| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3917310000 | Doc | 58.1% | CN | US | 2025-05-12 |

| 3917320050 | Doc | 58.1% | CN | US | 2025-05-12 |

| 3925900000 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3917400050 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3917290050 | Doc | 58.1% | CN | US | 2025-05-12 |

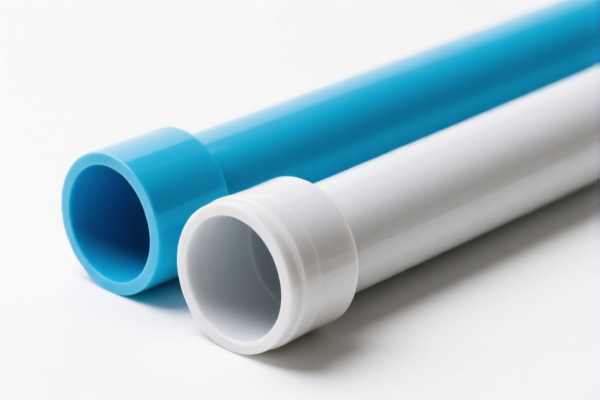

Here is the detailed classification and tariff information for plastic pipes for construction, based on the provided HS codes and tax details:

📦 Product Classification: Plastic Pipes for Construction

🔢 HS CODE: 3917310000

- Description: Building plastic pipes

- Total Tax Rate: 58.1%

- Breakdown:

- Base Tariff: 3.1%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code applies to general plastic pipes used in construction.

🔢 HS CODE: 3917320050

- Description: Plastic building pipes

- Total Tax Rate: 58.1%

- Breakdown:

- Base Tariff: 3.1%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: Similar to 3917310000, but may include specific types or specifications.

🔢 HS CODE: 3925900000

- Description: Building polyethylene plastic pipe materials

- Total Tax Rate: 60.3%

- Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is for polyethylene (PE) pipes used in construction, which may have a higher base tariff due to material type.

🔢 HS CODE: 3917400050

- Description: Plastic building drainage pipe fittings

- Total Tax Rate: 60.3%

- Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code applies to fittings used in drainage systems, which may be subject to higher tariffs due to complexity or material.

🔢 HS CODE: 3917290050

- Description: Short plastic pipes for construction

- Total Tax Rate: 58.1%

- Breakdown:

- Base Tariff: 3.1%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is for shorter lengths of plastic pipes, possibly used in specialized applications.

⚠️ Important Notes and Recommendations:

-

April 11, 2025 Special Tariff:

A 30.0% additional tariff will be applied to all the above HS codes after April 11, 2025. Ensure your import timeline is planned accordingly. -

Material and Certification:

- Verify the material composition (e.g., polyethylene, PVC, etc.) to ensure correct HS code classification.

-

Confirm if certifications (e.g., ISO, CE, or local standards) are required for customs clearance.

-

Unit Price and Tax Calculation:

- The total tax rate is calculated as:

Base Tariff + Additional Tariff + Special Tariff (if applicable) -

For example:

3.1% + 25.0% + 30.0% = 58.1%(for most codes) -

Anti-Dumping Duties:

- No specific anti-dumping duties are mentioned for these HS codes, but always check for any country-specific duties or trade agreements that may apply.

✅ Proactive Advice:

- Double-check the product description and material to ensure the correct HS code is used.

- Consult with customs brokers or tax consultants for the most up-to-date and accurate tariff information.

- Keep records of product specifications, invoices, and certifications to support customs declarations.

Let me know if you need help with HS code selection or tax calculation for a specific product. Here is the detailed classification and tariff information for plastic pipes for construction, based on the provided HS codes and tax details:

📦 Product Classification: Plastic Pipes for Construction

🔢 HS CODE: 3917310000

- Description: Building plastic pipes

- Total Tax Rate: 58.1%

- Breakdown:

- Base Tariff: 3.1%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code applies to general plastic pipes used in construction.

🔢 HS CODE: 3917320050

- Description: Plastic building pipes

- Total Tax Rate: 58.1%

- Breakdown:

- Base Tariff: 3.1%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: Similar to 3917310000, but may include specific types or specifications.

🔢 HS CODE: 3925900000

- Description: Building polyethylene plastic pipe materials

- Total Tax Rate: 60.3%

- Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is for polyethylene (PE) pipes used in construction, which may have a higher base tariff due to material type.

🔢 HS CODE: 3917400050

- Description: Plastic building drainage pipe fittings

- Total Tax Rate: 60.3%

- Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code applies to fittings used in drainage systems, which may be subject to higher tariffs due to complexity or material.

🔢 HS CODE: 3917290050

- Description: Short plastic pipes for construction

- Total Tax Rate: 58.1%

- Breakdown:

- Base Tariff: 3.1%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is for shorter lengths of plastic pipes, possibly used in specialized applications.

⚠️ Important Notes and Recommendations:

-

April 11, 2025 Special Tariff:

A 30.0% additional tariff will be applied to all the above HS codes after April 11, 2025. Ensure your import timeline is planned accordingly. -

Material and Certification:

- Verify the material composition (e.g., polyethylene, PVC, etc.) to ensure correct HS code classification.

-

Confirm if certifications (e.g., ISO, CE, or local standards) are required for customs clearance.

-

Unit Price and Tax Calculation:

- The total tax rate is calculated as:

Base Tariff + Additional Tariff + Special Tariff (if applicable) -

For example:

3.1% + 25.0% + 30.0% = 58.1%(for most codes) -

Anti-Dumping Duties:

- No specific anti-dumping duties are mentioned for these HS codes, but always check for any country-specific duties or trade agreements that may apply.

✅ Proactive Advice:

- Double-check the product description and material to ensure the correct HS code is used.

- Consult with customs brokers or tax consultants for the most up-to-date and accurate tariff information.

- Keep records of product specifications, invoices, and certifications to support customs declarations.

Let me know if you need help with HS code selection or tax calculation for a specific product.

Customer Reviews

No reviews yet.