| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3920631000 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3920610000 | Doc | 60.8% | CN | US | 2025-05-12 |

| 3920632000 | Doc | 60.8% | CN | US | 2025-05-12 |

| 3920690000 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3920631000 | Doc | 59.2% | CN | US | 2025-05-12 |

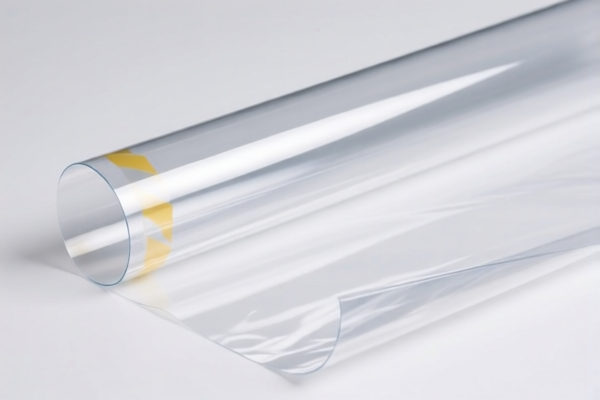

Product Name: Polycarbonate Protective Films

Classification: Plastic sheets, films, foils, and strips, non-cellular and not reinforced, made of polycarbonate, laminated, supported, or otherwise combined with other materials

✅ HS CODE Classification Overview

Below are the relevant HS codes and their associated tariff details for polycarbonate protective films:

🔢 HS CODE: 3920632000

Description: Polycarbonate protective films, non-cellular and not reinforced plastic products, not laminated, supported, or combined with other materials.

- Base Tariff Rate: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.8%

🔢 HS CODE: 3920631000

Description: Polycarbonate protective films, non-cellular and not reinforced, made of polycarbonate, flexible material, laminated, supported, or combined with other materials.

- Base Tariff Rate: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 59.2%

⚠️ Note: This code appears twice in your list with slightly different descriptions. Ensure the product is flexible and combined with other materials to qualify for this code.

🔢 HS CODE: 3920610000

Description: Other non-cellular and not reinforced plastic sheets, films, foils, and strips, made of polycarbonate, laminated, supported, or combined with other materials.

- Base Tariff Rate: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.8%

🔢 HS CODE: 3920690000

Description: Polyester protective films, non-cellular and not reinforced, laminated, supported, or combined with other materials.

- Base Tariff Rate: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 59.2%

⚠️ Note: This code is for polyester films, not polycarbonate. Ensure the material is polycarbonate to avoid misclassification.

📌 Key Considerations for Customs Compliance

- Material Verification: Confirm the product is made of polycarbonate, not polyester or other plastics.

- Product Form: Determine if the film is flexible and combined with other materials (e.g., adhesive backing, protective layers).

- Tariff Changes: Be aware of the April 11, 2025 special tariff increase (30.0%).

- Certifications: Check if any technical or safety certifications are required for import (e.g., RoHS, REACH, etc.).

- Unit Price: Verify the unit price to ensure it aligns with the HS code classification and avoids potential reclassification.

🛑 Proactive Advice

- Double-check the product description to match the correct HS code.

- Consult with a customs broker or classification expert if the product has multiple layers or components.

- Keep documentation (e.g., material certificates, product specifications) ready for customs inspection.

Let me know if you need help determining the most accurate HS code for your specific product.

Product Name: Polycarbonate Protective Films

Classification: Plastic sheets, films, foils, and strips, non-cellular and not reinforced, made of polycarbonate, laminated, supported, or otherwise combined with other materials

✅ HS CODE Classification Overview

Below are the relevant HS codes and their associated tariff details for polycarbonate protective films:

🔢 HS CODE: 3920632000

Description: Polycarbonate protective films, non-cellular and not reinforced plastic products, not laminated, supported, or combined with other materials.

- Base Tariff Rate: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.8%

🔢 HS CODE: 3920631000

Description: Polycarbonate protective films, non-cellular and not reinforced, made of polycarbonate, flexible material, laminated, supported, or combined with other materials.

- Base Tariff Rate: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 59.2%

⚠️ Note: This code appears twice in your list with slightly different descriptions. Ensure the product is flexible and combined with other materials to qualify for this code.

🔢 HS CODE: 3920610000

Description: Other non-cellular and not reinforced plastic sheets, films, foils, and strips, made of polycarbonate, laminated, supported, or combined with other materials.

- Base Tariff Rate: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.8%

🔢 HS CODE: 3920690000

Description: Polyester protective films, non-cellular and not reinforced, laminated, supported, or combined with other materials.

- Base Tariff Rate: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 59.2%

⚠️ Note: This code is for polyester films, not polycarbonate. Ensure the material is polycarbonate to avoid misclassification.

📌 Key Considerations for Customs Compliance

- Material Verification: Confirm the product is made of polycarbonate, not polyester or other plastics.

- Product Form: Determine if the film is flexible and combined with other materials (e.g., adhesive backing, protective layers).

- Tariff Changes: Be aware of the April 11, 2025 special tariff increase (30.0%).

- Certifications: Check if any technical or safety certifications are required for import (e.g., RoHS, REACH, etc.).

- Unit Price: Verify the unit price to ensure it aligns with the HS code classification and avoids potential reclassification.

🛑 Proactive Advice

- Double-check the product description to match the correct HS code.

- Consult with a customs broker or classification expert if the product has multiple layers or components.

- Keep documentation (e.g., material certificates, product specifications) ready for customs inspection.

Let me know if you need help determining the most accurate HS code for your specific product.

Customer Reviews

No reviews yet.