Found 2 matching results

(CN → US)

| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921905050 | Doc | 34.8% | CN | US | 2025-05-12 |

| 3926909989 | Doc | 42.8% | CN | US | 2025-05-12 |

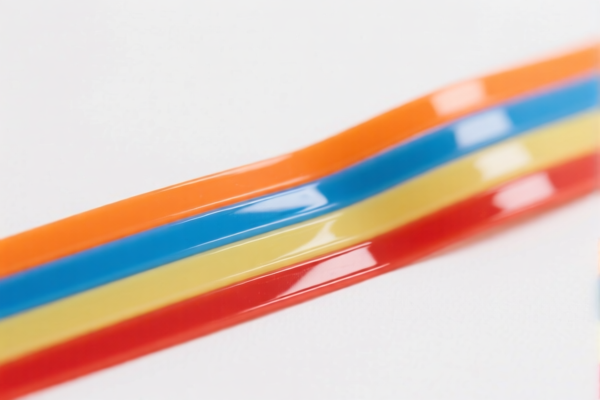

Product Classification: Plastic Strip (Extrusion)

HS CODE: 3921905050

Description: Other plastic sheets, plates, films, foils, and strips

🔍 Tariff Breakdown (as of now):

- Base Tariff Rate: 4.8%

- Additional Tariff (currently not applicable): 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 34.8%

⚠️ Important Notes:

- April 11 Special Tariff: Starting from April 11, 2025, an additional 30.0% tariff will be imposed on this product. This is a significant increase and will affect the total tax rate.

- No Anti-dumping duties currently apply to this product category.

- No specific anti-dumping duties on iron or aluminum are relevant here, as this is a plastic product.

📌 Proactive Advice for Users:

- Verify Material: Ensure the plastic strip is made from the correct type of polymer (e.g., polyethylene, polypropylene) to confirm it falls under the correct HS code.

- Check Unit Price: The final tax cost will depend on the declared value and unit price of the product.

- Certifications Required: Confirm if any certifications (e.g., RoHS, REACH, or specific import permits) are needed for the product in the destination country.

- Monitor Tariff Changes: Keep an eye on the April 11, 2025 deadline to prepare for the 30% additional tariff.

📊 Alternative HS Code (if applicable):

If the plastic strip is considered a finished product rather than a raw material, it may fall under 3926909989 ("Other plastic制品") with the following tax details:

- Base Tariff Rate: 5.3%

- Additional Tariff: 7.5%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 42.8%

This is a higher tax rate, so it's crucial to correctly classify the product to avoid unnecessary costs.

✅ Conclusion:

- For raw plastic strips (extrusion): Use HS CODE 3921905050 with a 34.8% total tax rate (including the 30% special tariff after April 11, 2025).

- For finished plastic products: Consider HS CODE 3926909989 with a 42.8% total tax rate.

- Act now: Confirm product classification and prepare for the upcoming tariff increase.

Product Classification: Plastic Strip (Extrusion)

HS CODE: 3921905050

Description: Other plastic sheets, plates, films, foils, and strips

🔍 Tariff Breakdown (as of now):

- Base Tariff Rate: 4.8%

- Additional Tariff (currently not applicable): 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 34.8%

⚠️ Important Notes:

- April 11 Special Tariff: Starting from April 11, 2025, an additional 30.0% tariff will be imposed on this product. This is a significant increase and will affect the total tax rate.

- No Anti-dumping duties currently apply to this product category.

- No specific anti-dumping duties on iron or aluminum are relevant here, as this is a plastic product.

📌 Proactive Advice for Users:

- Verify Material: Ensure the plastic strip is made from the correct type of polymer (e.g., polyethylene, polypropylene) to confirm it falls under the correct HS code.

- Check Unit Price: The final tax cost will depend on the declared value and unit price of the product.

- Certifications Required: Confirm if any certifications (e.g., RoHS, REACH, or specific import permits) are needed for the product in the destination country.

- Monitor Tariff Changes: Keep an eye on the April 11, 2025 deadline to prepare for the 30% additional tariff.

📊 Alternative HS Code (if applicable):

If the plastic strip is considered a finished product rather than a raw material, it may fall under 3926909989 ("Other plastic制品") with the following tax details:

- Base Tariff Rate: 5.3%

- Additional Tariff: 7.5%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 42.8%

This is a higher tax rate, so it's crucial to correctly classify the product to avoid unnecessary costs.

✅ Conclusion:

- For raw plastic strips (extrusion): Use HS CODE 3921905050 with a 34.8% total tax rate (including the 30% special tariff after April 11, 2025).

- For finished plastic products: Consider HS CODE 3926909989 with a 42.8% total tax rate.

- Act now: Confirm product classification and prepare for the upcoming tariff increase.

Customer Reviews

No reviews yet.