Found 5 matching results

(CN → US)

| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3907100000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3907100000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3907100000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3907100000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3907100000 | Doc | 61.5% | CN | US | 2025-05-12 |

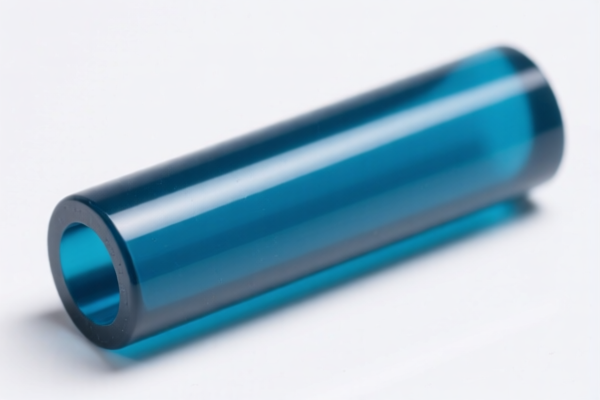

Product Name: Polyacetal Resin

HS CODE: 3907100000

✅ Classification Confirmation:

- Polyacetal Resin (including polymer, granules, copolymer, sheet, etc.) falls under HS Code 3907100000, which is designated for polyoxymethylene (polyacetal) resins.

- This classification is consistent with the description in the Harmonized System.

📊 Tariff Breakdown (as of latest data):

- Base Tariff Rate: 6.5%

- Additional Tariff (General): 25.0%

- Special Tariff Imposed After April 11, 2025: 30.0%

- Total Tariff Rate: 61.5%

⏱️ Time-Sensitive Policy Alert:

- April 11, 2025 Special Tariff:

A 30.0% additional tariff will be applied after April 11, 2025. This is a critical date to note for customs clearance planning.

🛑 Anti-Dumping Duties:

- Not applicable for Polyacetal Resin under HS Code 3907100000.

- No specific anti-dumping duties are currently imposed on this product category.

📌 Proactive Advice for Importers:

- Verify Material Specifications: Ensure the product is indeed polyacetal resin and not a blend or composite with other materials, which may affect classification.

- Check Unit Price and Packaging: Tariff calculations may depend on the declared value and packaging method.

- Certifications Required: Confirm if any import permits, technical specifications, or environmental compliance documents are needed for customs clearance.

- Monitor Policy Updates: Stay informed about any changes in tariff rates or trade policies post-April 11, 2025.

Let me know if you need help with customs documentation or further classification clarification.

Product Name: Polyacetal Resin

HS CODE: 3907100000

✅ Classification Confirmation:

- Polyacetal Resin (including polymer, granules, copolymer, sheet, etc.) falls under HS Code 3907100000, which is designated for polyoxymethylene (polyacetal) resins.

- This classification is consistent with the description in the Harmonized System.

📊 Tariff Breakdown (as of latest data):

- Base Tariff Rate: 6.5%

- Additional Tariff (General): 25.0%

- Special Tariff Imposed After April 11, 2025: 30.0%

- Total Tariff Rate: 61.5%

⏱️ Time-Sensitive Policy Alert:

- April 11, 2025 Special Tariff:

A 30.0% additional tariff will be applied after April 11, 2025. This is a critical date to note for customs clearance planning.

🛑 Anti-Dumping Duties:

- Not applicable for Polyacetal Resin under HS Code 3907100000.

- No specific anti-dumping duties are currently imposed on this product category.

📌 Proactive Advice for Importers:

- Verify Material Specifications: Ensure the product is indeed polyacetal resin and not a blend or composite with other materials, which may affect classification.

- Check Unit Price and Packaging: Tariff calculations may depend on the declared value and packaging method.

- Certifications Required: Confirm if any import permits, technical specifications, or environmental compliance documents are needed for customs clearance.

- Monitor Policy Updates: Stay informed about any changes in tariff rates or trade policies post-April 11, 2025.

Let me know if you need help with customs documentation or further classification clarification.

Customer Reviews

No reviews yet.