| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921905050 | Doc | 34.8% | CN | US | 2025-05-12 |

| 3919905060 | Doc | 60.8% | CN | US | 2025-05-12 |

| 3918903000 | Doc | 60.3% | CN | US | 2025-05-12 |

| 4802557020 | Doc | 55.0% | CN | US | 2025-05-12 |

| 4810291035 | Doc | 55.0% | CN | US | 2025-05-12 |

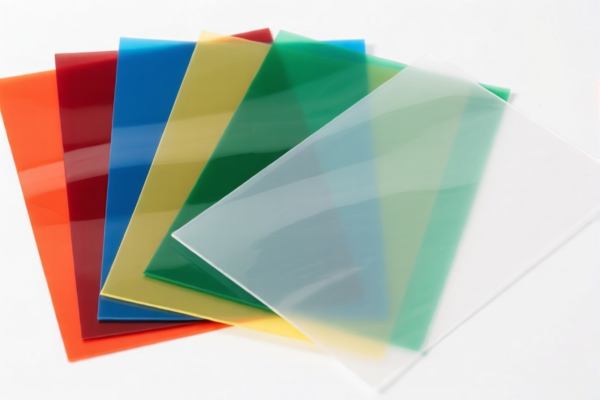

Here is the structured classification and tariff information for the declared product "Plastic sheets (stamping)", based on the provided HS codes and tax details:

✅ HS CODE: 3921905050

Product Description: Other plastic sheets, plates, films, foils and strips

Total Tax Rate: 34.8%

- Base Tariff Rate: 4.8%

- Additional Tariff (before April 11, 2025): 0.0%

- Additional Tariff (after April 11, 2025): 30.0%

- Anti-dumping duties: Not applicable for this product category

- Special Notes:

- This is the most likely HS code for plastic sheets used in stamping.

- The April 11, 2025 tariff increase is significant—30% added on top of the base rate.

- Proactive Advice: Confirm the material composition (e.g., PVC, PE, etc.) and unit price to ensure correct classification. Also, check if any certifications (e.g., RoHS, REACH) are required for export.

⚠️ HS CODE: 3919905060

Product Description: Other plastic stickers

Total Tax Rate: 60.8%

- Base Tariff Rate: 5.8%

- Additional Tariff (before April 11, 2025): 25.0%

- Additional Tariff (after April 11, 2025): 30.0%

- Anti-dumping duties: Not applicable

- Special Notes:

- This code applies to plastic stickers, which may be a different product than the declared plastic sheets.

- Proactive Advice: Ensure the product is not misclassified as a sticker if it is intended for industrial stamping. Clarify with the supplier or customs broker if unsure.

⚠️ HS CODE: 3918903000

Product Description: Other plastic wall or ceiling coverings with textile fiber backing

Total Tax Rate: 60.3%

- Base Tariff Rate: 5.3%

- Additional Tariff (before April 11, 2025): 25.0%

- Additional Tariff (after April 11, 2025): 30.0%

- Anti-dumping duties: Not applicable

- Special Notes:

- This code applies to decorative or construction materials, not industrial stamping sheets.

- Proactive Advice: Confirm the intended use of the product to avoid misclassification.

⚠️ HS CODE: 4802557020

Product Description: Uncoated paper and paperboard for writing, printing, or other graphic purposes

Total Tax Rate: 55.0%

- Base Tariff Rate: 0.0%

- Additional Tariff (before April 11, 2025): 25.0%

- Additional Tariff (after April 11, 2025): 30.0%

- Anti-dumping duties: Not applicable

- Special Notes:

- This is paper, not plastic. Likely not applicable to the declared product.

- Proactive Advice: Ensure the product is not misclassified as paper if it is made of plastic.

⚠️ HS CODE: 4810291035

Product Description: Paper coated with kaolin or other inorganic substances for writing, printing, or other graphic purposes

Total Tax Rate: 55.0%

- Base Tariff Rate: 0.0%

- Additional Tariff (before April 11, 2025): 25.0%

- Additional Tariff (after April 11, 2025): 30.0%

- Anti-dumping duties: Not applicable

- Special Notes:

- This is coated paper, not plastic. Not applicable to the declared product.

- Proactive Advice: Double-check the material and intended use to avoid misclassification.

