| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 4811909035 | Doc | 55.0% | CN | US | 2025-05-12 |

| 4810291035 | Doc | 55.0% | CN | US | 2025-05-12 |

| 4810296000 | Doc | 55.0% | CN | US | 2025-05-12 |

| 4810142090 | Doc | 55.0% | CN | US | 2025-05-12 |

| 4802557020 | Doc | 55.0% | CN | US | 2025-05-12 |

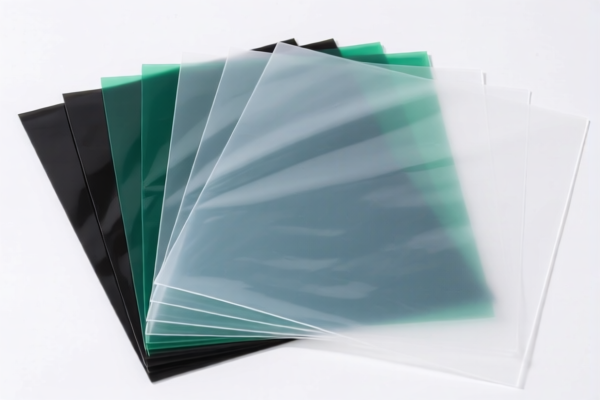

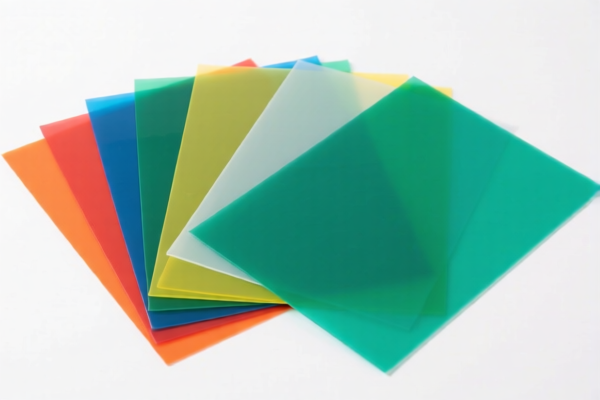

Product Classification: Plastic sheets (printing)

Note: Based on your input, the product is plastic sheets used for printing, but the HS codes provided are for paper products used in printing. This may indicate a misclassification or confusion between paper and plastic materials. Below is the detailed breakdown of the HS codes you provided, along with relevant customs compliance information.

📌 HS CODE: 4811909035

Description: Paper for writing, printing, or other graphic purposes, coated, impregnated, surfaced, surface-colored, surface-decorated, or printed

Total Tax Rate: 55.0%

Tax Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Key Notes:

- This code applies to paper, not plastic sheets.

- If your product is plastic, this code is not applicable.

- April 11 Special Tariff applies to imports from certain countries (e.g., China) after April 11, 2025.

📌 HS CODE: 4810291035

Description: Paper for writing, printing, or other graphic purposes, coated with kaolin or other inorganic substances

Total Tax Rate: 55.0%

Tax Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Key Notes:

- Again, this is for paper, not plastic.

- April 11 Special Tariff applies.

- Ensure your product is not misclassified as paper if it is actually plastic.

📌 HS CODE: 4810296000

Description: Paper and paperboard for writing, printing, or other graphic purposes

Total Tax Rate: 55.0%

Tax Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Key Notes:

- This is for paper and paperboard, not plastic.

- April 11 Special Tariff applies.

- Confirm the material composition of your product to avoid misclassification.

📌 HS CODE: 4810142090

Description: Paper and paperboard for writing, printing, or other graphic purposes

Total Tax Rate: 55.0%

Tax Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Key Notes:

- This is for paper and paperboard, not plastic.

- April 11 Special Tariff applies.

- Ensure your product is not misclassified as paper if it is plastic.

📌 HS CODE: 4802557020

Description: Uncoated paper and paperboard for writing, printing, or other graphic purposes, containing 25% or more by weight of cotton fiber, in rolls

Total Tax Rate: 55.0%

Tax Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Key Notes:

- This is for cotton-containing paper, not plastic.

- April 11 Special Tariff applies.

- Confirm the material and composition of your product to ensure correct classification.

