| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3908902000 | Doc | 55.0% | CN | US | 2025-05-12 |

| 3908907000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 5402510000 | Doc | 63.8% | CN | US | 2025-05-12 |

| 5503110000 | Doc | 59.3% | CN | US | 2025-05-12 |

| 3920991000 | Doc | 61.0% | CN | US | 2025-05-12 |

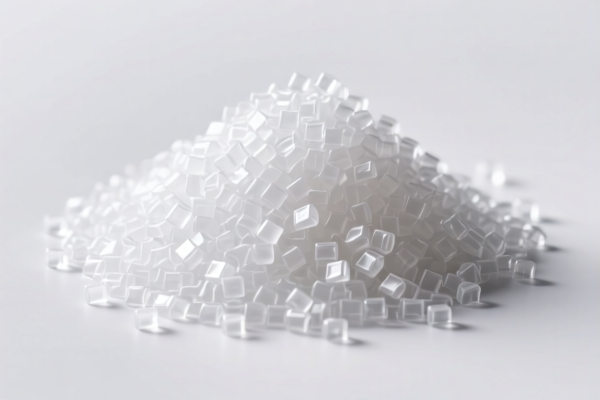

- HS CODE: 3908902000

- Product Description: Polyamide in primary form

- Base Tariff Rate: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 55.0%

-

Note: This code applies to polyamide in its primary (unprocessed) form.

-

HS CODE: 3908907000

- Product Description: Other polyamide in primary form

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

-

Note: This code covers other types of polyamide in primary form, excluding those under 3908902000.

-

HS CODE: 5402510000

- Product Description: Nylon or other polyamide material

- Base Tariff Rate: 8.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 63.8%

-

Note: This code applies to materials made of nylon or other polyamides, likely for textile use.

-

HS CODE: 5503110000

- Product Description: Synthetic short fibers made of nylon or other polyamides

- Base Tariff Rate: 4.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 59.3%

-

Note: This code is for synthetic short fibers made from polyamide, typically used in textiles.

-

HS CODE: 3920991000

- Product Description: Other plastics, sheets

- Base Tariff Rate: 6.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.0%

- Note: This code applies to other types of plastic sheets, not specifically polyamide.

✅ Proactive Advice:

- Verify Material Specifications: Ensure the product is indeed in its primary form (e.g., not compounded or processed) to match the correct HS code.

- Check Unit Price and Certification: Some HS codes may require specific certifications or documentation (e.g., for textile fibers).

- Monitor Tariff Changes: The additional tariffs after April 11, 2025, will increase the total tax burden by 5% (from 25% to 30%).

- Consult Customs Authority: For complex or high-value shipments, it is recommended to confirm the classification with local customs or a customs broker.

- HS CODE: 3908902000

- Product Description: Polyamide in primary form

- Base Tariff Rate: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 55.0%

-

Note: This code applies to polyamide in its primary (unprocessed) form.

-

HS CODE: 3908907000

- Product Description: Other polyamide in primary form

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

-

Note: This code covers other types of polyamide in primary form, excluding those under 3908902000.

-

HS CODE: 5402510000

- Product Description: Nylon or other polyamide material

- Base Tariff Rate: 8.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 63.8%

-

Note: This code applies to materials made of nylon or other polyamides, likely for textile use.

-

HS CODE: 5503110000

- Product Description: Synthetic short fibers made of nylon or other polyamides

- Base Tariff Rate: 4.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 59.3%

-

Note: This code is for synthetic short fibers made from polyamide, typically used in textiles.

-

HS CODE: 3920991000

- Product Description: Other plastics, sheets

- Base Tariff Rate: 6.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.0%

- Note: This code applies to other types of plastic sheets, not specifically polyamide.

✅ Proactive Advice:

- Verify Material Specifications: Ensure the product is indeed in its primary form (e.g., not compounded or processed) to match the correct HS code.

- Check Unit Price and Certification: Some HS codes may require specific certifications or documentation (e.g., for textile fibers).

- Monitor Tariff Changes: The additional tariffs after April 11, 2025, will increase the total tax burden by 5% (from 25% to 30%).

- Consult Customs Authority: For complex or high-value shipments, it is recommended to confirm the classification with local customs or a customs broker.

Customer Reviews

No reviews yet.