Found 2 matching results

(CN → US)

| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3917390050 | Doc | 33.1% | CN | US | 2025-05-12 |

| 3917400095 | Doc | 60.3% | CN | US | 2025-05-12 |

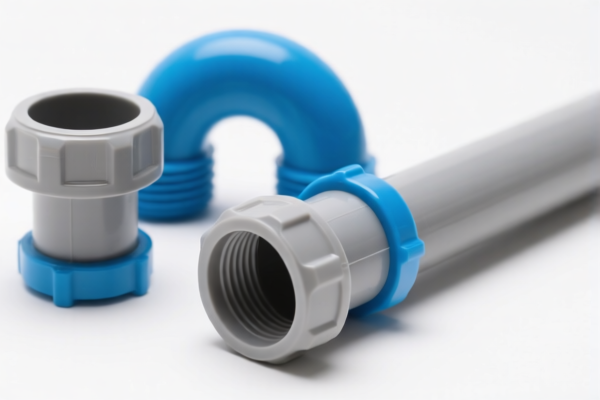

Product Classification: Plastic Water Supply Pipe Fittings (Other)

HS CODE: 3917.39.00.50 and 3917.40.00.95

🔍 Classification Overview

- HS CODE 3917.39.00.50: "Other plastic fittings" – typically used for general plastic pipe fittings, not specifically for water supply.

- HS CODE 3917.40.00.95: "Plastic fittings (other types)" – may include specialized or non-standard fittings, possibly for industrial or specific applications.

📊 Tariff Breakdown (as of now)

HS CODE 3917.39.00.50

- Base Tariff Rate: 3.1%

- Additional Tariff: 0.0%

- Tariff after April 11, 2025: +30.0% (Total: 33.1%)

HS CODE 3917.40.00.95

- Base Tariff Rate: 5.3%

- Additional Tariff: 25.0%

- Tariff after April 11, 2025: +30.0% (Total: 60.3%)

⏰ Time-Sensitive Policy Alert

- April 11, 2025: Additional tariffs of 30.0% will be imposed on both HS codes. This is a critical date for customs clearance planning and cost estimation.

🛑 Anti-Dumping Duties (if applicable)

- Not applicable for plastic pipe fittings (non-metallic). Anti-dumping duties typically apply to iron and aluminum products, not plastics.

📌 Proactive Advice for Importers

- Verify Material: Ensure the product is indeed made of plastic and not a composite or metal-based fitting.

- Check Unit Price: High tariffs may affect cost competitiveness; consider this in pricing strategy.

- Certifications: Confirm if any technical standards or certifications (e.g., ISO, GB, or local regulations) are required for import.

- HS Code Accuracy: Double-check the HS code with customs or a classification expert to avoid misclassification penalties.

- Plan Ahead: If importing after April 11, 2025, budget for the 30% additional tariff to avoid unexpected costs.

Let me know if you need help determining the correct HS code based on product specifications or documentation.

Product Classification: Plastic Water Supply Pipe Fittings (Other)

HS CODE: 3917.39.00.50 and 3917.40.00.95

🔍 Classification Overview

- HS CODE 3917.39.00.50: "Other plastic fittings" – typically used for general plastic pipe fittings, not specifically for water supply.

- HS CODE 3917.40.00.95: "Plastic fittings (other types)" – may include specialized or non-standard fittings, possibly for industrial or specific applications.

📊 Tariff Breakdown (as of now)

HS CODE 3917.39.00.50

- Base Tariff Rate: 3.1%

- Additional Tariff: 0.0%

- Tariff after April 11, 2025: +30.0% (Total: 33.1%)

HS CODE 3917.40.00.95

- Base Tariff Rate: 5.3%

- Additional Tariff: 25.0%

- Tariff after April 11, 2025: +30.0% (Total: 60.3%)

⏰ Time-Sensitive Policy Alert

- April 11, 2025: Additional tariffs of 30.0% will be imposed on both HS codes. This is a critical date for customs clearance planning and cost estimation.

🛑 Anti-Dumping Duties (if applicable)

- Not applicable for plastic pipe fittings (non-metallic). Anti-dumping duties typically apply to iron and aluminum products, not plastics.

📌 Proactive Advice for Importers

- Verify Material: Ensure the product is indeed made of plastic and not a composite or metal-based fitting.

- Check Unit Price: High tariffs may affect cost competitiveness; consider this in pricing strategy.

- Certifications: Confirm if any technical standards or certifications (e.g., ISO, GB, or local regulations) are required for import.

- HS Code Accuracy: Double-check the HS code with customs or a classification expert to avoid misclassification penalties.

- Plan Ahead: If importing after April 11, 2025, budget for the 30% additional tariff to avoid unexpected costs.

Let me know if you need help determining the correct HS code based on product specifications or documentation.

Customer Reviews

No reviews yet.