🚨 Important Alerts and Recommendations:

- Material Verification: Confirm whether your product is plastic or paper. If it is plastic, the above HS codes are not applicable.

- HS Code for Plastic Sheets (Printing): If your product is plastic sheets used for printing, the correct HS code may be 3920.99.90.90 (Plastic sheets, films, etc., not elsewhere specified).

- April 11 Special Tariff: Applies to imports from certain countries after April 11, 2025. Ensure you are aware of the origin of your goods.

- Certifications: Check if any certifications (e.g., environmental, safety) are required for your product.

- Unit Price: Verify the unit price and material composition to ensure correct classification and tax calculation.

✅ Proactive Advice:

- If your product is plastic, use HS CODE 3920.99.90.90 and consult a customs expert for confirmation.

- If your product is paper, the above HS codes may apply, but ensure material and usage match the description.

- Always check the origin of your goods to determine if the April 11 Special Tariff applies.

- Maintain product documentation (e.g., material composition, usage, certifications) for customs compliance.

Product Classification: Plastic sheets (printing)

Note: Based on your input, the product is plastic sheets used for printing, but the HS codes provided are for paper products used in printing. This may indicate a misclassification or confusion between paper and plastic materials. Below is the detailed breakdown of the HS codes you provided, along with relevant customs compliance information.

📌 HS CODE: 4811909035

Description: Paper for writing, printing, or other graphic purposes, coated, impregnated, surfaced, surface-colored, surface-decorated, or printed

Total Tax Rate: 55.0%

Tax Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Key Notes:

- This code applies to paper, not plastic sheets.

- If your product is plastic, this code is not applicable.

- April 11 Special Tariff applies to imports from certain countries (e.g., China) after April 11, 2025.

📌 HS CODE: 4810291035

Description: Paper for writing, printing, or other graphic purposes, coated with kaolin or other inorganic substances

Total Tax Rate: 55.0%

Tax Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Key Notes:

- Again, this is for paper, not plastic.

- April 11 Special Tariff applies.

- Ensure your product is not misclassified as paper if it is actually plastic.

📌 HS CODE: 4810296000

Description: Paper and paperboard for writing, printing, or other graphic purposes

Total Tax Rate: 55.0%

Tax Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Key Notes:

- This is for paper and paperboard, not plastic.

- April 11 Special Tariff applies.

- Confirm the material composition of your product to avoid misclassification.

📌 HS CODE: 4810142090

Description: Paper and paperboard for writing, printing, or other graphic purposes

Total Tax Rate: 55.0%

Tax Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Key Notes:

- This is for paper and paperboard, not plastic.

- April 11 Special Tariff applies.

- Ensure your product is not misclassified as paper if it is plastic.

📌 HS CODE: 4802557020

Description: Uncoated paper and paperboard for writing, printing, or other graphic purposes, containing 25% or more by weight of cotton fiber, in rolls

Total Tax Rate: 55.0%

Tax Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Key Notes:

- This is for cotton-containing paper, not plastic.

- April 11 Special Tariff applies.

- Confirm the material and composition of your product to ensure correct classification.

🚨 Important Alerts and Recommendations:

- Material Verification: Confirm whether your product is plastic or paper. If it is plastic, the above HS codes are not applicable.

- HS Code for Plastic Sheets (Printing): If your product is plastic sheets used for printing, the correct HS code may be 3920.99.90.90 (Plastic sheets, films, etc., not elsewhere specified).

- April 11 Special Tariff: Applies to imports from certain countries after April 11, 2025. Ensure you are aware of the origin of your goods.

- Certifications: Check if any certifications (e.g., environmental, safety) are required for your product.

- Unit Price: Verify the unit price and material composition to ensure correct classification and tax calculation.

✅ Proactive Advice:

- If your product is plastic, use HS CODE 3920.99.90.90 and consult a customs expert for confirmation.

- If your product is paper, the above HS codes may apply, but ensure material and usage match the description.

- Always check the origin of your goods to determine if the April 11 Special Tariff applies.

- Maintain product documentation (e.g., material composition, usage, certifications) for customs compliance.

Customer Reviews

No reviews yet.