| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3917320050 | Doc | 58.1% | CN | US | 2025-05-12 |

| 3917310000 | Doc | 58.1% | CN | US | 2025-05-12 |

| 3917400095 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3917400080 | Doc | 60.3% | CN | US | 2025-05-12 |

| 8467895060 | Doc | 37.5% | CN | US | 2025-05-12 |

Here is the detailed classification and tariff information for plastic pipes for irrigation based on the provided HS codes:

📦 Product Classification Overview: Plastic Pipes for Irrigation

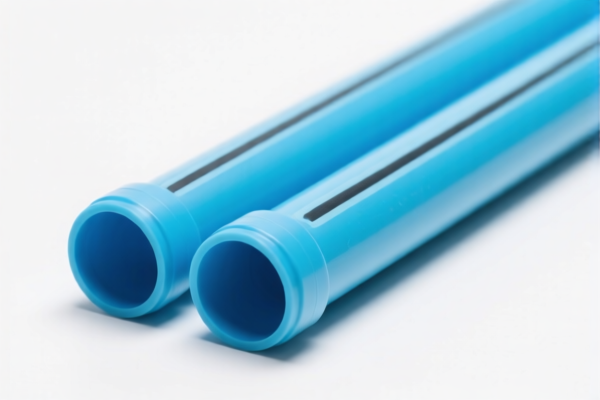

🔢 HS CODE: 3917320050

Product Description: Plastic irrigation pipes, plastic agricultural irrigation pipes, plastic agricultural pipes

- Base Tariff Rate: 3.1%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 58.1%

- Notes: This code is suitable for general plastic irrigation pipes used in agriculture.

🔢 HS CODE: 3917310000

Product Description: Agricultural irrigation plastic pipes, agricultural irrigation plastic hoses

- Base Tariff Rate: 3.1%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 58.1%

- Notes: This code applies to flexible plastic irrigation hoses used in agricultural settings.

🔢 HS CODE: 3917400095

Product Description: Plastic irrigation pipe fittings

- Base Tariff Rate: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.3%

- Notes: This code is for fittings used with irrigation pipes.

🔢 HS CODE: 3917400080

Product Description: Irrigation plastic pipe joints

- Base Tariff Rate: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.3%

- Notes: This code applies to joints used in irrigation systems.

🔢 HS CODE: 8467895060

Product Description: Agricultural plastic sprinkler pipes

- Base Tariff Rate: 0.0%

- Additional Tariff: 7.5%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 37.5%

- Notes: This code is for specialized sprinkler pipes used in agricultural irrigation.

⚠️ Important Notes and Recommendations:

- April 11, 2025 Special Tariff: A 30% additional tariff will be applied to all the above products after April 11, 2025. This is a time-sensitive policy and should be considered in your import planning.

- Material Verification: Confirm the material composition (e.g., PVC, HDPE, etc.) and unit price to ensure correct classification.

- Certifications: Check if any certifications (e.g., ISO, CE, or local agricultural standards) are required for import.

- Tariff Variability: The base tariff and additional tariffs may vary depending on the country of origin and trade agreements.

✅ Proactive Advice:

- Double-check the product description to match the most accurate HS code.

- Consult with customs brokers or trade compliance experts for complex or high-value shipments.

- Monitor policy updates related to agricultural imports and tariff changes after April 11, 2025.

Let me know if you need help with certification requirements or customs documentation for these products. Here is the detailed classification and tariff information for plastic pipes for irrigation based on the provided HS codes:

📦 Product Classification Overview: Plastic Pipes for Irrigation

🔢 HS CODE: 3917320050

Product Description: Plastic irrigation pipes, plastic agricultural irrigation pipes, plastic agricultural pipes

- Base Tariff Rate: 3.1%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 58.1%

- Notes: This code is suitable for general plastic irrigation pipes used in agriculture.

🔢 HS CODE: 3917310000

Product Description: Agricultural irrigation plastic pipes, agricultural irrigation plastic hoses

- Base Tariff Rate: 3.1%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 58.1%

- Notes: This code applies to flexible plastic irrigation hoses used in agricultural settings.

🔢 HS CODE: 3917400095

Product Description: Plastic irrigation pipe fittings

- Base Tariff Rate: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.3%

- Notes: This code is for fittings used with irrigation pipes.

🔢 HS CODE: 3917400080

Product Description: Irrigation plastic pipe joints

- Base Tariff Rate: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.3%

- Notes: This code applies to joints used in irrigation systems.

🔢 HS CODE: 8467895060

Product Description: Agricultural plastic sprinkler pipes

- Base Tariff Rate: 0.0%

- Additional Tariff: 7.5%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 37.5%

- Notes: This code is for specialized sprinkler pipes used in agricultural irrigation.

⚠️ Important Notes and Recommendations:

- April 11, 2025 Special Tariff: A 30% additional tariff will be applied to all the above products after April 11, 2025. This is a time-sensitive policy and should be considered in your import planning.

- Material Verification: Confirm the material composition (e.g., PVC, HDPE, etc.) and unit price to ensure correct classification.

- Certifications: Check if any certifications (e.g., ISO, CE, or local agricultural standards) are required for import.

- Tariff Variability: The base tariff and additional tariffs may vary depending on the country of origin and trade agreements.

✅ Proactive Advice:

- Double-check the product description to match the most accurate HS code.

- Consult with customs brokers or trade compliance experts for complex or high-value shipments.

- Monitor policy updates related to agricultural imports and tariff changes after April 11, 2025.

Let me know if you need help with certification requirements or customs documentation for these products.

Customer Reviews

No reviews yet.