| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3920610000 | Doc | 60.8% | CN | US | 2025-05-12 |

| 3920610000 | Doc | 60.8% | CN | US | 2025-05-12 |

| 3920610000 | Doc | 60.8% | CN | US | 2025-05-12 |

| 3920610000 | Doc | 60.8% | CN | US | 2025-05-12 |

| 3920632000 | Doc | 60.8% | CN | US | 2025-05-12 |

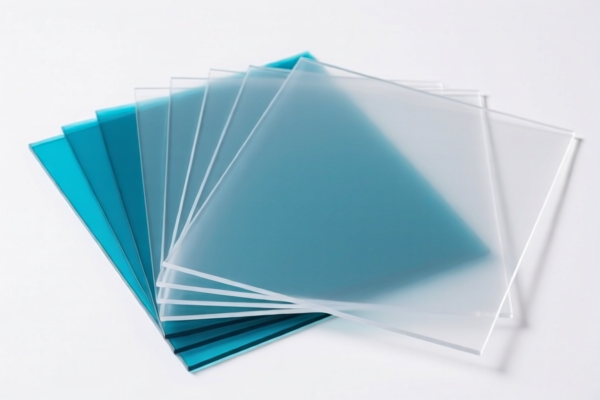

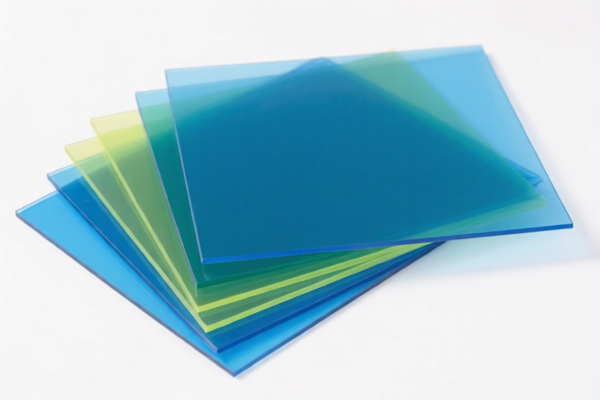

Product Name: Polycarbonate Plastic Sheets

HS CODE: 3920610000 (for most variants) and 3920632000 (for specific packaging board variants)

🔍 Classification Overview:

- HS CODE: 3920610000

- Description: Polycarbonate (PC) plastic sheets, including boards and packaging boards.

- HS CODE: 3920632000

- Description: Specific types of polycarbonate packaging boards (may vary by product specifics).

📊 Tariff Breakdown (as of latest data):

- Base Tariff Rate: 5.8%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tax Rate: 60.8% (5.8% + 25.0% + 30.0%)

⚠️ Important Note: The 30.0% additional tariff applies after April 11, 2025. Ensure your import timeline is aligned with this policy change.

📌 Key Considerations:

- Material Verification: Confirm that the product is indeed made of polycarbonate (PC) and not a blend or composite material, as this can affect classification.

- Unit Price: The total tax rate is based on the declared value, so ensure accurate pricing and documentation.

- Certifications: Check if any certifications (e.g., RoHS, REACH, or specific import permits) are required for the product in the destination country.

- HS Code Accuracy: Double-check the HS code based on the exact product description (e.g., "packaging board" may fall under a different subheading like 3920632000).

🛑 Proactive Advice:

- Consult a Customs Broker: For complex or high-value shipments, seek professional assistance to avoid misclassification.

- Monitor Policy Updates: Stay informed about any changes in tariff rates or import regulations, especially after April 11, 2025.

- Document Everything: Maintain clear records of product specifications, origin, and pricing to support customs declarations.

Let me know if you need help determining the correct HS code for a specific variant or if you need guidance on customs documentation.

Product Name: Polycarbonate Plastic Sheets

HS CODE: 3920610000 (for most variants) and 3920632000 (for specific packaging board variants)

🔍 Classification Overview:

- HS CODE: 3920610000

- Description: Polycarbonate (PC) plastic sheets, including boards and packaging boards.

- HS CODE: 3920632000

- Description: Specific types of polycarbonate packaging boards (may vary by product specifics).

📊 Tariff Breakdown (as of latest data):

- Base Tariff Rate: 5.8%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tax Rate: 60.8% (5.8% + 25.0% + 30.0%)

⚠️ Important Note: The 30.0% additional tariff applies after April 11, 2025. Ensure your import timeline is aligned with this policy change.

📌 Key Considerations:

- Material Verification: Confirm that the product is indeed made of polycarbonate (PC) and not a blend or composite material, as this can affect classification.

- Unit Price: The total tax rate is based on the declared value, so ensure accurate pricing and documentation.

- Certifications: Check if any certifications (e.g., RoHS, REACH, or specific import permits) are required for the product in the destination country.

- HS Code Accuracy: Double-check the HS code based on the exact product description (e.g., "packaging board" may fall under a different subheading like 3920632000).

🛑 Proactive Advice:

- Consult a Customs Broker: For complex or high-value shipments, seek professional assistance to avoid misclassification.

- Monitor Policy Updates: Stay informed about any changes in tariff rates or import regulations, especially after April 11, 2025.

- Document Everything: Maintain clear records of product specifications, origin, and pricing to support customs declarations.

Let me know if you need help determining the correct HS code for a specific variant or if you need guidance on customs documentation.

Customer Reviews

No reviews yet.