| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3917320050 | Doc | 58.1% | CN | US | 2025-05-12 |

| 3917390050 | Doc | 33.1% | CN | US | 2025-05-12 |

| 3917210000 | Doc | 58.1% | CN | US | 2025-05-12 |

| 3917400050 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3917290050 | Doc | 58.1% | CN | US | 2025-05-12 |

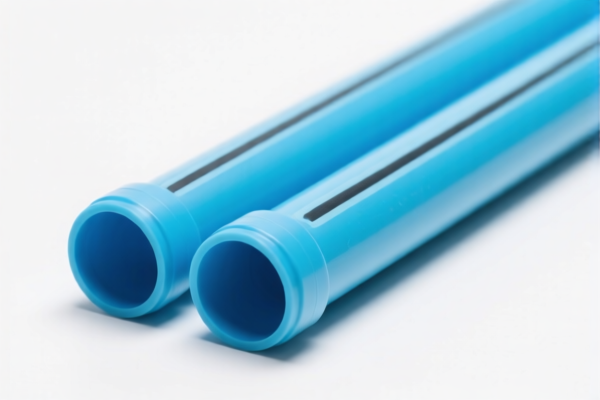

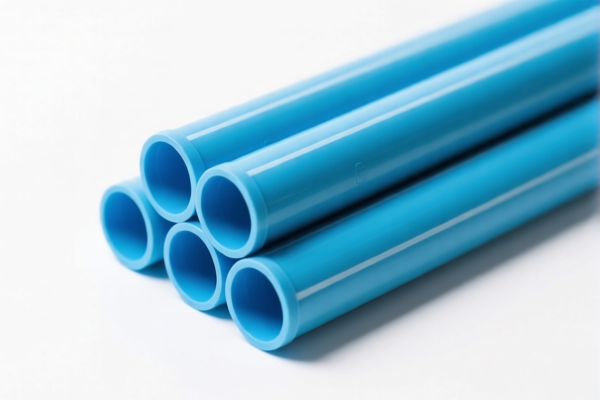

Here is the structured classification and tariff information for plastic pipes for garden based on the provided HS codes and tax details:

📦 Product Classification: Plastic Pipes for Garden

✅ HS CODE: 3917320050

- Description: Plastic garden pipes, classified under HS CODE 3917.

- Total Tax Rate: 58.1%

- Base Tariff: 3.1%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is suitable for general plastic garden pipes.

✅ HS CODE: 3917390050

- Description: Plastic water pipes, classified under HS CODE 3917390050.

- Total Tax Rate: 33.1%

- Base Tariff: 3.1%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: No additional tariffs currently apply, but the 30% special tariff will be imposed after April 11, 2025.

✅ HS CODE: 3917210000

- Description: Hard plastic pipes made from polyethylene, classified under HS CODE 3917210000.

- Total Tax Rate: 58.1%

- Base Tariff: 3.1%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is for rigid pipes made from specific polymers.

✅ HS CODE: 3917400050

- Description: Non-pressure drainage, waste, or ventilation (DWV) piping systems, including connectors.

- Total Tax Rate: 60.3%

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code applies to non-pressure systems and may include connectors or fittings.

✅ HS CODE: 3917290050

- Description: Short plastic pipes for garden use, less than 200 mm in length.

- Total Tax Rate: 58.1%

- Base Tariff: 3.1%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is for short, rigid plastic pipes used in gardening.

📌 Important Notes and Recommendations

-

Time-sensitive Policy Alert:

A 30% additional tariff will be imposed after April 11, 2025 for most of the above HS codes. Ensure your import timeline accounts for this. -

Material and Certification Check:

Verify the material composition (e.g., polyethylene, PVC, etc.) and unit price to ensure correct classification. Some HS codes are sensitive to material type. -

Certifications Required:

Confirm if any customs or safety certifications (e.g., CE, RoHS) are required for the product in the destination country. -

Tariff Variability:

The base tariff varies slightly between codes (e.g., 3.1% vs. 5.3%), so accurate classification is crucial to avoid overpayment.

🛠️ Proactive Advice

- Double-check the product description to match the most accurate HS code.

- Consult with customs brokers or import agents for real-time updates on tariff changes.

- Keep records of product specifications and invoices for customs audits.

Let me know if you need help determining the most suitable HS code for your specific product. Here is the structured classification and tariff information for plastic pipes for garden based on the provided HS codes and tax details:

📦 Product Classification: Plastic Pipes for Garden

✅ HS CODE: 3917320050

- Description: Plastic garden pipes, classified under HS CODE 3917.

- Total Tax Rate: 58.1%

- Base Tariff: 3.1%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is suitable for general plastic garden pipes.

✅ HS CODE: 3917390050

- Description: Plastic water pipes, classified under HS CODE 3917390050.

- Total Tax Rate: 33.1%

- Base Tariff: 3.1%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: No additional tariffs currently apply, but the 30% special tariff will be imposed after April 11, 2025.

✅ HS CODE: 3917210000

- Description: Hard plastic pipes made from polyethylene, classified under HS CODE 3917210000.

- Total Tax Rate: 58.1%

- Base Tariff: 3.1%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is for rigid pipes made from specific polymers.

✅ HS CODE: 3917400050

- Description: Non-pressure drainage, waste, or ventilation (DWV) piping systems, including connectors.

- Total Tax Rate: 60.3%

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code applies to non-pressure systems and may include connectors or fittings.

✅ HS CODE: 3917290050

- Description: Short plastic pipes for garden use, less than 200 mm in length.

- Total Tax Rate: 58.1%

- Base Tariff: 3.1%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is for short, rigid plastic pipes used in gardening.

📌 Important Notes and Recommendations

-

Time-sensitive Policy Alert:

A 30% additional tariff will be imposed after April 11, 2025 for most of the above HS codes. Ensure your import timeline accounts for this. -

Material and Certification Check:

Verify the material composition (e.g., polyethylene, PVC, etc.) and unit price to ensure correct classification. Some HS codes are sensitive to material type. -

Certifications Required:

Confirm if any customs or safety certifications (e.g., CE, RoHS) are required for the product in the destination country. -

Tariff Variability:

The base tariff varies slightly between codes (e.g., 3.1% vs. 5.3%), so accurate classification is crucial to avoid overpayment.

🛠️ Proactive Advice

- Double-check the product description to match the most accurate HS code.

- Consult with customs brokers or import agents for real-time updates on tariff changes.

- Keep records of product specifications and invoices for customs audits.

Let me know if you need help determining the most suitable HS code for your specific product.

Customer Reviews

No reviews yet.