Found 2 matching results

(CN → US)

| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3920920000 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3908907000 | Doc | 61.5% | CN | US | 2025-05-12 |

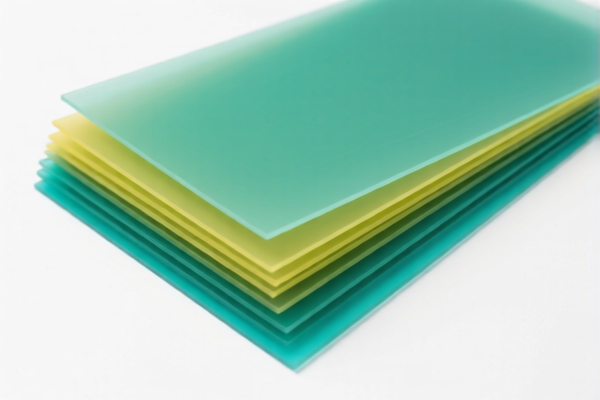

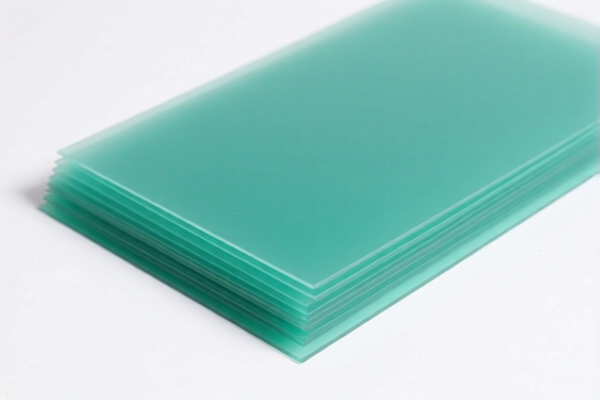

- HS CODE: 3920920000

- Product Description: Polyamide plastic sheets

- Base Tariff Rate: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Total Tax Rate: 59.2%

-

HS CODE: 3908907000

- Product Description: Polyamide sheets (alternative classification)

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

Key Notes:

- Tariff Increase Alert: Starting from April 11, 2025, an additional 30.0% tariff will be applied to both HS codes. This is a significant increase and may impact import costs.

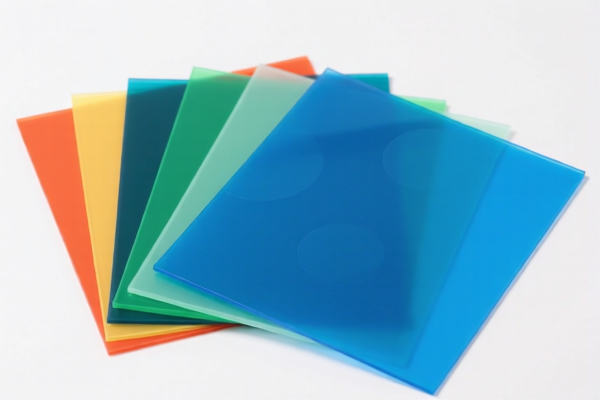

- Classification Clarification: The product may be classified under either 3920920000 or 3908907000 depending on specific attributes such as material composition, thickness, and intended use. Confirm the exact product specifications to ensure correct classification.

- Certifications Required: Verify if any certifications (e.g., RoHS, REACH, or specific import permits) are required for the product in the target market.

- Unit Price Verification: Ensure the unit price and quantity are accurately declared to avoid discrepancies during customs inspection.

Proactive Advice:

- Double-check the product’s technical specifications (e.g., whether it is a sheet, film, or molded product) to determine the correct HS code.

- Consult with a customs broker or classification expert if the product has mixed materials or special treatments (e.g., flame retardant, reinforced).

- Monitor policy updates after April 11, 2025, as the additional tariff may be subject to change or extension.

- HS CODE: 3920920000

- Product Description: Polyamide plastic sheets

- Base Tariff Rate: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Total Tax Rate: 59.2%

-

HS CODE: 3908907000

- Product Description: Polyamide sheets (alternative classification)

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

Key Notes:

- Tariff Increase Alert: Starting from April 11, 2025, an additional 30.0% tariff will be applied to both HS codes. This is a significant increase and may impact import costs.

- Classification Clarification: The product may be classified under either 3920920000 or 3908907000 depending on specific attributes such as material composition, thickness, and intended use. Confirm the exact product specifications to ensure correct classification.

- Certifications Required: Verify if any certifications (e.g., RoHS, REACH, or specific import permits) are required for the product in the target market.

- Unit Price Verification: Ensure the unit price and quantity are accurately declared to avoid discrepancies during customs inspection.

Proactive Advice:

- Double-check the product’s technical specifications (e.g., whether it is a sheet, film, or molded product) to determine the correct HS code.

- Consult with a customs broker or classification expert if the product has mixed materials or special treatments (e.g., flame retardant, reinforced).

- Monitor policy updates after April 11, 2025, as the additional tariff may be subject to change or extension.

Customer Reviews

No reviews yet.