📌 Summary and Recommendations:

- Best Fit HS Code: 3921905050 (Plastic sheets, plates, films, etc.)

- Key Tax Rate Changes:

- April 11, 2025 tariff increase of 30% applies to all listed codes.

- Total tax rate for 3921905050 is 34.8% (4.8% base + 30% additional).

- Critical Actions:

- Verify the material (e.g., PVC, PE, PP) and intended use (industrial stamping, decorative, etc.).

- Check certifications (e.g., RoHS, REACH) if exporting to the EU.

- Confirm with customs or a broker to ensure correct classification and avoid penalties.

Let me know if you need help with certification requirements or customs documentation for this product. Here is the structured classification and tariff information for the declared product "Plastic sheets (stamping)", based on the provided HS codes and tax details:

✅ HS CODE: 3921905050

Product Description: Other plastic sheets, plates, films, foils and strips

Total Tax Rate: 34.8%

- Base Tariff Rate: 4.8%

- Additional Tariff (before April 11, 2025): 0.0%

- Additional Tariff (after April 11, 2025): 30.0%

- Anti-dumping duties: Not applicable for this product category

- Special Notes:

- This is the most likely HS code for plastic sheets used in stamping.

- The April 11, 2025 tariff increase is significant—30% added on top of the base rate.

- Proactive Advice: Confirm the material composition (e.g., PVC, PE, etc.) and unit price to ensure correct classification. Also, check if any certifications (e.g., RoHS, REACH) are required for export.

⚠️ HS CODE: 3919905060

Product Description: Other plastic stickers

Total Tax Rate: 60.8%

- Base Tariff Rate: 5.8%

- Additional Tariff (before April 11, 2025): 25.0%

- Additional Tariff (after April 11, 2025): 30.0%

- Anti-dumping duties: Not applicable

- Special Notes:

- This code applies to plastic stickers, which may be a different product than the declared plastic sheets.

- Proactive Advice: Ensure the product is not misclassified as a sticker if it is intended for industrial stamping. Clarify with the supplier or customs broker if unsure.

⚠️ HS CODE: 3918903000

Product Description: Other plastic wall or ceiling coverings with textile fiber backing

Total Tax Rate: 60.3%

- Base Tariff Rate: 5.3%

- Additional Tariff (before April 11, 2025): 25.0%

- Additional Tariff (after April 11, 2025): 30.0%

- Anti-dumping duties: Not applicable

- Special Notes:

- This code applies to decorative or construction materials, not industrial stamping sheets.

- Proactive Advice: Confirm the intended use of the product to avoid misclassification.

⚠️ HS CODE: 4802557020

Product Description: Uncoated paper and paperboard for writing, printing, or other graphic purposes

Total Tax Rate: 55.0%

- Base Tariff Rate: 0.0%

- Additional Tariff (before April 11, 2025): 25.0%

- Additional Tariff (after April 11, 2025): 30.0%

- Anti-dumping duties: Not applicable

- Special Notes:

- This is paper, not plastic. Likely not applicable to the declared product.

- Proactive Advice: Ensure the product is not misclassified as paper if it is made of plastic.

⚠️ HS CODE: 4810291035

Product Description: Paper coated with kaolin or other inorganic substances for writing, printing, or other graphic purposes

Total Tax Rate: 55.0%

- Base Tariff Rate: 0.0%

- Additional Tariff (before April 11, 2025): 25.0%

- Additional Tariff (after April 11, 2025): 30.0%

- Anti-dumping duties: Not applicable

- Special Notes:

- This is coated paper, not plastic. Not applicable to the declared product.

- Proactive Advice: Double-check the material and intended use to avoid misclassification.

📌 Summary and Recommendations:

- Best Fit HS Code: 3921905050 (Plastic sheets, plates, films, etc.)

- Key Tax Rate Changes:

- April 11, 2025 tariff increase of 30% applies to all listed codes.

- Total tax rate for 3921905050 is 34.8% (4.8% base + 30% additional).

- Critical Actions:

- Verify the material (e.g., PVC, PE, PP) and intended use (industrial stamping, decorative, etc.).

- Check certifications (e.g., RoHS, REACH) if exporting to the EU.

- Confirm with customs or a broker to ensure correct classification and avoid penalties.

Let me know if you need help with certification requirements or customs documentation for this product.

Customer Reviews

No reviews yet.