| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3917390050 | Doc | 33.1% | CN | US | 2025-05-12 |

| 3917320050 | Doc | 58.1% | CN | US | 2025-05-12 |

| 3917400050 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3917400095 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3917390050 | Doc | 33.1% | CN | US | 2025-05-12 |

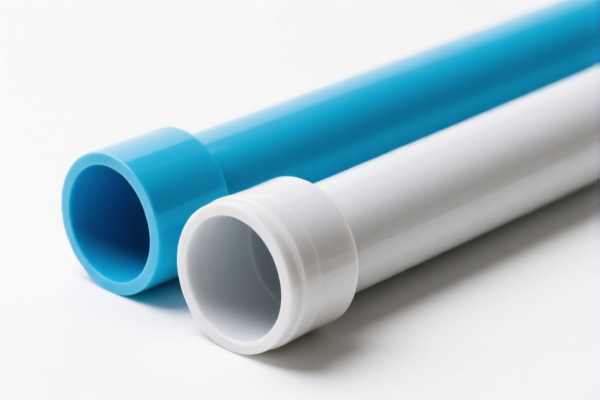

Product Classification: Plastic Sewage Pipes

HS CODE: 3917390050 (Plastic pipes and fittings, drainage pipes fall under the category of plastic pipes)

🔍 Tariff Overview and Key Details

- Base Tariff Rate: 3.1%

- Additional Tariff (before April 11, 2025): 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 33.1% (as of now)

- Note: After April 11, 2025, the total tax rate will increase to 33.1% (3.1% base + 30.0% special tariff).

📌 Important Notes and Recommendations

-

Material Verification: Ensure the product is indeed made of plastic and not a composite or reinforced material. If it contains other materials (e.g., metal), it may fall under a different HS code (e.g., 3917400050 or 3917400095).

-

Certifications Required: Confirm if any product certifications (e.g., ISO, CE, or local compliance standards) are required for import into the destination country.

-

Unit Price and Classification: Double-check the unit price and product description to ensure correct classification. Misclassification can lead to delays or penalties.

-

Alternative HS Codes: If the product is not a standard drainage pipe or includes fittings, consider other codes such as:

- 3917320050 (other plastic pipes without fittings)

- 3917400050 (non-pressure drainage/ventilation pipes)

- 3917400095 (other plastic fittings)

⚠️ Time-Sensitive Policy Alert

- April 11, 2025: A special tariff of 30.0% will be imposed on this product. This is a critical date for customs clearance planning and cost estimation.

✅ Proactive Advice

- Consult a customs broker or import compliance expert to confirm the most accurate HS code and applicable duties.

- Keep documentation (e.g., product specifications, invoices, and certificates) ready for customs inspection.

- Monitor policy updates related to import tariffs, especially around the April 11, 2025 deadline.

Let me know if you need help with HS code selection for similar products or further clarification on tariff implications.

Product Classification: Plastic Sewage Pipes

HS CODE: 3917390050 (Plastic pipes and fittings, drainage pipes fall under the category of plastic pipes)

🔍 Tariff Overview and Key Details

- Base Tariff Rate: 3.1%

- Additional Tariff (before April 11, 2025): 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 33.1% (as of now)

- Note: After April 11, 2025, the total tax rate will increase to 33.1% (3.1% base + 30.0% special tariff).

📌 Important Notes and Recommendations

-

Material Verification: Ensure the product is indeed made of plastic and not a composite or reinforced material. If it contains other materials (e.g., metal), it may fall under a different HS code (e.g., 3917400050 or 3917400095).

-

Certifications Required: Confirm if any product certifications (e.g., ISO, CE, or local compliance standards) are required for import into the destination country.

-

Unit Price and Classification: Double-check the unit price and product description to ensure correct classification. Misclassification can lead to delays or penalties.

-

Alternative HS Codes: If the product is not a standard drainage pipe or includes fittings, consider other codes such as:

- 3917320050 (other plastic pipes without fittings)

- 3917400050 (non-pressure drainage/ventilation pipes)

- 3917400095 (other plastic fittings)

⚠️ Time-Sensitive Policy Alert

- April 11, 2025: A special tariff of 30.0% will be imposed on this product. This is a critical date for customs clearance planning and cost estimation.

✅ Proactive Advice

- Consult a customs broker or import compliance expert to confirm the most accurate HS code and applicable duties.

- Keep documentation (e.g., product specifications, invoices, and certificates) ready for customs inspection.

- Monitor policy updates related to import tariffs, especially around the April 11, 2025 deadline.

Let me know if you need help with HS code selection for similar products or further clarification on tariff implications.

Customer Reviews

No reviews yet.