| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3917310000 | Doc | 58.1% | CN | US | 2025-05-12 |

| 3917390050 | Doc | 33.1% | CN | US | 2025-05-12 |

| 3917320050 | Doc | 58.1% | CN | US | 2025-05-12 |

| 5909002000 | Doc | 58.3% | CN | US | 2025-05-12 |

| 3917400095 | Doc | 60.3% | CN | US | 2025-05-12 |

Here is the structured classification and tariff information for Plastic Hoses for Irrigation, based on the provided HS codes and tax details:

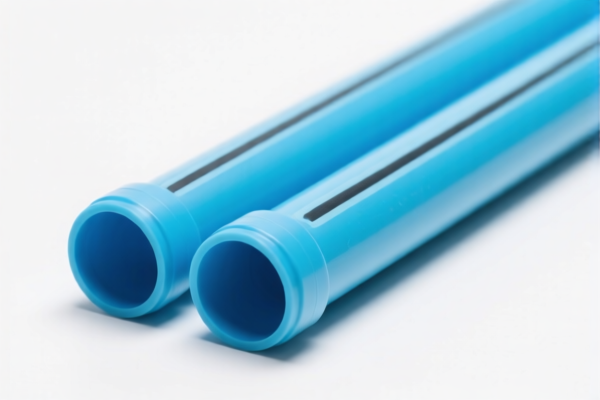

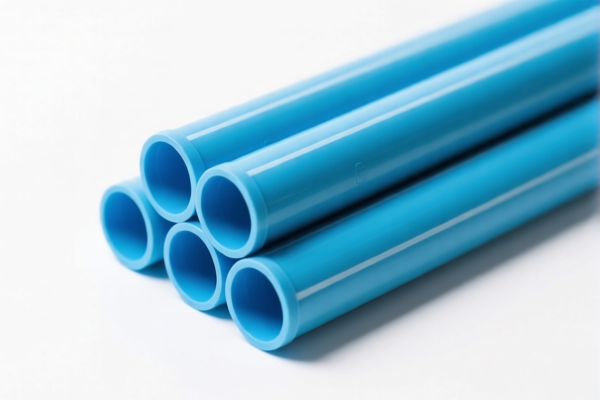

✅ HS CODE: 3917310000

Product Description: Agricultural irrigation plastic hoses, meeting the classification under HS code 3917, which refers to plastic hoses. These hoses typically need to meet certain pressure resistance requirements.

- Base Tariff Rate: 3.1%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 58.1%

- Key Notes:

- This code is suitable for general-purpose irrigation plastic hoses.

- Ensure the product meets pressure and durability standards for agricultural use.

- Verify if any specific certifications (e.g., ISO, CE) are required for export or import.

✅ HS CODE: 3917390050

Product Description: Agricultural irrigation hoses, classified under HS code 3917390050, which covers plastic tubes, fittings, and hoses.

- Base Tariff Rate: 3.1%

- Additional Tariff (General): 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 33.1%

- Key Notes:

- This code is more favorable in terms of additional tariffs.

- Ensure the product is clearly categorized as a hose and not a general-purpose tube.

- Confirm if the product is sold with or without fittings, as this may affect classification.

✅ HS CODE: 3917320050

Product Description: Plastic irrigation tubes, classified under HS code 3917320050, which refers to non-reinforced plastic tubes without fittings.

- Base Tariff Rate: 3.1%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 58.1%

- Key Notes:

- This code applies to simple, non-reinforced plastic tubes used in irrigation.

- Ensure the product is not reinforced or combined with other materials (e.g., metal).

- Confirm if the product is sold as a standalone tube or with fittings.

✅ HS CODE: 5909002000

Product Description: Agricultural irrigation textile hoses, classified under HS code 5909002000, which refers to textile hoses.

- Base Tariff Rate: 3.3%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 58.3%

- Key Notes:

- This code is for textile-based hoses, not plastic.

- Ensure the product is made of textile materials (e.g., woven fabric, synthetic fibers).

- Confirm if the hose is used for irrigation or other purposes (e.g., industrial).

