| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 5806321095 | Doc | 61.0% | CN | US | 2025-05-12 |

| 5903901800 | Doc | 63.0% | CN | US | 2025-05-12 |

| 5503199000 | Doc | 59.3% | CN | US | 2025-05-12 |

| 5407440060 | Doc | 67.0% | CN | US | 2025-05-12 |

| 5407440030 | Doc | 67.0% | CN | US | 2025-05-12 |

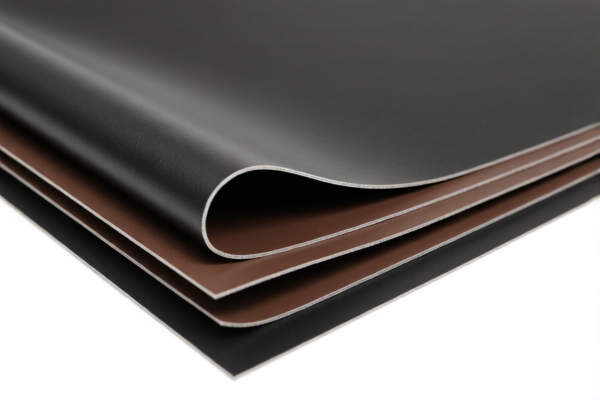

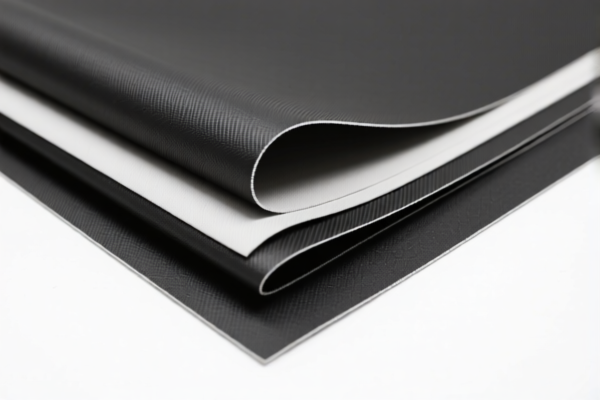

Product Name: Polyamide Automotive Interior Sheets

Classification: Based on the provided HS codes and summaries, the product is classified under various HS codes depending on its specific form and processing (e.g., woven, coated, printed, etc.).

🔍 HS Code Classification Overview

- 5806321095 – Narrow Woven Straps (Polyamide Automotive Interior Straps)

- Total Tax Rate: 61.0%

-

Breakdown:

- Base Tariff: 6.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

5903901800 – Coated Plastic Textile Fabrics (Polyamide Coated Automotive Interior Fabric)

- Total Tax Rate: 63.0%

-

Breakdown:

- Base Tariff: 8.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

5503199000 – Polyamide Fiber (Polyamide Automotive Interior Material)

- Total Tax Rate: 59.3%

-

Breakdown:

- Base Tariff: 4.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

5407440060 – Printed Woven Fabrics (Polyamide Printed Automotive Interior Fabric)

- Total Tax Rate: 67.0%

-

Breakdown:

- Base Tariff: 12.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

5407440030 – Woven Fabrics of Polyamide Filament (Polyamide Printed Automotive Interior Fabric)

- Total Tax Rate: 67.0%

- Breakdown:

- Base Tariff: 12.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

⚠️ Important Notes and Alerts

-

April 11, 2025 Special Tariff:

A 30.0% additional tariff will be imposed on all the above HS codes after April 11, 2025. This is a time-sensitive policy and must be accounted for in cost planning and customs declarations. -

Anti-Dumping Duties:

No specific anti-dumping duties are mentioned for polyamide products in the provided data. However, it is advisable to check the latest anti-dumping duty lists from customs authorities for any applicable duties. -

Material and Certification Requirements:

- Verify the material composition (e.g., whether it is 100% polyamide or blended with other fibers).

- Confirm the processing method (e.g., woven, coated, printed) to ensure correct HS code classification.

- Check if certifications (e.g., REACH, RoHS, flame resistance) are required for automotive use in your target market.

✅ Proactive Advice for Importers

- Double-check the product description to ensure it matches the HS code classification.

- Review the unit price and material composition to avoid misclassification penalties.

- Consult with customs brokers or classification experts if the product is complex or has multiple components.

- Plan for the April 11, 2025 tariff increase to avoid unexpected costs in your supply chain.

Let me know if you need help with a specific product description or customs documentation.

Product Name: Polyamide Automotive Interior Sheets

Classification: Based on the provided HS codes and summaries, the product is classified under various HS codes depending on its specific form and processing (e.g., woven, coated, printed, etc.).

🔍 HS Code Classification Overview

- 5806321095 – Narrow Woven Straps (Polyamide Automotive Interior Straps)

- Total Tax Rate: 61.0%

-

Breakdown:

- Base Tariff: 6.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

5903901800 – Coated Plastic Textile Fabrics (Polyamide Coated Automotive Interior Fabric)

- Total Tax Rate: 63.0%

-

Breakdown:

- Base Tariff: 8.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

5503199000 – Polyamide Fiber (Polyamide Automotive Interior Material)

- Total Tax Rate: 59.3%

-

Breakdown:

- Base Tariff: 4.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

5407440060 – Printed Woven Fabrics (Polyamide Printed Automotive Interior Fabric)

- Total Tax Rate: 67.0%

-

Breakdown:

- Base Tariff: 12.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

5407440030 – Woven Fabrics of Polyamide Filament (Polyamide Printed Automotive Interior Fabric)

- Total Tax Rate: 67.0%

- Breakdown:

- Base Tariff: 12.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

⚠️ Important Notes and Alerts

-

April 11, 2025 Special Tariff:

A 30.0% additional tariff will be imposed on all the above HS codes after April 11, 2025. This is a time-sensitive policy and must be accounted for in cost planning and customs declarations. -

Anti-Dumping Duties:

No specific anti-dumping duties are mentioned for polyamide products in the provided data. However, it is advisable to check the latest anti-dumping duty lists from customs authorities for any applicable duties. -

Material and Certification Requirements:

- Verify the material composition (e.g., whether it is 100% polyamide or blended with other fibers).

- Confirm the processing method (e.g., woven, coated, printed) to ensure correct HS code classification.

- Check if certifications (e.g., REACH, RoHS, flame resistance) are required for automotive use in your target market.

✅ Proactive Advice for Importers

- Double-check the product description to ensure it matches the HS code classification.

- Review the unit price and material composition to avoid misclassification penalties.

- Consult with customs brokers or classification experts if the product is complex or has multiple components.

- Plan for the April 11, 2025 tariff increase to avoid unexpected costs in your supply chain.

Let me know if you need help with a specific product description or customs documentation.

Customer Reviews

No reviews yet.