| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3920632000 | Doc | 60.8% | CN | US | 2025-05-12 |

| 3920610000 | Doc | 60.8% | CN | US | 2025-05-12 |

| 3907400000 | Doc | 60.8% | CN | US | 2025-05-12 |

| 3920690000 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3920610000 | Doc | 60.8% | CN | US | 2025-05-12 |

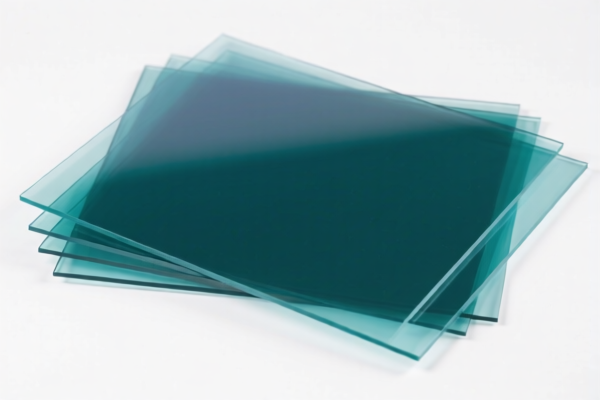

Product Classification: Polycarbonate Optical Sheets

HS CODEs and Tax Details:

- HS CODE: 3920632000

- Product: Polycarbonate Optical Sheets

- Total Tax Rate: 60.8%

-

Breakdown:

- Base Tariff: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3920610000

- Product: Polycarbonate Optical Sheets / Polycarbonate Light Guide Panels

- Total Tax Rate: 60.8%

-

Breakdown:

- Base Tariff: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3907400000

- Product: Optical-Grade Polycarbonate Granules

- Total Tax Rate: 60.8%

-

Breakdown:

- Base Tariff: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3920690000

- Product: Polyester Optical Sheets

- Total Tax Rate: 59.2%

- Breakdown:

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

📌 Key Notes:

-

April 11, 2025 Special Tariff:

A 30.0% additional tariff will be applied to all the above HS codes after April 11, 2025. This is a time-sensitive policy and must be considered in your customs planning. -

Anti-Dumping Duties:

No specific anti-dumping duties are mentioned for polycarbonate optical sheets in the provided data. However, it is advisable to confirm with customs or a trade compliance expert if your product is subject to any ongoing anti-dumping investigations. -

Material and Certification Requirements:

- Verify the material composition (e.g., whether it is optical-grade polycarbonate or polyester) to ensure correct HS code classification.

-

Confirm if certifications (e.g., RoHS, REACH, or optical performance standards) are required for import into the destination country.

-

Unit Price and Tax Calculation:

The total tax rate is calculated as:

Base Tariff + Additional Tariff + Special Tariff (if applicable)

For example: - 5.8% + 25.0% + 30.0% = 60.8%

- 4.2% + 25.0% + 30.0% = 59.2%

✅ Proactive Advice:

- Double-check the product description to ensure it matches the HS code used (e.g., optical sheets vs. light guide panels vs. granules).

- Review the import date to determine if the April 11, 2025, special tariff applies.

-

Consult with customs or a trade compliance expert if your product is part of any ongoing trade investigations or has special import restrictions. Product Classification: Polycarbonate Optical Sheets

HS CODEs and Tax Details: -

HS CODE: 3920632000

- Product: Polycarbonate Optical Sheets

- Total Tax Rate: 60.8%

-

Breakdown:

- Base Tariff: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3920610000

- Product: Polycarbonate Optical Sheets / Polycarbonate Light Guide Panels

- Total Tax Rate: 60.8%

-

Breakdown:

- Base Tariff: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3907400000

- Product: Optical-Grade Polycarbonate Granules

- Total Tax Rate: 60.8%

-

Breakdown:

- Base Tariff: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3920690000

- Product: Polyester Optical Sheets

- Total Tax Rate: 59.2%

- Breakdown:

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

📌 Key Notes:

-

April 11, 2025 Special Tariff:

A 30.0% additional tariff will be applied to all the above HS codes after April 11, 2025. This is a time-sensitive policy and must be considered in your customs planning. -

Anti-Dumping Duties:

No specific anti-dumping duties are mentioned for polycarbonate optical sheets in the provided data. However, it is advisable to confirm with customs or a trade compliance expert if your product is subject to any ongoing anti-dumping investigations. -

Material and Certification Requirements:

- Verify the material composition (e.g., whether it is optical-grade polycarbonate or polyester) to ensure correct HS code classification.

-

Confirm if certifications (e.g., RoHS, REACH, or optical performance standards) are required for import into the destination country.

-

Unit Price and Tax Calculation:

The total tax rate is calculated as:

Base Tariff + Additional Tariff + Special Tariff (if applicable)

For example: - 5.8% + 25.0% + 30.0% = 60.8%

- 4.2% + 25.0% + 30.0% = 59.2%

✅ Proactive Advice:

- Double-check the product description to ensure it matches the HS code used (e.g., optical sheets vs. light guide panels vs. granules).

- Review the import date to determine if the April 11, 2025, special tariff applies.

- Consult with customs or a trade compliance expert if your product is part of any ongoing trade investigations or has special import restrictions.

Customer Reviews

No reviews yet.