| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3920610000 | Doc | 60.8% | CN | US | 2025-05-12 |

| 3920632000 | Doc | 60.8% | CN | US | 2025-05-12 |

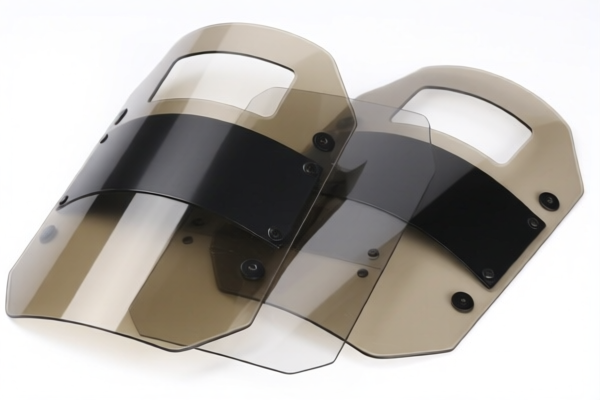

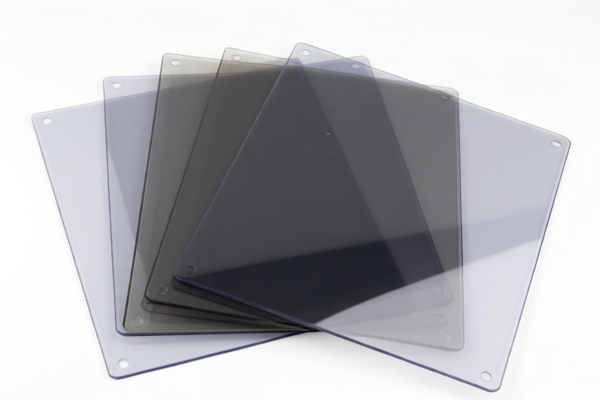

Product Name: Polycarbonate Bulletproof Sheets

Classification HS Code:

- 3920610000

- 3920632000

🔍 HS Code Classification Overview

- 3920610000: Covers polycarbonate sheets with special functions such as impact resistance, radiation protection, anti-theft, and UV protection.

- 3920632000: Covers polycarbonate protective sheets and impact-resistant sheets made of polycarbonate material.

Both HS codes are used for polycarbonate sheets with specific functional properties, including bulletproof applications.

📊 Tariff Breakdown (as of now)

- Base Tariff Rate: 5.8%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tax Rate: 60.8% (5.8% + 25.0% + 30.0%)

⚠️ Important Note: The 30.0% additional tariff will be imposed after April 11, 2025. Ensure your customs clearance is completed before this date if you wish to avoid the higher rate.

📌 Key Considerations for Customs Compliance

- Material Verification: Confirm that the product is indeed made of polycarbonate and not a composite or mixed material, as this may affect classification.

- Unit Price: The tax rate may be influenced by the FOB price or unit value of the product. Ensure accurate pricing documentation.

- Certifications: Check if any safety, security, or performance certifications (e.g., bulletproof rating, UV resistance) are required for import.

- Documentation: Provide product specifications, technical data sheets, and certificates of compliance to support the HS code classification.

🛑 Proactive Advice

- Double-check the HS code with customs authorities or a qualified customs broker to avoid misclassification.

- Monitor policy updates related to anti-dumping duties or special tariffs on materials like polycarbonate (especially if imported from countries under trade restrictions).

- Plan ahead for the April 11, 2025 tariff change to avoid unexpected costs.

Let me know if you need help with certification requirements or customs documentation templates.

Product Name: Polycarbonate Bulletproof Sheets

Classification HS Code:

- 3920610000

- 3920632000

🔍 HS Code Classification Overview

- 3920610000: Covers polycarbonate sheets with special functions such as impact resistance, radiation protection, anti-theft, and UV protection.

- 3920632000: Covers polycarbonate protective sheets and impact-resistant sheets made of polycarbonate material.

Both HS codes are used for polycarbonate sheets with specific functional properties, including bulletproof applications.

📊 Tariff Breakdown (as of now)

- Base Tariff Rate: 5.8%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tax Rate: 60.8% (5.8% + 25.0% + 30.0%)

⚠️ Important Note: The 30.0% additional tariff will be imposed after April 11, 2025. Ensure your customs clearance is completed before this date if you wish to avoid the higher rate.

📌 Key Considerations for Customs Compliance

- Material Verification: Confirm that the product is indeed made of polycarbonate and not a composite or mixed material, as this may affect classification.

- Unit Price: The tax rate may be influenced by the FOB price or unit value of the product. Ensure accurate pricing documentation.

- Certifications: Check if any safety, security, or performance certifications (e.g., bulletproof rating, UV resistance) are required for import.

- Documentation: Provide product specifications, technical data sheets, and certificates of compliance to support the HS code classification.

🛑 Proactive Advice

- Double-check the HS code with customs authorities or a qualified customs broker to avoid misclassification.

- Monitor policy updates related to anti-dumping duties or special tariffs on materials like polycarbonate (especially if imported from countries under trade restrictions).

- Plan ahead for the April 11, 2025 tariff change to avoid unexpected costs.

Let me know if you need help with certification requirements or customs documentation templates.

Customer Reviews

No reviews yet.