Found 5 matching results

(CN → US)

| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3908902000 | Doc | 55.0% | CN | US | 2025-05-12 |

| 3908907000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 5402510000 | Doc | 63.8% | CN | US | 2025-05-12 |

| 3908902000 | Doc | 55.0% | CN | US | 2025-05-12 |

| 3908907000 | Doc | 61.5% | CN | US | 2025-05-12 |

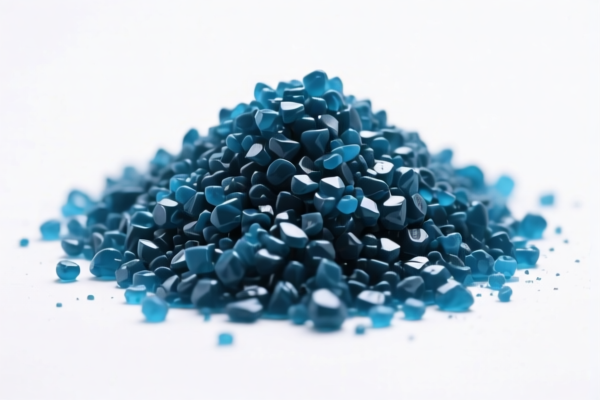

- HS CODE: 3908902000

- Product Description: Primary form of polyamide (nylon)

- Base Tariff Rate: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 2, 2025: 30.0%

- Total Tax Rate: 55.0%

-

Note: This code applies to polyamide in its primary (unprocessed) form.

-

HS CODE: 3908907000

- Product Description: Other primary forms of polyamide

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 2, 2025: 30.0%

- Total Tax Rate: 61.5%

-

Note: This code covers other types of polyamide in primary form, excluding those under 3908902000.

-

HS CODE: 5402510000

- Product Description: Products made of nylon or other polyamides

- Base Tariff Rate: 8.8%

- Additional Tariff: 25.0%

- Special Tariff after April 2, 2025: 30.0%

- Total Tax Rate: 63.8%

- Note: This code applies to finished products made from polyamide, not the raw material itself.

📌 Important Notes for Users:

- Verify the product form: Ensure whether the product is in its primary (raw) form (e.g., polyamide resin) or a finished product made from polyamide (e.g., fabric, plastic parts).

- Check the material composition: If the product contains other additives or is blended with other materials, it may fall under a different HS code.

- Be aware of the April 2, 2025, tariff increase: If your goods are imported after this date, the additional tariff will increase from 25% to 30%.

- Certifications required: Depending on the country of import, you may need to provide documentation such as material safety data sheets (MSDS), origin certificates, or customs declarations.

- Consult a customs broker: For complex cases, especially if the product is a blend or semi-finished product, it is advisable to seek professional customs advice to avoid misclassification and penalties.

- HS CODE: 3908902000

- Product Description: Primary form of polyamide (nylon)

- Base Tariff Rate: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 2, 2025: 30.0%

- Total Tax Rate: 55.0%

-

Note: This code applies to polyamide in its primary (unprocessed) form.

-

HS CODE: 3908907000

- Product Description: Other primary forms of polyamide

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 2, 2025: 30.0%

- Total Tax Rate: 61.5%

-

Note: This code covers other types of polyamide in primary form, excluding those under 3908902000.

-

HS CODE: 5402510000

- Product Description: Products made of nylon or other polyamides

- Base Tariff Rate: 8.8%

- Additional Tariff: 25.0%

- Special Tariff after April 2, 2025: 30.0%

- Total Tax Rate: 63.8%

- Note: This code applies to finished products made from polyamide, not the raw material itself.

📌 Important Notes for Users:

- Verify the product form: Ensure whether the product is in its primary (raw) form (e.g., polyamide resin) or a finished product made from polyamide (e.g., fabric, plastic parts).

- Check the material composition: If the product contains other additives or is blended with other materials, it may fall under a different HS code.

- Be aware of the April 2, 2025, tariff increase: If your goods are imported after this date, the additional tariff will increase from 25% to 30%.

- Certifications required: Depending on the country of import, you may need to provide documentation such as material safety data sheets (MSDS), origin certificates, or customs declarations.

- Consult a customs broker: For complex cases, especially if the product is a blend or semi-finished product, it is advisable to seek professional customs advice to avoid misclassification and penalties.

Customer Reviews

No reviews yet.