| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3920920000 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3908907000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 5503199000 | Doc | 59.3% | CN | US | 2025-05-12 |

| 3920100000 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3920690000 | Doc | 59.2% | CN | US | 2025-05-12 |

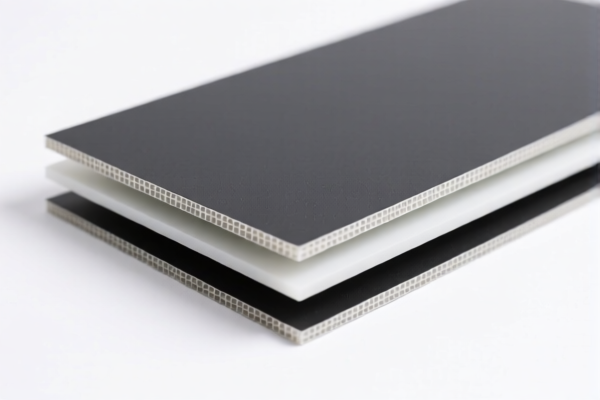

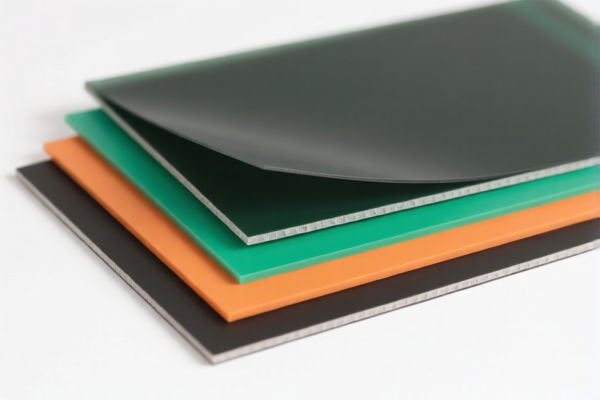

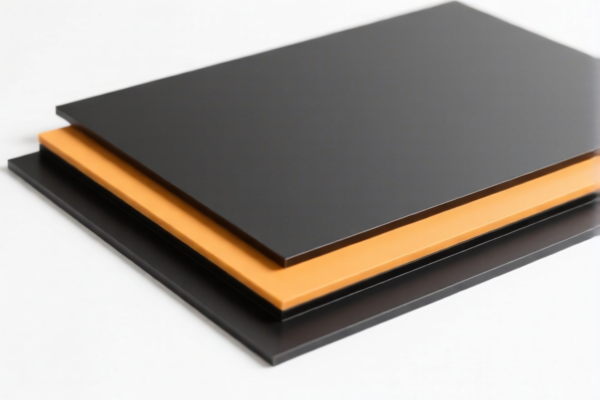

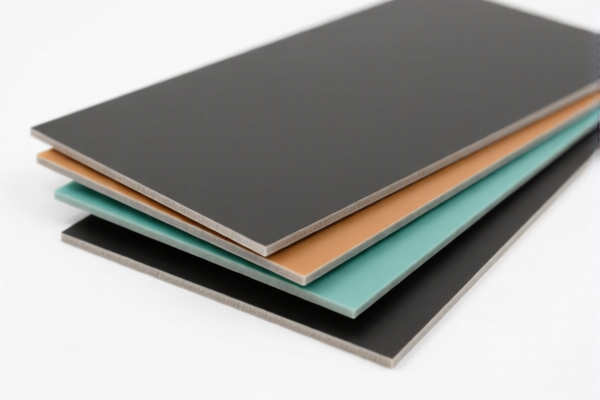

Product Name: Polyamide Composite Sheets

Classification HS Code Analysis:

- HS CODE: 3920920000

- Product Description: Polyamide composite sheets

- Total Tax Rate: 59.2%

- Breakdown:

- Base Tariff Rate: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Notes: This is the most relevant code for polyamide composite sheets. Ensure the product is not misclassified as a different type of composite material (e.g., polyethylene or polyester).

-

HS CODE: 3908907000

- Product Description: Polyamide sheets

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Notes: This code applies to polyamide sheets, not composite materials. If your product contains additives or reinforcing materials, it may be better classified under 3920920000.

-

HS CODE: 5503199000

- Product Description: Polyamide fiber composite materials

- Total Tax Rate: 59.3%

- Breakdown:

- Base Tariff Rate: 4.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Notes: This code is for fiber-based composite materials. If your product is primarily a sheet and not fiber-reinforced, this may not be the correct classification.

-

HS CODE: 3920100000

- Product Description: Polyethylene composite boards

- Total Tax Rate: 59.2%

- Breakdown:

- Base Tariff Rate: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Notes: This code is for polyethylene composites, not polyamide. Be cautious of misclassification if the material is not polyethylene.

-

HS CODE: 3920690000

- Product Description: Polyester composite boards

- Total Tax Rate: 59.2%

- Breakdown:

- Base Tariff Rate: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Notes: This code applies to polyester composites. If your product is polyamide-based, this is not the correct classification.

✅ Proactive Advice:

- Verify Material Composition: Confirm that the product is indeed polyamide-based and not a composite of other polymers (e.g., polyethylene or polyester).

- Check Unit Price and Certification: Ensure that the product meets any required certifications (e.g., REACH, RoHS) and that the unit price is consistent with the classification.

- Monitor Tariff Changes: The additional tariffs after April 11, 2025, will increase the total tax rate by 5% (from 25% to 30%). Plan accordingly for import costs.

-

Consult Customs Authority: If in doubt, consult with a customs broker or the local customs authority to confirm the correct classification and tax implications. Product Name: Polyamide Composite Sheets

Classification HS Code Analysis: -

HS CODE: 3920920000

- Product Description: Polyamide composite sheets

- Total Tax Rate: 59.2%

- Breakdown:

- Base Tariff Rate: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Notes: This is the most relevant code for polyamide composite sheets. Ensure the product is not misclassified as a different type of composite material (e.g., polyethylene or polyester).

-

HS CODE: 3908907000

- Product Description: Polyamide sheets

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Notes: This code applies to polyamide sheets, not composite materials. If your product contains additives or reinforcing materials, it may be better classified under 3920920000.

-

HS CODE: 5503199000

- Product Description: Polyamide fiber composite materials

- Total Tax Rate: 59.3%

- Breakdown:

- Base Tariff Rate: 4.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Notes: This code is for fiber-based composite materials. If your product is primarily a sheet and not fiber-reinforced, this may not be the correct classification.

-

HS CODE: 3920100000

- Product Description: Polyethylene composite boards

- Total Tax Rate: 59.2%

- Breakdown:

- Base Tariff Rate: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Notes: This code is for polyethylene composites, not polyamide. Be cautious of misclassification if the material is not polyethylene.

-

HS CODE: 3920690000

- Product Description: Polyester composite boards

- Total Tax Rate: 59.2%

- Breakdown:

- Base Tariff Rate: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Notes: This code applies to polyester composites. If your product is polyamide-based, this is not the correct classification.

✅ Proactive Advice:

- Verify Material Composition: Confirm that the product is indeed polyamide-based and not a composite of other polymers (e.g., polyethylene or polyester).

- Check Unit Price and Certification: Ensure that the product meets any required certifications (e.g., REACH, RoHS) and that the unit price is consistent with the classification.

- Monitor Tariff Changes: The additional tariffs after April 11, 2025, will increase the total tax rate by 5% (from 25% to 30%). Plan accordingly for import costs.

- Consult Customs Authority: If in doubt, consult with a customs broker or the local customs authority to confirm the correct classification and tax implications.

Customer Reviews

No reviews yet.