| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3920610000 | Doc | 60.8% | CN | US | 2025-05-12 |

| 3920632000 | Doc | 60.8% | CN | US | 2025-05-12 |

| 3920690000 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3916905000 | Doc | 60.8% | CN | US | 2025-05-12 |

| 3921905050 | Doc | 34.8% | CN | US | 2025-05-12 |

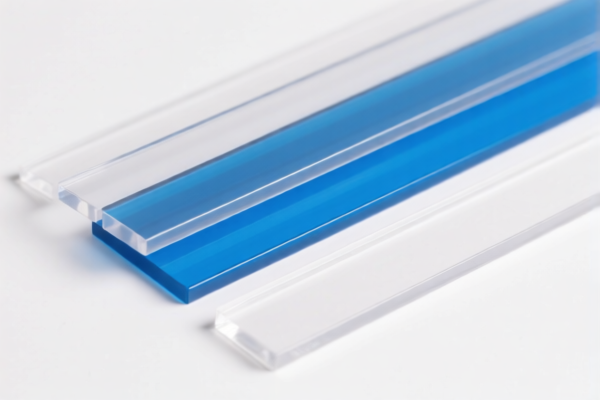

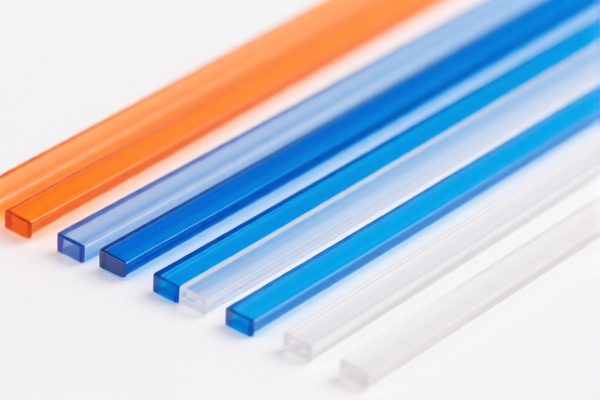

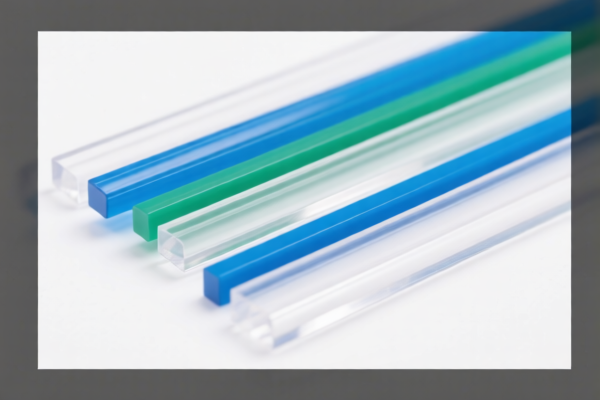

Product Name: Polycarbonate Plastic Strips

Classification HS Code Analysis:

Below are the HS codes and corresponding tariff details for the declared product "Polycarbonate Plastic Strips" and similar plastic strips:

✅ HS CODE: 3920610000

Description: Polycarbonate Plastic Strips

Total Tax Rate: 60.8%

Tariff Breakdown:

- Base Tariff: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Note: This is the most accurate classification for polycarbonate strips.

✅ HS CODE: 3920632000

Description: Polyester Plastic Strips

Total Tax Rate: 60.8%

Tariff Breakdown:

- Base Tariff: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Note: This code applies to polyester strips, not polycarbonate.

✅ HS CODE: 3920690000

Description: Polyester Plastic Strips

Total Tax Rate: 59.2%

Tariff Breakdown:

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Note: Lower base tariff compared to 3920632000, but still subject to the same additional and special tariffs.

✅ HS CODE: 3916905000

Description: Polyester Plastic Strips

Total Tax Rate: 60.8%

Tariff Breakdown:

- Base Tariff: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Note: Another code for polyester strips, with the same total tax rate as 3920632000.

✅ HS CODE: 3921905050

Description: Polymer Plastic Strips

Total Tax Rate: 34.8%

Tariff Breakdown:

- Base Tariff: 4.8%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

Note: This code applies to general polymer strips and has a significantly lower base tariff. However, it is not specific to polycarbonate.

📌 Key Observations:

- April 11, 2025 Special Tariff: All the above HS codes are subject to an additional 30.0% tariff after April 11, 2025. This is a critical date to be aware of for customs clearance planning.

- Material Specificity: Ensure the product is correctly classified as polycarbonate (not polyester or general polymer) to avoid misclassification and potential penalties.

- Tariff Variance: The base tariff varies depending on the material and HS code. For example, 3921905050 has a much lower base tariff but is not specific to polycarbonate.

🛑 Proactive Advice:

- Verify Material: Confirm the exact material (e.g., polycarbonate vs. polyester) to ensure correct HS code selection.

- Check Unit Price: The total tax rate will affect the final cost, so be aware of the unit price and quantity.

- Certifications: Some HS codes may require specific certifications (e.g., RoHS, REACH) depending on the destination country.

- Consult Customs Broker: For high-value or complex shipments, consult a customs broker to ensure compliance and avoid delays.

Let me know if you need help determining the correct HS code based on product specifications.

Product Name: Polycarbonate Plastic Strips

Classification HS Code Analysis:

Below are the HS codes and corresponding tariff details for the declared product "Polycarbonate Plastic Strips" and similar plastic strips:

✅ HS CODE: 3920610000

Description: Polycarbonate Plastic Strips

Total Tax Rate: 60.8%

Tariff Breakdown:

- Base Tariff: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Note: This is the most accurate classification for polycarbonate strips.

✅ HS CODE: 3920632000

Description: Polyester Plastic Strips

Total Tax Rate: 60.8%

Tariff Breakdown:

- Base Tariff: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Note: This code applies to polyester strips, not polycarbonate.

✅ HS CODE: 3920690000

Description: Polyester Plastic Strips

Total Tax Rate: 59.2%

Tariff Breakdown:

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Note: Lower base tariff compared to 3920632000, but still subject to the same additional and special tariffs.

✅ HS CODE: 3916905000

Description: Polyester Plastic Strips

Total Tax Rate: 60.8%

Tariff Breakdown:

- Base Tariff: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Note: Another code for polyester strips, with the same total tax rate as 3920632000.

✅ HS CODE: 3921905050

Description: Polymer Plastic Strips

Total Tax Rate: 34.8%

Tariff Breakdown:

- Base Tariff: 4.8%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

Note: This code applies to general polymer strips and has a significantly lower base tariff. However, it is not specific to polycarbonate.

📌 Key Observations:

- April 11, 2025 Special Tariff: All the above HS codes are subject to an additional 30.0% tariff after April 11, 2025. This is a critical date to be aware of for customs clearance planning.

- Material Specificity: Ensure the product is correctly classified as polycarbonate (not polyester or general polymer) to avoid misclassification and potential penalties.

- Tariff Variance: The base tariff varies depending on the material and HS code. For example, 3921905050 has a much lower base tariff but is not specific to polycarbonate.

🛑 Proactive Advice:

- Verify Material: Confirm the exact material (e.g., polycarbonate vs. polyester) to ensure correct HS code selection.

- Check Unit Price: The total tax rate will affect the final cost, so be aware of the unit price and quantity.

- Certifications: Some HS codes may require specific certifications (e.g., RoHS, REACH) depending on the destination country.

- Consult Customs Broker: For high-value or complex shipments, consult a customs broker to ensure compliance and avoid delays.

Let me know if you need help determining the correct HS code based on product specifications.

Customer Reviews

No reviews yet.