| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3917390050 | Doc | 33.1% | CN | US | 2025-05-12 |

| 3917400095 | Doc | 60.3% | CN | US | 2025-05-12 |

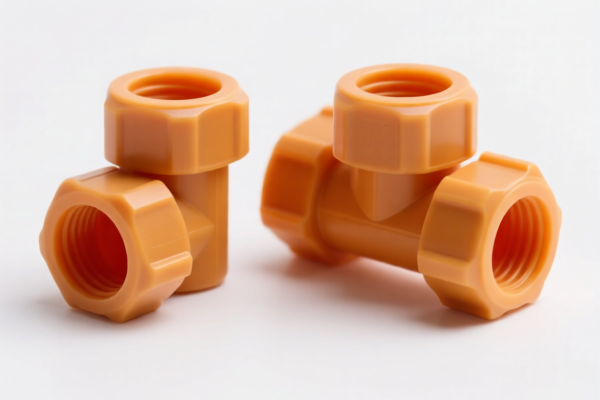

Product Classification: Plastic Oil Pipe Fittings (Other)

Based on the provided HS codes and tax details, here is the structured breakdown for customs compliance and tariff considerations:

🔍 HS CODE: 3917390050

Description: Other plastic pipe fittings

Total Tax Rate: 33.1%

- Base Tariff Rate: 3.1%

- Additional Tariffs: 0.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Anti-dumping duties on iron and aluminum: Not applicable (this product is plastic, not metal)

🔍 HS CODE: 3917400095

Description: Plastic pipe fittings (other types)

Total Tax Rate: 60.3%

- Base Tariff Rate: 5.3%

- Additional Tariffs: 25.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Anti-dumping duties on iron and aluminum: Not applicable (this product is plastic, not metal)

⚠️ Important Notes and Recommendations:

- Time-sensitive policy alert:

-

Starting April 11, 2025, an additional 30.0% tariff will be applied to both HS codes. Ensure your import timeline accounts for this.

-

Material verification:

-

Confirm the material composition of the fittings (e.g., PVC, PE, PP, etc.) to ensure correct classification. Misclassification can lead to penalties or delays.

-

Certifications required:

-

Check if product certifications (e.g., ISO, CE, RoHS) are required for import into the destination country.

-

Unit price and quantity:

-

Verify the unit price and quantity for accurate tax calculation, especially if the product is subject to ad valorem (value-based) tariffs.

-

Customs documentation:

- Ensure all customs documentation (commercial invoice, packing list, bill of lading) is accurate and consistent with the HS code and product description.

✅ Proactive Advice:

- If you are importing large quantities or repeatedly, consider customs broker assistance to ensure compliance and avoid delays.

- Keep updated records of product specifications and supplier information for audit purposes.

Let me know if you need help determining the correct HS code based on specific product details.

Product Classification: Plastic Oil Pipe Fittings (Other)

Based on the provided HS codes and tax details, here is the structured breakdown for customs compliance and tariff considerations:

🔍 HS CODE: 3917390050

Description: Other plastic pipe fittings

Total Tax Rate: 33.1%

- Base Tariff Rate: 3.1%

- Additional Tariffs: 0.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Anti-dumping duties on iron and aluminum: Not applicable (this product is plastic, not metal)

🔍 HS CODE: 3917400095

Description: Plastic pipe fittings (other types)

Total Tax Rate: 60.3%

- Base Tariff Rate: 5.3%

- Additional Tariffs: 25.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Anti-dumping duties on iron and aluminum: Not applicable (this product is plastic, not metal)

⚠️ Important Notes and Recommendations:

- Time-sensitive policy alert:

-

Starting April 11, 2025, an additional 30.0% tariff will be applied to both HS codes. Ensure your import timeline accounts for this.

-

Material verification:

-

Confirm the material composition of the fittings (e.g., PVC, PE, PP, etc.) to ensure correct classification. Misclassification can lead to penalties or delays.

-

Certifications required:

-

Check if product certifications (e.g., ISO, CE, RoHS) are required for import into the destination country.

-

Unit price and quantity:

-

Verify the unit price and quantity for accurate tax calculation, especially if the product is subject to ad valorem (value-based) tariffs.

-

Customs documentation:

- Ensure all customs documentation (commercial invoice, packing list, bill of lading) is accurate and consistent with the HS code and product description.

✅ Proactive Advice:

- If you are importing large quantities or repeatedly, consider customs broker assistance to ensure compliance and avoid delays.

- Keep updated records of product specifications and supplier information for audit purposes.

Let me know if you need help determining the correct HS code based on specific product details.

Customer Reviews

No reviews yet.