Found 3 matching results

(CN → US)

| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3907100000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3907210000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3907290000 | Doc | 61.5% | CN | US | 2025-05-12 |

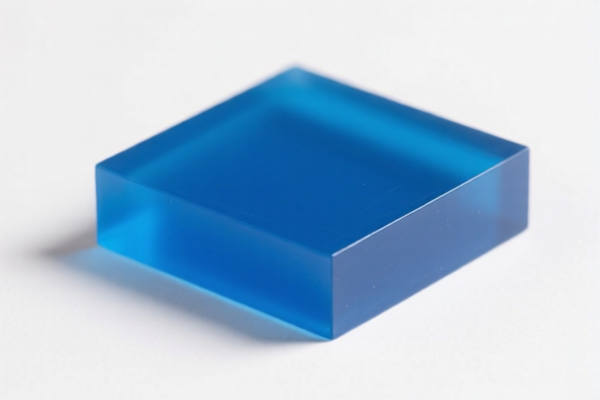

Product Name: Polyacetal Resin Raw Material

HS CODE: 3907100000 (for polyacetal resin raw material, pellets, film, etc.)

HS CODE: 3907210000 (for polyether resin raw material)

🔍 HS Code Classification Summary:

- 3907100000 applies to polyacetal resin raw material, including pellets, film, and other forms.

- 3907210000 applies to polyether resin raw material.

- Both fall under Chapter 39 (Plastics and articles thereof), Heading 3907 (Polyacetal, polyether, and other polyether polyols, whether or not modified, in the form of solutions, dispersions, or other forms).

📊 Tariff Structure (as of now):

- Base Tariff Rate: 6.5%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tariff Rate: 61.5%

⏰ Time-Sensitive Policy Alert:

- April 11, 2025 Special Tariff: A 30.0% additional tariff will be imposed on this product after April 11, 2025. This is a critical date for customs clearance planning and cost estimation.

🛑 Anti-Dumping Duties:

- Not applicable for polyacetal or polyether resin raw materials (no known anti-dumping duties currently in place for this category).

📌 Proactive Advice for Importers:

- Verify the exact material composition (e.g., whether it is polyacetal or polyether) to ensure correct HS code classification.

- Check the unit price and quantity to determine if any preferential tariff rates apply (e.g., under free trade agreements).

- Confirm required certifications (e.g., REACH, RoHS, or other local regulatory compliance documents).

- Plan customs clearance and tariff costs in advance, especially considering the April 11, 2025 tariff increase.

✅ Summary of Key Points:

- HS Code: 3907100000 or 3907210000 (depending on resin type)

- Total Tariff: 61.5% (6.5% base + 25% general + 30% after April 11, 2025)

- No anti-dumping duties currently applicable

- Critical date: April 11, 2025 – tariff increase will take effect

- Action Required: Confirm product details and compliance documents before importation

Let me know if you need help with HS code verification or customs documentation!

Product Name: Polyacetal Resin Raw Material

HS CODE: 3907100000 (for polyacetal resin raw material, pellets, film, etc.)

HS CODE: 3907210000 (for polyether resin raw material)

🔍 HS Code Classification Summary:

- 3907100000 applies to polyacetal resin raw material, including pellets, film, and other forms.

- 3907210000 applies to polyether resin raw material.

- Both fall under Chapter 39 (Plastics and articles thereof), Heading 3907 (Polyacetal, polyether, and other polyether polyols, whether or not modified, in the form of solutions, dispersions, or other forms).

📊 Tariff Structure (as of now):

- Base Tariff Rate: 6.5%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tariff Rate: 61.5%

⏰ Time-Sensitive Policy Alert:

- April 11, 2025 Special Tariff: A 30.0% additional tariff will be imposed on this product after April 11, 2025. This is a critical date for customs clearance planning and cost estimation.

🛑 Anti-Dumping Duties:

- Not applicable for polyacetal or polyether resin raw materials (no known anti-dumping duties currently in place for this category).

📌 Proactive Advice for Importers:

- Verify the exact material composition (e.g., whether it is polyacetal or polyether) to ensure correct HS code classification.

- Check the unit price and quantity to determine if any preferential tariff rates apply (e.g., under free trade agreements).

- Confirm required certifications (e.g., REACH, RoHS, or other local regulatory compliance documents).

- Plan customs clearance and tariff costs in advance, especially considering the April 11, 2025 tariff increase.

✅ Summary of Key Points:

- HS Code: 3907100000 or 3907210000 (depending on resin type)

- Total Tariff: 61.5% (6.5% base + 25% general + 30% after April 11, 2025)

- No anti-dumping duties currently applicable

- Critical date: April 11, 2025 – tariff increase will take effect

- Action Required: Confirm product details and compliance documents before importation

Let me know if you need help with HS code verification or customs documentation!

Customer Reviews

No reviews yet.