| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3920920000 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3908907000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3920690000 | Doc | 59.2% | CN | US | 2025-05-12 |

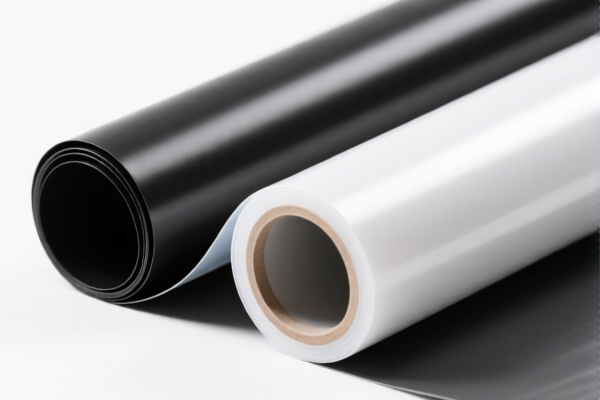

Product Name: Polyamide Composite Films

Classification HS Code: 3920920000

🔍 HS Code and Classification Summary:

- HS Code: 3920920000

- Product Description: Polyamide composite films, polyamide films composite, polyamide composite material films, polyamide film sheets, etc., all fall under this HS code.

- Total Tax Rate: 59.2%

📊 Tariff Breakdown:

- Base Tariff Rate: 4.2%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This is a time-sensitive policy. Ensure compliance with updated regulations after this date.

⚠️ Important Notes and Alerts:

- April 11 Special Tariff: A 30% additional tariff will be applied after April 11, 2025. This is a critical date for customs clearance planning.

- No Anti-dumping duties on iron and aluminum: Not applicable for this product category.

- Material and Certification Verification: Confirm the exact composition and unit price of the product. Some customs authorities may require specific certifications (e.g., material composition reports, origin documentation).

📌 Proactive Advice:

- Verify Product Composition: Ensure the product is indeed a polyamide composite film and not misclassified as a different type of film (e.g., polyester).

- Check for Additional Tariff Exemptions: Some regions or trade agreements may offer preferential rates. Confirm eligibility if applicable.

- Document Properly: Maintain records of product specifications, origin, and any certifications to support customs declarations and avoid delays.

🔄 Alternative HS Codes for Reference:

- 3908907000 – For polyamide films (not composite).

- Total Tax Rate: 61.5%

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

-

Special Tariff after April 11, 2025: 30.0%

-

3920690000 – For polyester composite films.

- Total Tax Rate: 59.2%

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

If you are importing or exporting this product, it is highly recommended to consult with a customs broker or a compliance expert to ensure full adherence to current regulations and avoid unexpected costs.

Product Name: Polyamide Composite Films

Classification HS Code: 3920920000

🔍 HS Code and Classification Summary:

- HS Code: 3920920000

- Product Description: Polyamide composite films, polyamide films composite, polyamide composite material films, polyamide film sheets, etc., all fall under this HS code.

- Total Tax Rate: 59.2%

📊 Tariff Breakdown:

- Base Tariff Rate: 4.2%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This is a time-sensitive policy. Ensure compliance with updated regulations after this date.

⚠️ Important Notes and Alerts:

- April 11 Special Tariff: A 30% additional tariff will be applied after April 11, 2025. This is a critical date for customs clearance planning.

- No Anti-dumping duties on iron and aluminum: Not applicable for this product category.

- Material and Certification Verification: Confirm the exact composition and unit price of the product. Some customs authorities may require specific certifications (e.g., material composition reports, origin documentation).

📌 Proactive Advice:

- Verify Product Composition: Ensure the product is indeed a polyamide composite film and not misclassified as a different type of film (e.g., polyester).

- Check for Additional Tariff Exemptions: Some regions or trade agreements may offer preferential rates. Confirm eligibility if applicable.

- Document Properly: Maintain records of product specifications, origin, and any certifications to support customs declarations and avoid delays.

🔄 Alternative HS Codes for Reference:

- 3908907000 – For polyamide films (not composite).

- Total Tax Rate: 61.5%

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

-

Special Tariff after April 11, 2025: 30.0%

-

3920690000 – For polyester composite films.

- Total Tax Rate: 59.2%

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

If you are importing or exporting this product, it is highly recommended to consult with a customs broker or a compliance expert to ensure full adherence to current regulations and avoid unexpected costs.

Customer Reviews

No reviews yet.