| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3920920000 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3920690000 | Doc | 59.2% | CN | US | 2025-05-12 |

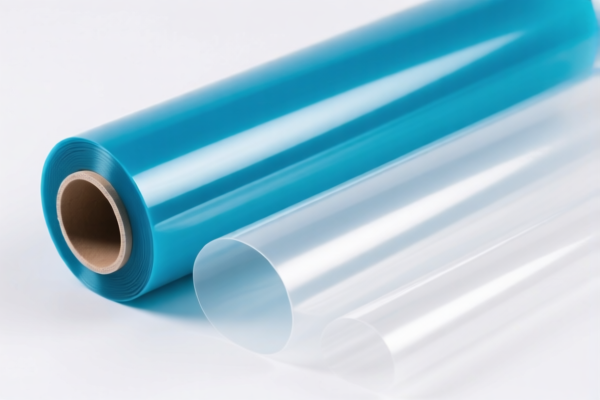

Product Name: Polyamide Packaging Films

Classification: HS Code 3920920000

✅ HS CODE: 3920920000

Description: Other plastic sheets, plates, films, foils and strips, non-cellular and not reinforced, laminated, supported or otherwise combined with other materials: Other plastics: Made of polyamide.

🔍 Tariff Breakdown (as of now):

- Base Tariff Rate: 4.2%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 59.2%

⚠️ Important Notes:

- April 11 Special Tariff: Starting from April 11, 2025, an additional 30.0% tariff will be applied on top of the base and general tariffs. This is a time-sensitive policy and will significantly increase the total tax burden.

- No Anti-dumping duties on iron/aluminum: This product is made of polyamide (a type of plastic), so anti-dumping duties on metals do not apply.

- No specific mention of anti-dumping or countervailing duties for this product category.

📌 Proactive Advice for Importers:

- Verify Material Composition: Ensure the product is indeed made of polyamide and not a blend or composite that might fall under a different HS code.

- Check Unit Price and Packaging: Confirm the unit of measurement (e.g., kg, m²) and whether the product is sold in bulk or packaged, as this can affect customs valuation.

- Certifications Required: Confirm if any certifications (e.g., RoHS, REACH, or specific import permits) are required for the product in the destination country.

- Monitor Tariff Updates: Keep an eye on any changes in tariff policies, especially after April 11, 2025, to avoid unexpected costs.

📊 Comparison with Similar HS Code (3920690000):

- HS Code 3920690000 is for polyester-based products, not polyamide.

- Same Total Tax Rate (59.2%) due to identical base and additional tariffs.

- Different Material: Ensure correct classification based on the actual polymer used (polyamide vs. polyester).

Let me know if you need help with customs documentation or further classification clarification.

Product Name: Polyamide Packaging Films

Classification: HS Code 3920920000

✅ HS CODE: 3920920000

Description: Other plastic sheets, plates, films, foils and strips, non-cellular and not reinforced, laminated, supported or otherwise combined with other materials: Other plastics: Made of polyamide.

🔍 Tariff Breakdown (as of now):

- Base Tariff Rate: 4.2%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 59.2%

⚠️ Important Notes:

- April 11 Special Tariff: Starting from April 11, 2025, an additional 30.0% tariff will be applied on top of the base and general tariffs. This is a time-sensitive policy and will significantly increase the total tax burden.

- No Anti-dumping duties on iron/aluminum: This product is made of polyamide (a type of plastic), so anti-dumping duties on metals do not apply.

- No specific mention of anti-dumping or countervailing duties for this product category.

📌 Proactive Advice for Importers:

- Verify Material Composition: Ensure the product is indeed made of polyamide and not a blend or composite that might fall under a different HS code.

- Check Unit Price and Packaging: Confirm the unit of measurement (e.g., kg, m²) and whether the product is sold in bulk or packaged, as this can affect customs valuation.

- Certifications Required: Confirm if any certifications (e.g., RoHS, REACH, or specific import permits) are required for the product in the destination country.

- Monitor Tariff Updates: Keep an eye on any changes in tariff policies, especially after April 11, 2025, to avoid unexpected costs.

📊 Comparison with Similar HS Code (3920690000):

- HS Code 3920690000 is for polyester-based products, not polyamide.

- Same Total Tax Rate (59.2%) due to identical base and additional tariffs.

- Different Material: Ensure correct classification based on the actual polymer used (polyamide vs. polyester).

Let me know if you need help with customs documentation or further classification clarification.

Customer Reviews

No reviews yet.