| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3920995000 | Doc | 60.8% | CN | US | 2025-05-12 |

| 3920992000 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3926909400 | Doc | 55.0% | CN | US | 2025-05-12 |

| 3921905050 | Doc | 34.8% | CN | US | 2025-05-12 |

| 3919905030 | Doc | 60.8% | CN | US | 2025-05-12 |

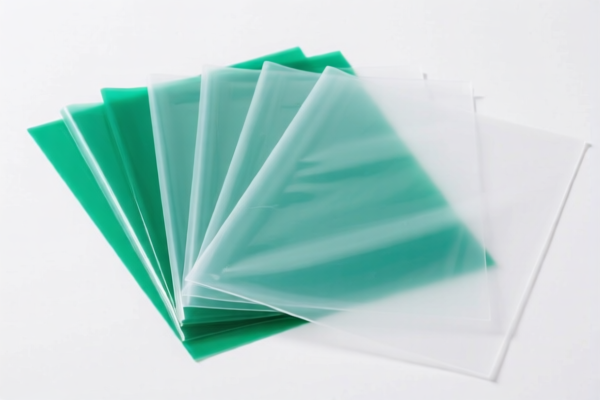

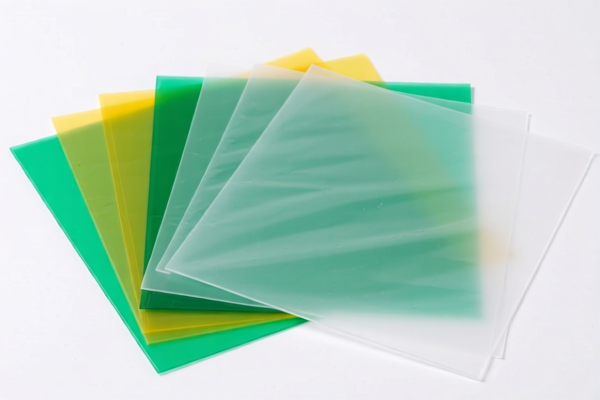

Here is the detailed classification and tariff information for plastic insulation sheets and related products, based on the provided HS codes and tax details:

📦 Product Classification Overview: Plastic Insulation Sheets and Related Products

🔢 HS CODE: 3920995000 – Plastic Insulation Sheets

- Base Tariff Rate: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.8%

- Notes:

- This is the most common classification for general plastic insulation sheets.

- Ensure the product is not classified under a more specific HS code (e.g., 3920992000 for films).

🔢 HS CODE: 3920992000 – Plastic Insulation Films

- Base Tariff Rate: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 59.2%

- Notes:

- This code applies to thin plastic films used for insulation.

- Confirm the thickness and intended use to avoid misclassification.

🔢 HS CODE: 3926909400 – Plastic Card Insulation Membrane

- Base Tariff Rate: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 55.0%

- Notes:

- This is for specialized insulation membranes used in plastic cards.

- May require additional documentation or certification for specific applications.

🔢 HS CODE: 3921905050 – Plastic Insulation Strips

- Base Tariff Rate: 4.8%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 34.8%

- Notes:

- This code is for narrow strips used in insulation.

- Lower base tariff, but still subject to the 30% special tariff after April 11, 2025.

🔢 HS CODE: 3919905030 – Insulated Plastic Tape

- Base Tariff Rate: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.8%

- Notes:

- This is for adhesive plastic tapes with insulation properties.

- Ensure the product is not classified under a different category (e.g., adhesive tapes).

⚠️ Important Reminders:

- April 11, 2025 Special Tariff:

- All the above products are subject to an additional 30% tariff after April 11, 2025.

-

This is a time-sensitive policy—check the exact date of import to avoid unexpected costs.

-

Anti-Dumping Duties:

- If the product contains iron or aluminum components, additional anti-dumping duties may apply.

-

Confirm the composition of the product and consult customs or a compliance expert if in doubt.

-

Certifications and Documentation:

- Verify if certifications (e.g., RoHS, REACH, or specific industry standards) are required for the product.

- Ensure material specifications and unit price are clearly documented for customs clearance.

✅ Proactive Advice:

- Double-check the HS code based on the product's exact description, material, and use.

- Consult a customs broker or HS code database for the most up-to-date classification.

- Keep records of product specifications, invoices, and certifications to support customs declarations.

Let me know if you need help determining the correct HS code for a specific product description. Here is the detailed classification and tariff information for plastic insulation sheets and related products, based on the provided HS codes and tax details:

📦 Product Classification Overview: Plastic Insulation Sheets and Related Products

🔢 HS CODE: 3920995000 – Plastic Insulation Sheets

- Base Tariff Rate: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.8%

- Notes:

- This is the most common classification for general plastic insulation sheets.

- Ensure the product is not classified under a more specific HS code (e.g., 3920992000 for films).

🔢 HS CODE: 3920992000 – Plastic Insulation Films

- Base Tariff Rate: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 59.2%

- Notes:

- This code applies to thin plastic films used for insulation.

- Confirm the thickness and intended use to avoid misclassification.

🔢 HS CODE: 3926909400 – Plastic Card Insulation Membrane

- Base Tariff Rate: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 55.0%

- Notes:

- This is for specialized insulation membranes used in plastic cards.

- May require additional documentation or certification for specific applications.

🔢 HS CODE: 3921905050 – Plastic Insulation Strips

- Base Tariff Rate: 4.8%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 34.8%

- Notes:

- This code is for narrow strips used in insulation.

- Lower base tariff, but still subject to the 30% special tariff after April 11, 2025.

🔢 HS CODE: 3919905030 – Insulated Plastic Tape

- Base Tariff Rate: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.8%

- Notes:

- This is for adhesive plastic tapes with insulation properties.

- Ensure the product is not classified under a different category (e.g., adhesive tapes).

⚠️ Important Reminders:

- April 11, 2025 Special Tariff:

- All the above products are subject to an additional 30% tariff after April 11, 2025.

-

This is a time-sensitive policy—check the exact date of import to avoid unexpected costs.

-

Anti-Dumping Duties:

- If the product contains iron or aluminum components, additional anti-dumping duties may apply.

-

Confirm the composition of the product and consult customs or a compliance expert if in doubt.

-

Certifications and Documentation:

- Verify if certifications (e.g., RoHS, REACH, or specific industry standards) are required for the product.

- Ensure material specifications and unit price are clearly documented for customs clearance.

✅ Proactive Advice:

- Double-check the HS code based on the product's exact description, material, and use.

- Consult a customs broker or HS code database for the most up-to-date classification.

- Keep records of product specifications, invoices, and certifications to support customs declarations.

Let me know if you need help determining the correct HS code for a specific product description.

Customer Reviews

No reviews yet.