Found 5 matching results

(CN → US)

| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3920690000 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3921905050 | Doc | 34.8% | CN | US | 2025-05-12 |

| 3920632000 | Doc | 60.8% | CN | US | 2025-05-12 |

| 4411924000 | Doc | 61.0% | CN | US | 2025-05-12 |

| 3920100000 | Doc | 59.2% | CN | US | 2025-05-12 |

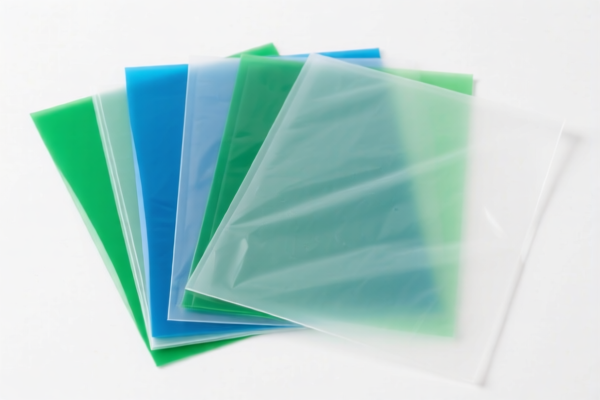

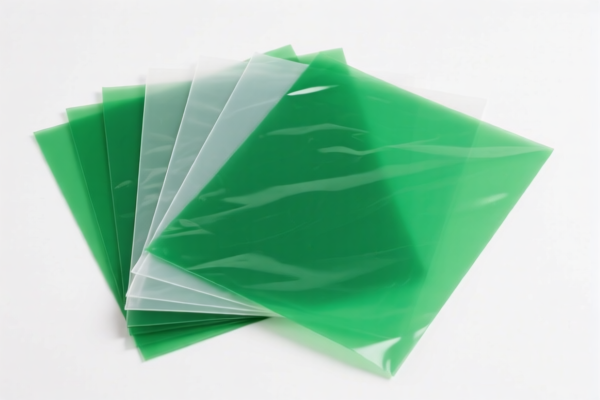

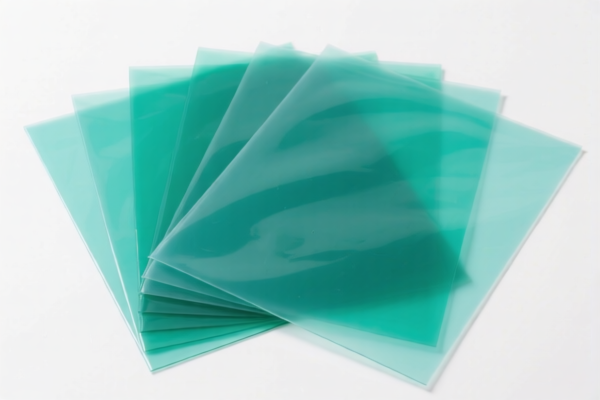

Product Classification: Polyester Laminated Sheets

HS CODE: 3920690000 (Primary Classification)

🔍 Classification Summary:

- Product: Non-cellulose and non-reinforced plastic sheets, plates, films, foils, and strips, laminated, supported, or otherwise combined with other materials, of other polyesters.

- HS CODE: 3920690000 (10-digit code)

📊 Tariff Breakdown:

- Base Tariff Rate: 4.2%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tax Rate: 59.2%

⚠️ Important Notes:

- April 11, 2025 Special Tariff: A 30.0% additional tariff will be imposed on imports after this date. This is a time-sensitive policy and must be considered in cost planning.

- Anti-dumping duties: Not applicable for this product category.

- Material Verification: Confirm that the product is indeed made of polyester and is laminated or combined with other materials. This is critical for accurate classification.

- Certifications: Ensure that any required import documentation (e.g., commodity inspection reports, customs declarations) are prepared in advance.

📌 Proactive Advice:

- Check Material Composition: Ensure the product is not misclassified under a different HS code (e.g., 3921905050 for other types of plastic sheets).

- Review Unit Price: The total tax rate may affect the final cost, so consider this in pricing and compliance strategies.

- Consult Customs Broker: For complex cases, especially if the product has multiple layers or mixed materials, a customs broker can help ensure correct classification and avoid penalties.

📋 Alternative HS Codes (for Reference):

- 3921905050 – Plastic sheets (may apply if the product is not laminated or combined with other materials).

- 3920632000 – Other polyester-based laminated products (if the product is of a specific type).

- 4411924000 – Wood or wood fiber boards (not applicable for polyester products).

- 3920100000 – Ethylene polymer sheets (not applicable for polyester-based products).

If you have more details about the product (e.g., thickness, composition, end use), I can provide a more tailored classification and compliance guidance.

Product Classification: Polyester Laminated Sheets

HS CODE: 3920690000 (Primary Classification)

🔍 Classification Summary:

- Product: Non-cellulose and non-reinforced plastic sheets, plates, films, foils, and strips, laminated, supported, or otherwise combined with other materials, of other polyesters.

- HS CODE: 3920690000 (10-digit code)

📊 Tariff Breakdown:

- Base Tariff Rate: 4.2%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tax Rate: 59.2%

⚠️ Important Notes:

- April 11, 2025 Special Tariff: A 30.0% additional tariff will be imposed on imports after this date. This is a time-sensitive policy and must be considered in cost planning.

- Anti-dumping duties: Not applicable for this product category.

- Material Verification: Confirm that the product is indeed made of polyester and is laminated or combined with other materials. This is critical for accurate classification.

- Certifications: Ensure that any required import documentation (e.g., commodity inspection reports, customs declarations) are prepared in advance.

📌 Proactive Advice:

- Check Material Composition: Ensure the product is not misclassified under a different HS code (e.g., 3921905050 for other types of plastic sheets).

- Review Unit Price: The total tax rate may affect the final cost, so consider this in pricing and compliance strategies.

- Consult Customs Broker: For complex cases, especially if the product has multiple layers or mixed materials, a customs broker can help ensure correct classification and avoid penalties.

📋 Alternative HS Codes (for Reference):

- 3921905050 – Plastic sheets (may apply if the product is not laminated or combined with other materials).

- 3920632000 – Other polyester-based laminated products (if the product is of a specific type).

- 4411924000 – Wood or wood fiber boards (not applicable for polyester products).

- 3920100000 – Ethylene polymer sheets (not applicable for polyester-based products).

If you have more details about the product (e.g., thickness, composition, end use), I can provide a more tailored classification and compliance guidance.

Customer Reviews

No reviews yet.