✅ HS CODE: 3917400095

Product Description: Plastic irrigation fittings, classified under HS code 3917400095, which refers to plastic fittings.

- Base Tariff Rate: 5.3%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.3%

- Key Notes:

- This code is for fittings used with irrigation systems.

- Ensure the product is clearly identified as a fitting and not a complete hose.

- Confirm if the fittings are compatible with standard irrigation systems.

📌 Proactive Advice for Importers/Exporters:

- Verify Material and Unit Price: Confirm whether the product is made of plastic, textile, or a combination of materials. This will determine the correct HS code.

- Check Required Certifications: Some countries may require specific certifications (e.g., CE, ISO, or agricultural use approvals).

- Monitor Tariff Changes: The April 11, 2025 special tariff applies to all the above codes. Ensure your import/export plans are adjusted accordingly.

- Review Anti-Dumping Duties: If the product contains iron or aluminum components, check for applicable anti-dumping duties (not listed here, but may apply depending on the country of origin).

Let me know if you need help determining the most suitable HS code for your specific product. Here is the structured classification and tariff information for Plastic Hoses for Irrigation, based on the provided HS codes and tax details:

✅ HS CODE: 3917310000

Product Description: Agricultural irrigation plastic hoses, meeting the classification under HS code 3917, which refers to plastic hoses. These hoses typically need to meet certain pressure resistance requirements.

- Base Tariff Rate: 3.1%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 58.1%

- Key Notes:

- This code is suitable for general-purpose irrigation plastic hoses.

- Ensure the product meets pressure and durability standards for agricultural use.

- Verify if any specific certifications (e.g., ISO, CE) are required for export or import.

✅ HS CODE: 3917390050

Product Description: Agricultural irrigation hoses, classified under HS code 3917390050, which covers plastic tubes, fittings, and hoses.

- Base Tariff Rate: 3.1%

- Additional Tariff (General): 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 33.1%

- Key Notes:

- This code is more favorable in terms of additional tariffs.

- Ensure the product is clearly categorized as a hose and not a general-purpose tube.

- Confirm if the product is sold with or without fittings, as this may affect classification.

✅ HS CODE: 3917320050

Product Description: Plastic irrigation tubes, classified under HS code 3917320050, which refers to non-reinforced plastic tubes without fittings.

- Base Tariff Rate: 3.1%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 58.1%

- Key Notes:

- This code applies to simple, non-reinforced plastic tubes used in irrigation.

- Ensure the product is not reinforced or combined with other materials (e.g., metal).

- Confirm if the product is sold as a standalone tube or with fittings.

✅ HS CODE: 5909002000

Product Description: Agricultural irrigation textile hoses, classified under HS code 5909002000, which refers to textile hoses.

- Base Tariff Rate: 3.3%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 58.3%

- Key Notes:

- This code is for textile-based hoses, not plastic.

- Ensure the product is made of textile materials (e.g., woven fabric, synthetic fibers).

- Confirm if the hose is used for irrigation or other purposes (e.g., industrial).

✅ HS CODE: 3917400095

Product Description: Plastic irrigation fittings, classified under HS code 3917400095, which refers to plastic fittings.

- Base Tariff Rate: 5.3%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.3%

- Key Notes:

- This code is for fittings used with irrigation systems.

- Ensure the product is clearly identified as a fitting and not a complete hose.

- Confirm if the fittings are compatible with standard irrigation systems.

📌 Proactive Advice for Importers/Exporters:

- Verify Material and Unit Price: Confirm whether the product is made of plastic, textile, or a combination of materials. This will determine the correct HS code.

- Check Required Certifications: Some countries may require specific certifications (e.g., CE, ISO, or agricultural use approvals).

- Monitor Tariff Changes: The April 11, 2025 special tariff applies to all the above codes. Ensure your import/export plans are adjusted accordingly.

- Review Anti-Dumping Duties: If the product contains iron or aluminum components, check for applicable anti-dumping duties (not listed here, but may apply depending on the country of origin).

Let me know if you need help determining the most suitable HS code for your specific product.

Customer Reviews

No reviews yet.