Found 4 matching results

(CN → US)

| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3920920000 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3920920000 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3908907000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3920920000 | Doc | 59.2% | CN | US | 2025-05-12 |

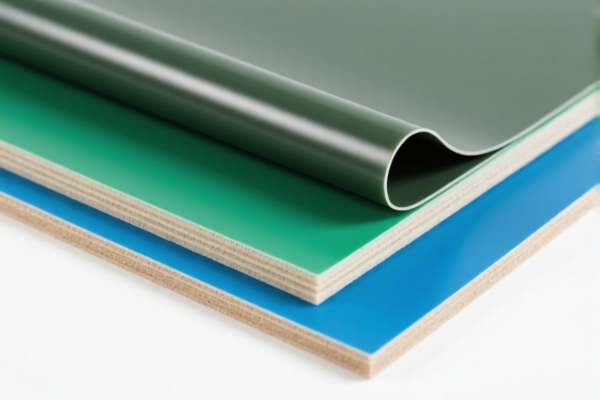

Product Classification: Polyamide Industrial Sheets

HS CODE: 3920920000 (for most entries) and 3908907000 (for "聚酰胺板")

🔍 Classification Overview

- 3920920000 is the HS code for polyamide industrial sheets, including industrial packaging sheets and plastic boards.

- 3908907000 is for polyamide sheets (possibly more general or specialized variants).

📊 Tariff Breakdown (as of current data)

For HS CODE: 3920920000 (Polyamide Industrial Sheets, Packaging, Plastic Boards)

- Base Tariff Rate: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 59.2%

For HS CODE: 3908907000 (Polyamide Sheets)

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

⏰ Time-Sensitive Policy Alert

- April 11, 2025: Additional tariffs will increase from 25.0% to 30.0% for both HS codes.

- This change may significantly impact import costs. Ensure your customs declarations are accurate and up-to-date.

🛑 Anti-Dumping Duties (if applicable)

- Not specified in the provided data.

- If your product is subject to anti-dumping duties on iron or aluminum (though polyamide is not metal), you may need to check with customs or consult a compliance expert.

📌 Proactive Advice for Importers

- Verify Material Specifications: Confirm the exact type of polyamide (e.g., nylon 6, nylon 66) and whether it's reinforced or modified.

- Check Unit Price and Packaging: Tariff rates may vary based on product form (e.g., sheets vs. molded parts).

- Certifications Required: Ensure compliance with any required certifications (e.g., REACH, RoHS, or specific industry standards).

- Consult Customs Broker: For accurate classification and tariff calculation, especially if the product is borderline or has multiple uses.

✅ Summary of Key Points

- HS CODE 3920920000 is the most common for polyamide industrial sheets.

- Total tax rate is 59.2%, with a 30.0% additional tariff after April 11, 2025.

- HS CODE 3908907000 has a slightly higher total tax rate of 61.5%.

- April 11, 2025 is a critical date for tariff changes — plan accordingly.

Product Classification: Polyamide Industrial Sheets

HS CODE: 3920920000 (for most entries) and 3908907000 (for "聚酰胺板")

🔍 Classification Overview

- 3920920000 is the HS code for polyamide industrial sheets, including industrial packaging sheets and plastic boards.

- 3908907000 is for polyamide sheets (possibly more general or specialized variants).

📊 Tariff Breakdown (as of current data)

For HS CODE: 3920920000 (Polyamide Industrial Sheets, Packaging, Plastic Boards)

- Base Tariff Rate: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 59.2%

For HS CODE: 3908907000 (Polyamide Sheets)

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

⏰ Time-Sensitive Policy Alert

- April 11, 2025: Additional tariffs will increase from 25.0% to 30.0% for both HS codes.

- This change may significantly impact import costs. Ensure your customs declarations are accurate and up-to-date.

🛑 Anti-Dumping Duties (if applicable)

- Not specified in the provided data.

- If your product is subject to anti-dumping duties on iron or aluminum (though polyamide is not metal), you may need to check with customs or consult a compliance expert.

📌 Proactive Advice for Importers

- Verify Material Specifications: Confirm the exact type of polyamide (e.g., nylon 6, nylon 66) and whether it's reinforced or modified.

- Check Unit Price and Packaging: Tariff rates may vary based on product form (e.g., sheets vs. molded parts).

- Certifications Required: Ensure compliance with any required certifications (e.g., REACH, RoHS, or specific industry standards).

- Consult Customs Broker: For accurate classification and tariff calculation, especially if the product is borderline or has multiple uses.

✅ Summary of Key Points

- HS CODE 3920920000 is the most common for polyamide industrial sheets.

- Total tax rate is 59.2%, with a 30.0% additional tariff after April 11, 2025.

- HS CODE 3908907000 has a slightly higher total tax rate of 61.5%.

- April 11, 2025 is a critical date for tariff changes — plan accordingly.

Customer Reviews

No reviews yet.