| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921904090 | Doc | 34.2% | CN | US | 2025-05-12 |

| 3921905050 | Doc | 34.8% | CN | US | 2025-05-12 |

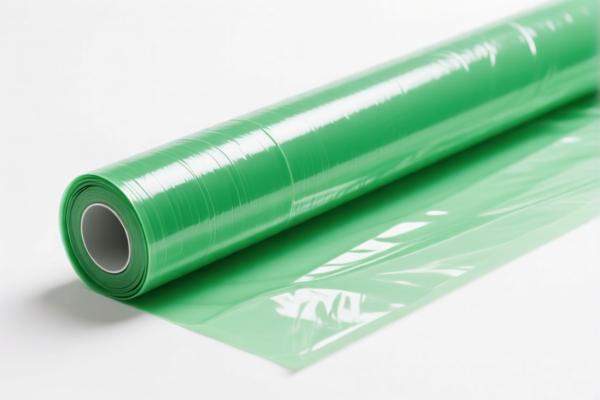

Product Classification: Polyester Plastic Film (Greenhouse)

HS CODE:

- 3921904090 – Plastic film for household use

- 3921905050 – Plastic film for packaging use

🔍 Key Tax Rate Breakdown (as of now):

- Base Tariff Rate:

- 3921904090: 4.2%

-

3921905050: 4.8%

-

Additional Tariffs (Currently 0.0%):

-

No additional tariffs are currently applied for either HS code.

-

April 11, 2025 Special Tariff:

- 30.0% will be added to the base tariff after April 11, 2025.

-

Total Tax Rate after April 11, 2025:

- 3921904090: 34.2% (4.2% + 30.0%)

- 3921905050: 34.8% (4.8% + 30.0%)

-

Anti-dumping duties on iron and aluminum:

- Not applicable for plastic films (polyester).

⚠️ Important Notes and Recommendations:

-

Verify Material and Unit Price:

Ensure the product is indeed polyester-based and not a blend or composite material, as this may affect classification. -

Check Required Certifications:

Confirm if any certifications (e.g., RoHS, REACH, or specific import permits) are required for the product in the destination country. -

Monitor Tariff Changes:

The 30.0% additional tariff will be imposed after April 11, 2025. If you plan to import in the near future, consider this in your cost estimation and logistics planning. -

Consult with Customs Broker:

For precise classification and compliance, it is advisable to consult a customs broker or a qualified customs compliance expert, especially if the product has multiple uses or is part of a larger product assembly.

Let me know if you need help with customs documentation or further classification details.

Product Classification: Polyester Plastic Film (Greenhouse)

HS CODE:

- 3921904090 – Plastic film for household use

- 3921905050 – Plastic film for packaging use

🔍 Key Tax Rate Breakdown (as of now):

- Base Tariff Rate:

- 3921904090: 4.2%

-

3921905050: 4.8%

-

Additional Tariffs (Currently 0.0%):

-

No additional tariffs are currently applied for either HS code.

-

April 11, 2025 Special Tariff:

- 30.0% will be added to the base tariff after April 11, 2025.

-

Total Tax Rate after April 11, 2025:

- 3921904090: 34.2% (4.2% + 30.0%)

- 3921905050: 34.8% (4.8% + 30.0%)

-

Anti-dumping duties on iron and aluminum:

- Not applicable for plastic films (polyester).

⚠️ Important Notes and Recommendations:

-

Verify Material and Unit Price:

Ensure the product is indeed polyester-based and not a blend or composite material, as this may affect classification. -

Check Required Certifications:

Confirm if any certifications (e.g., RoHS, REACH, or specific import permits) are required for the product in the destination country. -

Monitor Tariff Changes:

The 30.0% additional tariff will be imposed after April 11, 2025. If you plan to import in the near future, consider this in your cost estimation and logistics planning. -

Consult with Customs Broker:

For precise classification and compliance, it is advisable to consult a customs broker or a qualified customs compliance expert, especially if the product has multiple uses or is part of a larger product assembly.

Let me know if you need help with customs documentation or further classification details.

Customer Reviews

No reviews yet.