| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3925200091 | Doc | 42.8% | CN | US | 2025-05-12 |

| 3925200020 | Doc | 42.8% | CN | US | 2025-05-12 |

| 3925200020 | Doc | 42.8% | CN | US | 2025-05-12 |

| 3925200091 | Doc | 42.8% | CN | US | 2025-05-12 |

| 3925200020 | Doc | 42.8% | CN | US | 2025-05-12 |

| 3925200091 | Doc | 42.8% | CN | US | 2025-05-12 |

| 3925200020 | Doc | 42.8% | CN | US | 2025-05-12 |

| 3925200010 | Doc | 42.8% | CN | US | 2025-05-12 |

| 3925200091 | Doc | 42.8% | CN | US | 2025-05-12 |

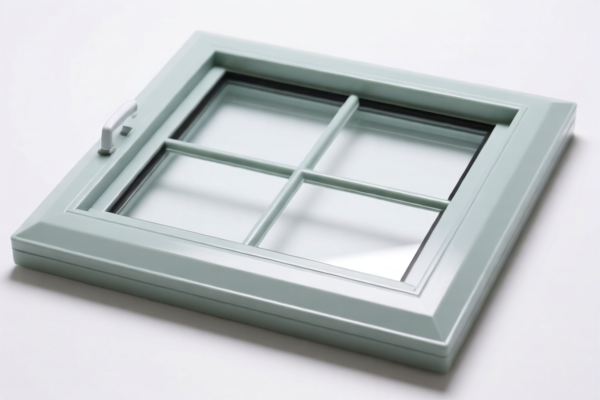

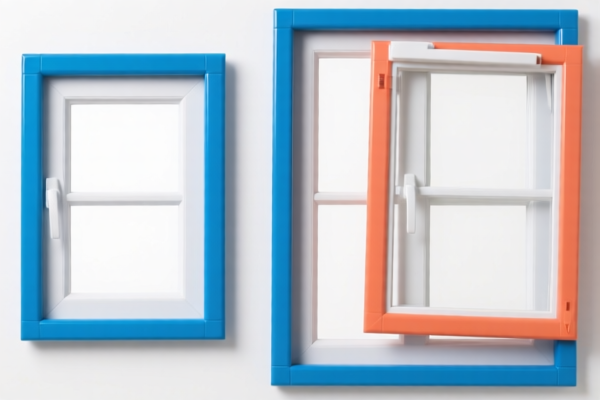

Product Classification: Plastic Windows and Window Frames

HS CODEs and Tax Details (April 2025 Update)

🔍 HS CODE Overview

All listed products fall under HS CODE 39252000, with variations in the 8th and 9th digits based on specific product types (e.g., residential, decorative, door frames, etc.). The full 10-digit HS codes are:

- 3925200010 – Plastic door frames

- 3925200020 – Plastic building/window frames (including residential, decorative)

- 3925200091 – Other plastic window/door frames (e.g., window frames, door frames, window sashes, etc.)

📊 Tariff Breakdown

- Base Tariff Rate: 5.3%

- Additional Tariff: 7.5%

- Special Tariff (April 11, 2025 onwards): 30.0%

- Total Tax Rate: 42.8% (5.3% + 7.5% + 30.0%)

⚠️ Important Note: The 30.0% special tariff applies after April 11, 2025. Ensure your import timeline aligns with this policy change.

📌 Key Considerations

- Material Verification: Confirm the product is made entirely of plastic (e.g., PVC, polyethylene). Mixed materials may fall under different HS codes.

- Product Description: Use precise terms in customs documentation (e.g., "residential window frame" vs. "decorative window frame").

- Certifications: Some countries may require certifications (e.g., fire resistance, energy efficiency) for building materials.

- Unit Price: Accurate unit pricing is essential for customs valuation and duty calculation.

🛑 Anti-Dumping Duties?

- Not applicable for plastic window and door frames (unlike iron or aluminum products).

- No specific anti-dumping duties are currently listed for this category.

✅ Proactive Advice

- Double-check HS CODE: Ensure the correct 10-digit code is used based on the product type and use (e.g., residential vs. decorative).

- Update Documentation: If importing after April 11, 2025, be prepared for the 30.0% additional tariff.

- Consult a Customs Broker: For complex cases or large shipments, professional assistance is recommended to avoid delays or penalties.

Let me know if you need help determining the correct HS code for a specific product description or if you're preparing customs documentation.

Product Classification: Plastic Windows and Window Frames

HS CODEs and Tax Details (April 2025 Update)

🔍 HS CODE Overview

All listed products fall under HS CODE 39252000, with variations in the 8th and 9th digits based on specific product types (e.g., residential, decorative, door frames, etc.). The full 10-digit HS codes are:

- 3925200010 – Plastic door frames

- 3925200020 – Plastic building/window frames (including residential, decorative)

- 3925200091 – Other plastic window/door frames (e.g., window frames, door frames, window sashes, etc.)

📊 Tariff Breakdown

- Base Tariff Rate: 5.3%

- Additional Tariff: 7.5%

- Special Tariff (April 11, 2025 onwards): 30.0%

- Total Tax Rate: 42.8% (5.3% + 7.5% + 30.0%)

⚠️ Important Note: The 30.0% special tariff applies after April 11, 2025. Ensure your import timeline aligns with this policy change.

📌 Key Considerations

- Material Verification: Confirm the product is made entirely of plastic (e.g., PVC, polyethylene). Mixed materials may fall under different HS codes.

- Product Description: Use precise terms in customs documentation (e.g., "residential window frame" vs. "decorative window frame").

- Certifications: Some countries may require certifications (e.g., fire resistance, energy efficiency) for building materials.

- Unit Price: Accurate unit pricing is essential for customs valuation and duty calculation.

🛑 Anti-Dumping Duties?

- Not applicable for plastic window and door frames (unlike iron or aluminum products).

- No specific anti-dumping duties are currently listed for this category.

✅ Proactive Advice

- Double-check HS CODE: Ensure the correct 10-digit code is used based on the product type and use (e.g., residential vs. decorative).

- Update Documentation: If importing after April 11, 2025, be prepared for the 30.0% additional tariff.

- Consult a Customs Broker: For complex cases or large shipments, professional assistance is recommended to avoid delays or penalties.

Let me know if you need help determining the correct HS code for a specific product description or if you're preparing customs documentation.

Customer Reviews

No reviews yet.