| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3925200091 | Doc | 42.8% | CN | US | 2025-05-12 |

| 3925200020 | Doc | 42.8% | CN | US | 2025-05-12 |

| 3925200020 | Doc | 42.8% | CN | US | 2025-05-12 |

| 3925200091 | Doc | 42.8% | CN | US | 2025-05-12 |

| 3925200020 | Doc | 42.8% | CN | US | 2025-05-12 |

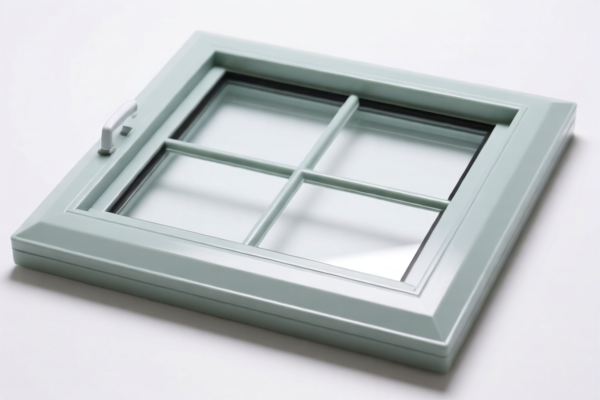

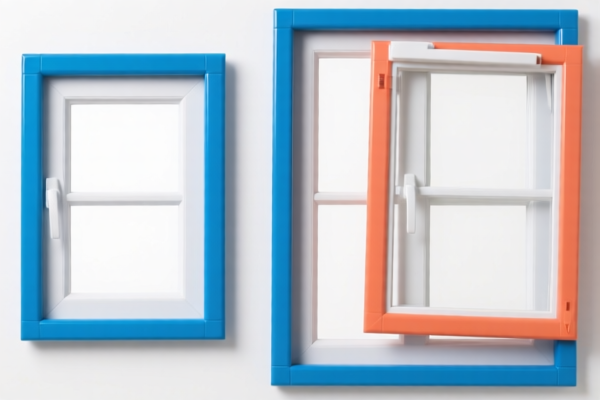

Product Classification: Plastic Window Frames

HS CODEs: 3925200020 and 3925200091

Classification Summary:

- Plastic window frames, including architectural, decorative, and floor-to-ceiling types, are classified under HS CODE 3925200020 or 3925200091, depending on specific product details.

🔍 Tariff Overview (As of Now)

- Base Tariff Rate: 5.3%

- Additional Tariff: 7.5%

- Special Tariff (April 11, 2025 onwards): 30.0%

- Total Tax Rate: 42.8% (5.3% + 7.5% + 30.0%)

⏱️ Time-Sensitive Policy Alert

Important: Starting April 11, 2025, an additional 30.0% tariff will be imposed on plastic window frames. This is a significant increase and will directly impact the total tax rate.

📌 Key Considerations for Customs Compliance

- Material Verification: Confirm the exact composition of the plastic (e.g., PVC, polyethylene) and whether it contains any additives or reinforcements (e.g., metal frames or glass).

- Product Description: Ensure the product description on the invoice and customs documents clearly specifies the type of window frame (e.g., architectural, decorative, floor-to-ceiling).

- Certifications: Check if any certifications (e.g., fire resistance, energy efficiency) are required for import into the destination country.

- Unit Price: Accurate unit pricing is essential for customs valuation and tax calculation.

- Origin of Goods: Be aware of any preferential trade agreements that may apply to reduce the tariff rate.

📌 Proactive Advice

- Review HS Code Classification: Double-check the HS code with a customs broker or classification service to avoid misclassification penalties.

- Monitor Policy Updates: Stay informed about any changes in tariff rates or trade policies, especially after April 11, 2025.

- Consult a Customs Expert: For complex or high-value shipments, consider professional customs compliance support to ensure smooth clearance.

Let me know if you need help with HS code verification or customs documentation for your specific product.

Product Classification: Plastic Window Frames

HS CODEs: 3925200020 and 3925200091

Classification Summary:

- Plastic window frames, including architectural, decorative, and floor-to-ceiling types, are classified under HS CODE 3925200020 or 3925200091, depending on specific product details.

🔍 Tariff Overview (As of Now)

- Base Tariff Rate: 5.3%

- Additional Tariff: 7.5%

- Special Tariff (April 11, 2025 onwards): 30.0%

- Total Tax Rate: 42.8% (5.3% + 7.5% + 30.0%)

⏱️ Time-Sensitive Policy Alert

Important: Starting April 11, 2025, an additional 30.0% tariff will be imposed on plastic window frames. This is a significant increase and will directly impact the total tax rate.

📌 Key Considerations for Customs Compliance

- Material Verification: Confirm the exact composition of the plastic (e.g., PVC, polyethylene) and whether it contains any additives or reinforcements (e.g., metal frames or glass).

- Product Description: Ensure the product description on the invoice and customs documents clearly specifies the type of window frame (e.g., architectural, decorative, floor-to-ceiling).

- Certifications: Check if any certifications (e.g., fire resistance, energy efficiency) are required for import into the destination country.

- Unit Price: Accurate unit pricing is essential for customs valuation and tax calculation.

- Origin of Goods: Be aware of any preferential trade agreements that may apply to reduce the tariff rate.

📌 Proactive Advice

- Review HS Code Classification: Double-check the HS code with a customs broker or classification service to avoid misclassification penalties.

- Monitor Policy Updates: Stay informed about any changes in tariff rates or trade policies, especially after April 11, 2025.

- Consult a Customs Expert: For complex or high-value shipments, consider professional customs compliance support to ensure smooth clearance.

Let me know if you need help with HS code verification or customs documentation for your specific product.

Customer Reviews

No reviews yet.