounted for in import planning.

- No Anti-dumping duties are currently listed for these classifications.

- No specific anti-dumping duties on iron or aluminum apply here, as the product is made of plastic.

📌 Proactive Advice for Importers

- Verify Material: Ensure the product is indeed made of plastic and not a composite or metal-plastic hybrid, which may fall under a different HS code.

- Check Unit Price: The tax rate is based on the declared value, so accurate pricing is essential for correct duty calculation.

- Certifications: Confirm if any certifications (e.g., RoHS, REACH, or local import permits) are required for the product in the destination country.

- Consult Customs Broker: For complex cases, especially if the product is a new or modified type of plastic fitting, a customs broker can help ensure correct classification.

Let me know if you need help determining which HS code applies to your specific product type or if you need assistance with customs documentation.

Product Classification: Plastic Building Pipe Fittings (Other)

HS CODE: 3917.39.00.50 and 3917.40.00.95

🔍 Classification Overview

- HS CODE 3917.39.00.50: "Other plastic pipe fittings"

- HS CODE 3917.40.00.95: "Plastic pipe fittings (other types)"

Both classifications fall under Chapter 39 (Plastics and articles thereof) and Heading 3917 (Plastic pipes, tubes, and hoses, of plastics, whether or not fitted with couplings, and other plastic pipe fittings).

📊 Tariff Breakdown (as of now)

HS CODE 3917.39.00.50

- Base Tariff Rate: 3.1%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 33.1%

HS CODE 3917.40.00.95

- Base Tariff Rate: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.3%

⚠️ Important Notes

- April 11, 2025 Special Tariff: A 30% additional tariff will be imposed on both classifications after April 11, 2025. This is a time-sensitive policy and must be accounted for in import planning.

- No Anti-dumping duties are currently listed for these classifications.

- No specific anti-dumping duties on iron or aluminum apply here, as the product is made of plastic.

📌 Proactive Advice for Importers

- Verify Material: Ensure the product is indeed made of plastic and not a composite or metal-plastic hybrid, which may fall under a different HS code.

- Check Unit Price: The tax rate is based on the declared value, so accurate pricing is essential for correct duty calculation.

- Certifications: Confirm if any certifications (e.g., RoHS, REACH, or local import permits) are required for the product in the destination country.

- Consult Customs Broker: For complex cases, especially if the product is a new or modified type of plastic fitting, a customs broker can help ensure correct classification.

Let me know if you need help determining which HS code applies to your specific product type or if you need assistance with customs documentation.

Customer Reviews

No reviews yet.