| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921905050 | Doc | 34.8% | CN | US | 2025-05-12 |

| 3921904090 | Doc | 34.2% | CN | US | 2025-05-12 |

| 3920992000 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3921902900 | Doc | 59.4% | CN | US | 2025-05-12 |

Here is the structured analysis and classification for the Plastic Film (Composite) product based on the provided HS codes and tax details:

✅ HS CODE: 3921905050

Product Description: Plastic Film for Packaging

- Base Tariff Rate: 4.8%

- Additional Tariff (before April 11, 2025): 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 34.8%

- Notes:

- This code is for plastic films primarily used in packaging.

- The 30% additional tariff applies only after April 11, 2025.

- No anti-dumping duties are mentioned for this category.

✅ HS CODE: 3921904090

Product Description: Plastic Film for Household Use

- Base Tariff Rate: 4.2%

- Additional Tariff (before April 11, 2025): 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 34.2%

- Notes:

- This code applies to plastic films used in household applications.

- The 30% additional tariff applies only after April 11, 2025.

- No anti-dumping duties are mentioned for this category.

✅ HS CODE: 3920992000

Product Description: Plastic Cling Film

- Base Tariff Rate: 4.2%

- Additional Tariff (before April 11, 2025): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 59.2%

- Notes:

- This code is for plastic cling film, commonly used for food packaging.

- A 25% additional tariff is already in effect.

- After April 11, 2025, an additional 30% will be applied.

- Total tax rate will increase significantly after this date.

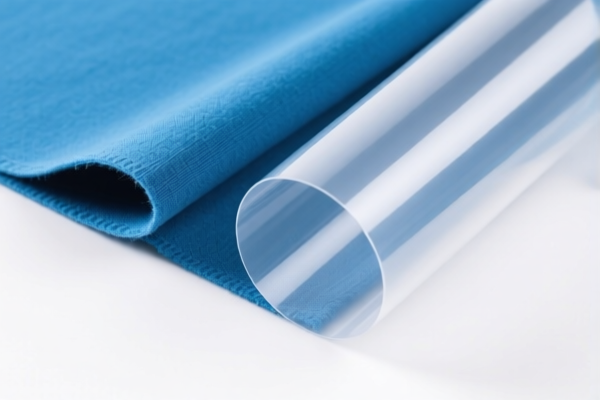

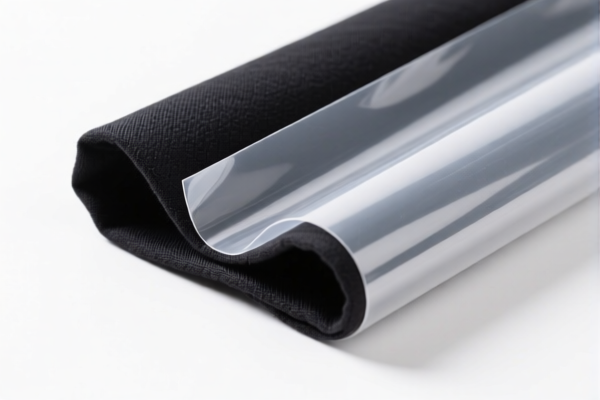

✅ HS CODE: 3921902900

Product Description: Plastic Textile Composite Film (High Density)

- Base Tariff Rate: 4.4%

- Additional Tariff (before April 11, 2025): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 59.4%

- Notes:

- This code applies to high-density composite films used in textile applications.

- A 25% additional tariff is already in effect.

- After April 11, 2025, an additional 30% will be applied.

- Total tax rate will increase significantly after this date.

📌 Proactive Advice for Users:

- Verify Material and Unit Price: Ensure the product is correctly classified based on its material composition and intended use (e.g., packaging vs. household vs. textile).

- Check Required Certifications: Some products may require specific certifications (e.g., food-grade, safety, or environmental compliance).

- Monitor Tariff Changes: The April 11, 2025 deadline is critical. If your shipment is scheduled after this date, the tax rate will increase significantly.

- Consider Alternative HS Codes: If your product can be classified under a different code with lower tariffs, consult a customs expert to explore options.

Let me know if you need help determining the most suitable HS code for your specific product. Here is the structured analysis and classification for the Plastic Film (Composite) product based on the provided HS codes and tax details:

✅ HS CODE: 3921905050

Product Description: Plastic Film for Packaging

- Base Tariff Rate: 4.8%

- Additional Tariff (before April 11, 2025): 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 34.8%

- Notes:

- This code is for plastic films primarily used in packaging.

- The 30% additional tariff applies only after April 11, 2025.

- No anti-dumping duties are mentioned for this category.

✅ HS CODE: 3921904090

Product Description: Plastic Film for Household Use

- Base Tariff Rate: 4.2%

- Additional Tariff (before April 11, 2025): 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 34.2%

- Notes:

- This code applies to plastic films used in household applications.

- The 30% additional tariff applies only after April 11, 2025.

- No anti-dumping duties are mentioned for this category.

✅ HS CODE: 3920992000

Product Description: Plastic Cling Film

- Base Tariff Rate: 4.2%

- Additional Tariff (before April 11, 2025): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 59.2%

- Notes:

- This code is for plastic cling film, commonly used for food packaging.

- A 25% additional tariff is already in effect.

- After April 11, 2025, an additional 30% will be applied.

- Total tax rate will increase significantly after this date.

✅ HS CODE: 3921902900

Product Description: Plastic Textile Composite Film (High Density)

- Base Tariff Rate: 4.4%

- Additional Tariff (before April 11, 2025): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 59.4%

- Notes:

- This code applies to high-density composite films used in textile applications.

- A 25% additional tariff is already in effect.

- After April 11, 2025, an additional 30% will be applied.

- Total tax rate will increase significantly after this date.

📌 Proactive Advice for Users:

- Verify Material and Unit Price: Ensure the product is correctly classified based on its material composition and intended use (e.g., packaging vs. household vs. textile).

- Check Required Certifications: Some products may require specific certifications (e.g., food-grade, safety, or environmental compliance).

- Monitor Tariff Changes: The April 11, 2025 deadline is critical. If your shipment is scheduled after this date, the tax rate will increase significantly.

- Consider Alternative HS Codes: If your product can be classified under a different code with lower tariffs, consult a customs expert to explore options.

Let me know if you need help determining the most suitable HS code for your specific product.

Customer Reviews

No reviews yet.