| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3920920000 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3920991000 | Doc | 61.0% | CN | US | 2025-05-12 |

| 3920920000 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3920920000 | Doc | 59.2% | CN | US | 2025-05-12 |

| 5407410030 | Doc | 68.6% | CN | US | 2025-05-12 |

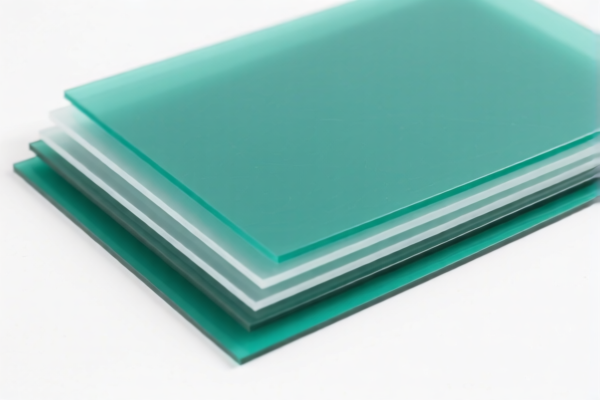

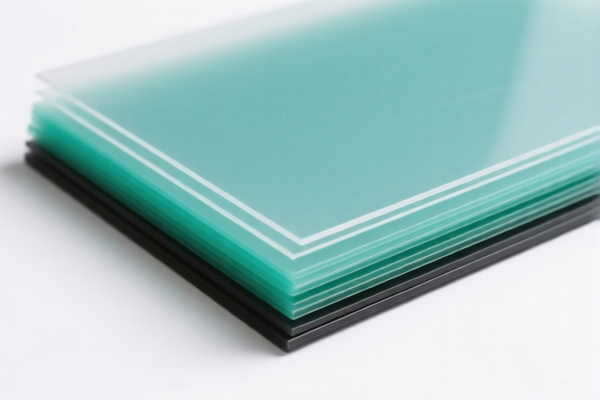

Product Classification and Customs Duty Analysis for "Polyamide Plastic Supported Sheets"

Below is the detailed breakdown of the HS codes and associated customs duties for the product "Polyamide Plastic Supported Sheets":

✅ HS CODE: 3920920000

Product Description:

- Polyamide plastic sheets, including foil and film (various descriptions provided in the input).

Tariff Breakdown:

- Base Tariff Rate: 4.2%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 59.2%

Notes: - This code applies to multiple product forms (e.g., sheets, foil, film) made of polyamide plastic. - The same HS code is used for different product forms, so material and product form must be verified to ensure correct classification.

✅ HS CODE: 3920991000

Product Description:

- Polyamide plastic sheets (not elsewhere specified).

Tariff Breakdown:

- Base Tariff Rate: 6.0%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.0%

Notes: - This code is for polyamide plastic sheets that do not fall under the more specific 3920920000 category. - Ensure the product is not classified under 3920920000 to avoid overpayment of duties.

✅ HS CODE: 5407410030

Product Description:

- Polyamide lightweight supported fabric (e.g., woven or non-woven fabric).

Tariff Breakdown:

- Base Tariff Rate: 13.6%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 68.6%

Notes: - This code applies to fabric made of polyamide, not solid plastic sheets. - Material and product form must be clearly defined to avoid misclassification.

📌 Important Reminders:

- Verify the exact product form and material composition (e.g., is it a sheet, film, or fabric? Is it woven or non-woven?).

- Check the unit price and product specifications to ensure the correct HS code is applied.

- Review the April 11, 2025, special tariff and its impact on your total customs costs.

- Check if any anti-dumping or countervailing duties apply (not specified in this data, but may be relevant depending on origin).

- Ensure compliance with any required certifications (e.g., REACH, RoHS, or other import regulations).

🛑 Action Required:

- Confirm the product form and material with your supplier.

- Review certifications and documentation required for customs clearance.

- Consider consulting a customs broker or expert for complex or high-value shipments. Product Classification and Customs Duty Analysis for "Polyamide Plastic Supported Sheets"

Below is the detailed breakdown of the HS codes and associated customs duties for the product "Polyamide Plastic Supported Sheets":

✅ HS CODE: 3920920000

Product Description:

- Polyamide plastic sheets, including foil and film (various descriptions provided in the input).

Tariff Breakdown:

- Base Tariff Rate: 4.2%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 59.2%

Notes: - This code applies to multiple product forms (e.g., sheets, foil, film) made of polyamide plastic. - The same HS code is used for different product forms, so material and product form must be verified to ensure correct classification.

✅ HS CODE: 3920991000

Product Description:

- Polyamide plastic sheets (not elsewhere specified).

Tariff Breakdown:

- Base Tariff Rate: 6.0%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.0%

Notes: - This code is for polyamide plastic sheets that do not fall under the more specific 3920920000 category. - Ensure the product is not classified under 3920920000 to avoid overpayment of duties.

✅ HS CODE: 5407410030

Product Description:

- Polyamide lightweight supported fabric (e.g., woven or non-woven fabric).

Tariff Breakdown:

- Base Tariff Rate: 13.6%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 68.6%

Notes: - This code applies to fabric made of polyamide, not solid plastic sheets. - Material and product form must be clearly defined to avoid misclassification.

📌 Important Reminders:

- Verify the exact product form and material composition (e.g., is it a sheet, film, or fabric? Is it woven or non-woven?).

- Check the unit price and product specifications to ensure the correct HS code is applied.

- Review the April 11, 2025, special tariff and its impact on your total customs costs.

- Check if any anti-dumping or countervailing duties apply (not specified in this data, but may be relevant depending on origin).

- Ensure compliance with any required certifications (e.g., REACH, RoHS, or other import regulations).

🛑 Action Required:

- Confirm the product form and material with your supplier.

- Review certifications and documentation required for customs clearance.

- Consider consulting a customs broker or expert for complex or high-value shipments.

Customer Reviews

No reviews yet.