Found 5 matching results

(CN → US)

| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3920920000 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3908907000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3920920000 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3920920000 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3920920000 | Doc | 59.2% | CN | US | 2025-05-12 |

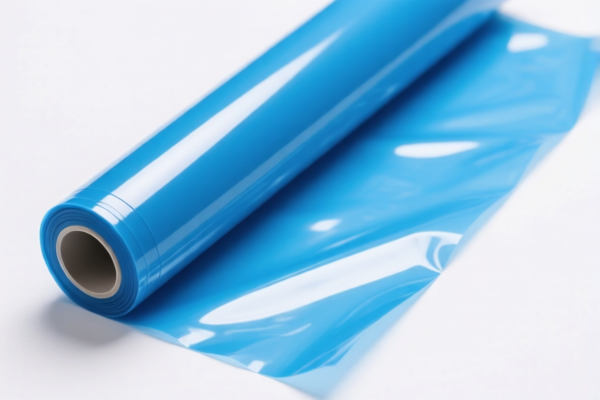

Product Classification: Polyamide Plastic Films

HS CODE: 3920920000 (for most variants of polyamide plastic films)

🔍 Classification Overview

- Product Name: Polyamide Plastic Films (including packaging, composite, and film sheets)

- HS Code: 3920920000 (common code for various polyamide film types)

- Tariff Summary:

- Base Tariff Rate: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 59.2%

📌 Key Tax Rate Changes

- Base Tariff: 4.2% (applies to all imports)

- Additional Tariff: 25.0% (standard additional duty)

- April 11, 2025 Special Tariff: 30.0% (applies to imports after this date)

- Total Tax Rate: 4.2% + 25.0% + 30.0% = 59.2%

⚠️ Note: The 30.0% special tariff is only applicable after April 11, 2025. Ensure your import timeline is aligned with this policy.

📦 Customs Compliance Considerations

- Material Verification: Confirm the exact composition and thickness of the polyamide film (e.g., whether it's a composite or packaging film).

- Unit Price: Accurate pricing is essential for customs valuation and duty calculation.

- Certifications: Check if any certifications (e.g., RoHS, REACH, or specific import permits) are required for the product.

- Documentation: Ensure proper documentation (e.g., commercial invoice, packing list, and product specifications) is prepared for customs clearance.

📌 Proactive Advice

- Verify HS Code: Confirm that the product is correctly classified under 3920920000 and not under a different code (e.g., 3908907000 for polyamide films).

- Monitor Tariff Changes: Stay updated on any new or revised tariffs, especially after April 11, 2025.

- Consult Customs Broker: For complex or high-value shipments, consider engaging a customs broker to ensure compliance and avoid delays.

📊 Summary Table

| Tariff Type | Rate |

|---|---|

| Base Tariff | 4.2% |

| Additional Tariff | 25.0% |

| April 11, 2025 Tariff | 30.0% |

| Total Tax Rate | 59.2% |

Let me know if you need help with HS code verification or customs documentation!

Product Classification: Polyamide Plastic Films

HS CODE: 3920920000 (for most variants of polyamide plastic films)

🔍 Classification Overview

- Product Name: Polyamide Plastic Films (including packaging, composite, and film sheets)

- HS Code: 3920920000 (common code for various polyamide film types)

- Tariff Summary:

- Base Tariff Rate: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 59.2%

📌 Key Tax Rate Changes

- Base Tariff: 4.2% (applies to all imports)

- Additional Tariff: 25.0% (standard additional duty)

- April 11, 2025 Special Tariff: 30.0% (applies to imports after this date)

- Total Tax Rate: 4.2% + 25.0% + 30.0% = 59.2%

⚠️ Note: The 30.0% special tariff is only applicable after April 11, 2025. Ensure your import timeline is aligned with this policy.

📦 Customs Compliance Considerations

- Material Verification: Confirm the exact composition and thickness of the polyamide film (e.g., whether it's a composite or packaging film).

- Unit Price: Accurate pricing is essential for customs valuation and duty calculation.

- Certifications: Check if any certifications (e.g., RoHS, REACH, or specific import permits) are required for the product.

- Documentation: Ensure proper documentation (e.g., commercial invoice, packing list, and product specifications) is prepared for customs clearance.

📌 Proactive Advice

- Verify HS Code: Confirm that the product is correctly classified under 3920920000 and not under a different code (e.g., 3908907000 for polyamide films).

- Monitor Tariff Changes: Stay updated on any new or revised tariffs, especially after April 11, 2025.

- Consult Customs Broker: For complex or high-value shipments, consider engaging a customs broker to ensure compliance and avoid delays.

📊 Summary Table

| Tariff Type | Rate |

|---|---|

| Base Tariff | 4.2% |

| Additional Tariff | 25.0% |

| April 11, 2025 Tariff | 30.0% |

| Total Tax Rate | 59.2% |

Let me know if you need help with HS code verification or customs documentation!

Customer Reviews

No reviews yet.