Found 5 matching results

(CN → US)

| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3920631000 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3920610000 | Doc | 60.8% | CN | US | 2025-05-12 |

| 3920690000 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3921135000 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3920100000 | Doc | 59.2% | CN | US | 2025-05-12 |

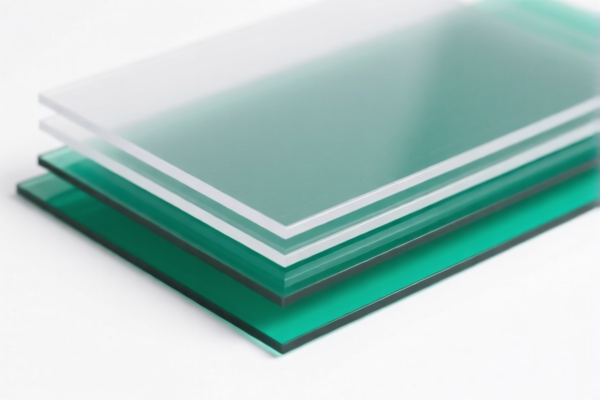

Product Name: Polycarbonate Composite Sheets

Classification HS Code: 3920631000 (for Polycarbonate Composite Sheets)

🔍 HS Code and Tax Information Overview

- HS CODE: 3920631000

- Description: Polycarbonate composite sheets, as per the description of HS code 3920631000.

- Total Tax Rate: 59.2%

- Tax Breakdown:

- Base Tariff Rate: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

📌 Key Tax Rate Changes and Notes

- Base Tariff: 4.2% (standard import duty for this category)

- Additional Tariff: 25.0% (applies generally to all imports under this classification)

- April 11 Special Tariff (2025): 30.0% (applies after April 11, 2025, as per updated trade policies)

- No Anti-dumping duties reported for this product category (as of current data)

⚠️ Time-Sensitive Policy Alert

- Special Tariff after April 11, 2025: If your import is scheduled after this date, the total tax rate will increase to 59.2% (4.2% + 25.0% + 30.0%).

📦 Proactive Advice for Importers

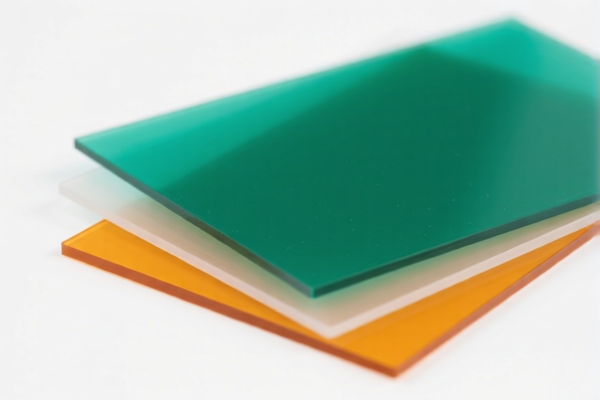

- Verify Material Composition: Ensure the product is indeed polycarbonate composite and not misclassified (e.g., polyester or polyethylene composites fall under different HS codes).

- Check Unit Price and Certification: Confirm the unit price and whether any certifications (e.g., fire resistance, UV resistance) are required for import compliance.

- Review Import Documentation: Ensure all customs documents (e.g., commercial invoice, packing list, bill of lading) are accurate and match the HS code classification.

- Consult Local Customs Authority: For the most up-to-date and region-specific tariff information, especially if importing to China or other countries with dynamic trade policies.

📌 Alternative HS Codes for Similar Products

| HS Code | Product Type | Total Tax Rate | Notes |

|---|---|---|---|

| 3920610000 | Polycarbonate Composite Sheets | 60.8% | Higher base tariff (5.8%) |

| 3920690000 | Polyester Composite Sheets | 59.2% | Same tax structure |

| 3921135000 | Polyurethane Composite Sheets | 59.2% | Same tax structure |

| 3920100000 | Polyethylene Composite Sheets | 59.2% | Same tax structure |

If you are importing Polycarbonate Composite Sheets, HS Code 3920631000 is the correct classification. Be mindful of the April 11, 2025 tariff change and ensure your product is accurately classified to avoid delays or penalties.

Product Name: Polycarbonate Composite Sheets

Classification HS Code: 3920631000 (for Polycarbonate Composite Sheets)

🔍 HS Code and Tax Information Overview

- HS CODE: 3920631000

- Description: Polycarbonate composite sheets, as per the description of HS code 3920631000.

- Total Tax Rate: 59.2%

- Tax Breakdown:

- Base Tariff Rate: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

📌 Key Tax Rate Changes and Notes

- Base Tariff: 4.2% (standard import duty for this category)

- Additional Tariff: 25.0% (applies generally to all imports under this classification)

- April 11 Special Tariff (2025): 30.0% (applies after April 11, 2025, as per updated trade policies)

- No Anti-dumping duties reported for this product category (as of current data)

⚠️ Time-Sensitive Policy Alert

- Special Tariff after April 11, 2025: If your import is scheduled after this date, the total tax rate will increase to 59.2% (4.2% + 25.0% + 30.0%).

📦 Proactive Advice for Importers

- Verify Material Composition: Ensure the product is indeed polycarbonate composite and not misclassified (e.g., polyester or polyethylene composites fall under different HS codes).

- Check Unit Price and Certification: Confirm the unit price and whether any certifications (e.g., fire resistance, UV resistance) are required for import compliance.

- Review Import Documentation: Ensure all customs documents (e.g., commercial invoice, packing list, bill of lading) are accurate and match the HS code classification.

- Consult Local Customs Authority: For the most up-to-date and region-specific tariff information, especially if importing to China or other countries with dynamic trade policies.

📌 Alternative HS Codes for Similar Products

| HS Code | Product Type | Total Tax Rate | Notes |

|---|---|---|---|

| 3920610000 | Polycarbonate Composite Sheets | 60.8% | Higher base tariff (5.8%) |

| 3920690000 | Polyester Composite Sheets | 59.2% | Same tax structure |

| 3921135000 | Polyurethane Composite Sheets | 59.2% | Same tax structure |

| 3920100000 | Polyethylene Composite Sheets | 59.2% | Same tax structure |

If you are importing Polycarbonate Composite Sheets, HS Code 3920631000 is the correct classification. Be mindful of the April 11, 2025 tariff change and ensure your product is accurately classified to avoid delays or penalties.

Customer Reviews

No reviews yet.