| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3917400095 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3917390050 | Doc | 33.1% | CN | US | 2025-05-12 |

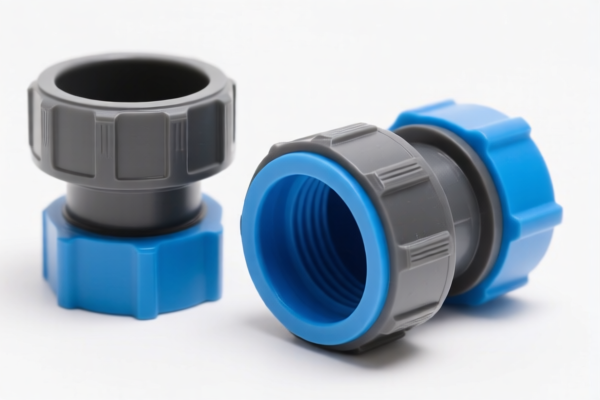

Product Classification: Plastic Cooling Water Pipe Fittings (Other)

HS CODE: 3917.39.00.50 (10-digit code)

🔍 Classification Summary

- Product: Plastic pipe fittings (other types)

- HS Code: 3917.39.00.50

- Total Tax Rate: 33.1%

📊 Tariff Breakdown

- Base Tariff Rate: 3.1%

- Additional Tariff (General): 0.0%

- Special Tariff Imposed After April 2, 2025: 30.0%

⚠️ Important Note: The 30.0% additional tariff applies after April 2, 2025. This is a time-sensitive policy and may affect your customs clearance costs if the product is imported after this date.

📌 Key Considerations

- Material Verification: Ensure the product is made of plastic and not metal (e.g., iron or aluminum), as different materials may fall under different HS codes and be subject to anti-dumping duties.

- Unit Price and Certification: Confirm the unit price and whether any certifications (e.g., RoHS, REACH, or specific import permits) are required for compliance.

- Classification Accuracy: Double-check the product description and technical specifications to ensure it falls under 3917.39.00.50 and not a more specific or different HS code.

📌 Proactive Advice

- Check Import Date: If your import is scheduled after April 2, 2025, be prepared for the 30.0% additional tariff.

- Consult Customs Broker: For complex or high-value shipments, consider working with a customs broker to ensure accurate classification and compliance.

- Document Everything: Keep records of product specifications, invoices, and any certifications to support your classification and tariff calculations.

Let me know if you need help with certification requirements or comparative analysis with other HS codes (e.g., 3917.40.00.95).

Product Classification: Plastic Cooling Water Pipe Fittings (Other)

HS CODE: 3917.39.00.50 (10-digit code)

🔍 Classification Summary

- Product: Plastic pipe fittings (other types)

- HS Code: 3917.39.00.50

- Total Tax Rate: 33.1%

📊 Tariff Breakdown

- Base Tariff Rate: 3.1%

- Additional Tariff (General): 0.0%

- Special Tariff Imposed After April 2, 2025: 30.0%

⚠️ Important Note: The 30.0% additional tariff applies after April 2, 2025. This is a time-sensitive policy and may affect your customs clearance costs if the product is imported after this date.

📌 Key Considerations

- Material Verification: Ensure the product is made of plastic and not metal (e.g., iron or aluminum), as different materials may fall under different HS codes and be subject to anti-dumping duties.

- Unit Price and Certification: Confirm the unit price and whether any certifications (e.g., RoHS, REACH, or specific import permits) are required for compliance.

- Classification Accuracy: Double-check the product description and technical specifications to ensure it falls under 3917.39.00.50 and not a more specific or different HS code.

📌 Proactive Advice

- Check Import Date: If your import is scheduled after April 2, 2025, be prepared for the 30.0% additional tariff.

- Consult Customs Broker: For complex or high-value shipments, consider working with a customs broker to ensure accurate classification and compliance.

- Document Everything: Keep records of product specifications, invoices, and any certifications to support your classification and tariff calculations.

Let me know if you need help with certification requirements or comparative analysis with other HS codes (e.g., 3917.40.00.95).

Customer Reviews

No reviews yet.