| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3917390050 | Doc | 33.1% | CN | US | 2025-05-12 |

| 3917400095 | Doc | 60.3% | CN | US | 2025-05-12 |

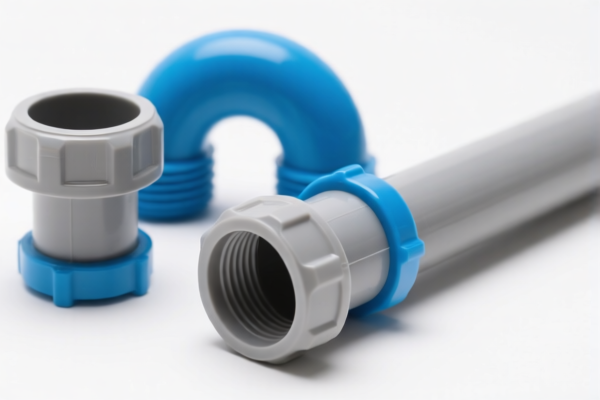

Product Classification: Plastic New Type Pipe Fittings (Other)

Based on the provided HS codes and tax details, here is the structured breakdown for customs compliance and tariff considerations:

🔍 HS CODE: 3917390050

Description: Other plastic pipe fittings

Total Tax Rate: 33.1%

- Base Tariff Rate: 3.1%

- Additional Tariffs: 0.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Anti-dumping duties on iron and aluminum: Not applicable (plastic products)

📌 Proactive Advice:

- Confirm the material composition of the fittings (e.g., PVC, PE, etc.) to ensure correct classification.

- Check if the product is subject to any specific trade agreements or preferential tariffs.

- Ensure certifications (e.g., RoHS, REACH) are in place if exporting to the EU or other regulated markets.

🔍 HS CODE: 3917400095

Description: Plastic pipe fittings (other types)

Total Tax Rate: 60.3%

- Base Tariff Rate: 5.3%

- Additional Tariffs: 25.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Anti-dumping duties on iron and aluminum: Not applicable (plastic products)

📌 Proactive Advice:

- Verify the unit price and product type to ensure the correct HS code is applied.

- Be aware of the cumulative effect of base + additional + special tariffs (5.3% + 25% + 30% = 60.3%).

- If exporting to China, ensure compliance with import regulations and customs documentation.

⚠️ Important Notes:

- April 11, 2025 is a critical date for tariff changes. Ensure your import/export timeline accounts for this.

- Plastic products are generally not subject to anti-dumping duties on iron/aluminum, but always verify with the latest customs updates.

- If your product is not clearly defined under these HS codes, consider consulting a customs broker or HS code classifier for more precise classification.

Let me know if you need help with certification requirements or customs documentation for these products.

Product Classification: Plastic New Type Pipe Fittings (Other)

Based on the provided HS codes and tax details, here is the structured breakdown for customs compliance and tariff considerations:

🔍 HS CODE: 3917390050

Description: Other plastic pipe fittings

Total Tax Rate: 33.1%

- Base Tariff Rate: 3.1%

- Additional Tariffs: 0.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Anti-dumping duties on iron and aluminum: Not applicable (plastic products)

📌 Proactive Advice:

- Confirm the material composition of the fittings (e.g., PVC, PE, etc.) to ensure correct classification.

- Check if the product is subject to any specific trade agreements or preferential tariffs.

- Ensure certifications (e.g., RoHS, REACH) are in place if exporting to the EU or other regulated markets.

🔍 HS CODE: 3917400095

Description: Plastic pipe fittings (other types)

Total Tax Rate: 60.3%

- Base Tariff Rate: 5.3%

- Additional Tariffs: 25.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Anti-dumping duties on iron and aluminum: Not applicable (plastic products)

📌 Proactive Advice:

- Verify the unit price and product type to ensure the correct HS code is applied.

- Be aware of the cumulative effect of base + additional + special tariffs (5.3% + 25% + 30% = 60.3%).

- If exporting to China, ensure compliance with import regulations and customs documentation.

⚠️ Important Notes:

- April 11, 2025 is a critical date for tariff changes. Ensure your import/export timeline accounts for this.

- Plastic products are generally not subject to anti-dumping duties on iron/aluminum, but always verify with the latest customs updates.

- If your product is not clearly defined under these HS codes, consider consulting a customs broker or HS code classifier for more precise classification.

Let me know if you need help with certification requirements or customs documentation for these products.

Customer Reviews

No reviews yet.