Found 3 matching results

(CN → US)

| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921905050 | Doc | 34.8% | CN | US | 2025-05-12 |

| 3921904090 | Doc | 34.2% | CN | US | 2025-05-12 |

| 3901205000 | Doc | 61.5% | CN | US | 2025-05-12 |

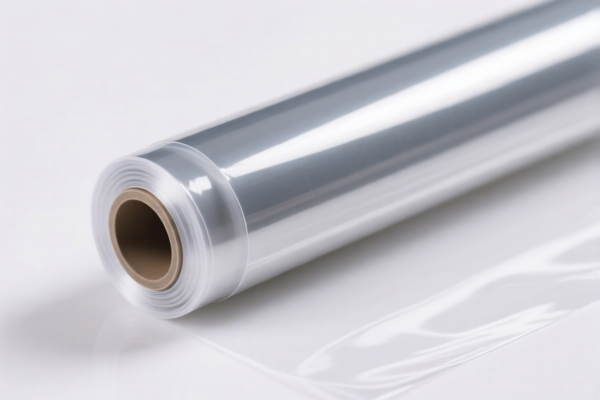

Product Classification and Tax Information for Polyester Plastic Film (Packaging)

Here is the detailed breakdown of the HS codes and associated tariffs for the declared product:

1. HS Code: 3921905050 – Plastic Film for Packaging

- Description: Plastic film used for packaging purposes.

- Base Tariff Rate: 4.8%

- Additional Tariff (before April 11, 2025): 0.0%

- Additional Tariff (after April 11, 2025): 30.0%

- Total Tax Rate: 34.8%

- Special Notes:

- April 11 Special Tariff: Applies after April 11, 2025.

- No anti-dumping duties are currently applicable for this product.

2. HS Code: 3921904090 – Plastic Film for Household Use

- Description: Plastic film intended for household use.

- Base Tariff Rate: 4.2%

- Additional Tariff (before April 11, 2025): 0.0%

- Additional Tariff (after April 11, 2025): 30.0%

- Total Tax Rate: 34.2%

- Special Notes:

- April 11 Special Tariff: Applies after April 11, 2025.

- No anti-dumping duties are currently applicable for this product.

3. HS Code: 3901205000 – Polyethylene Granules (Packaging)

- Description: Polyethylene granules used in packaging.

- Base Tariff Rate: 6.5%

- Additional Tariff (before April 11, 2025): 25.0%

- Additional Tariff (after April 11, 2025): 30.0%

- Total Tax Rate: 61.5%

- Special Notes:

- April 11 Special Tariff: Applies after April 11, 2025.

- No anti-dumping duties are currently applicable for this product.

Proactive Advice:

- Verify Material and Unit Price: Ensure the product is correctly classified based on its material (e.g., polyethylene, polyester) and intended use (packaging vs. household).

- Check Required Certifications: Confirm if any certifications (e.g., RoHS, REACH, or customs documentation) are required for import.

- Monitor Tariff Changes: Be aware that the April 11, 2025 tariff increase will significantly impact the total tax rate for all three HS codes.

- Consult a Customs Broker: For complex or high-value shipments, consider professional customs brokerage assistance to ensure compliance and avoid delays.

Let me know if you need help with classification based on specific product details or documentation. Product Classification and Tax Information for Polyester Plastic Film (Packaging)

Here is the detailed breakdown of the HS codes and associated tariffs for the declared product:

1. HS Code: 3921905050 – Plastic Film for Packaging

- Description: Plastic film used for packaging purposes.

- Base Tariff Rate: 4.8%

- Additional Tariff (before April 11, 2025): 0.0%

- Additional Tariff (after April 11, 2025): 30.0%

- Total Tax Rate: 34.8%

- Special Notes:

- April 11 Special Tariff: Applies after April 11, 2025.

- No anti-dumping duties are currently applicable for this product.

2. HS Code: 3921904090 – Plastic Film for Household Use

- Description: Plastic film intended for household use.

- Base Tariff Rate: 4.2%

- Additional Tariff (before April 11, 2025): 0.0%

- Additional Tariff (after April 11, 2025): 30.0%

- Total Tax Rate: 34.2%

- Special Notes:

- April 11 Special Tariff: Applies after April 11, 2025.

- No anti-dumping duties are currently applicable for this product.

3. HS Code: 3901205000 – Polyethylene Granules (Packaging)

- Description: Polyethylene granules used in packaging.

- Base Tariff Rate: 6.5%

- Additional Tariff (before April 11, 2025): 25.0%

- Additional Tariff (after April 11, 2025): 30.0%

- Total Tax Rate: 61.5%

- Special Notes:

- April 11 Special Tariff: Applies after April 11, 2025.

- No anti-dumping duties are currently applicable for this product.

Proactive Advice:

- Verify Material and Unit Price: Ensure the product is correctly classified based on its material (e.g., polyethylene, polyester) and intended use (packaging vs. household).

- Check Required Certifications: Confirm if any certifications (e.g., RoHS, REACH, or customs documentation) are required for import.

- Monitor Tariff Changes: Be aware that the April 11, 2025 tariff increase will significantly impact the total tax rate for all three HS codes.

- Consult a Customs Broker: For complex or high-value shipments, consider professional customs brokerage assistance to ensure compliance and avoid delays.

Let me know if you need help with classification based on specific product details or documentation.

Customer Reviews

No reviews yet.