| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 5408312090 | Doc | 69.9% | CN | US | 2025-05-12 |

| 5407694060 | Doc | 63.5% | CN | US | 2025-05-12 |

| 5506400000 | Doc | 60.0% | CN | US | 2025-05-12 |

| 5503400000 | Doc | 59.3% | CN | US | 2025-05-12 |

| 3902900050 | Doc | 61.5% | CN | US | 2025-05-12 |

Product Classification and Customs Tariff Analysis for Polyester Plastic Sheets (Automotive Interior)

Here is the detailed breakdown of the HS codes and associated tariffs for the declared product:

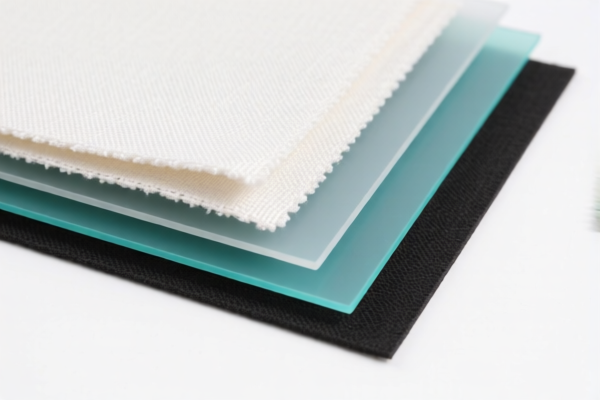

1. HS CODE: 5408312090

Product Description: Polyester fiber automotive interior fabric

Total Tax Rate: 69.9%

- Base Tariff: 14.9%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This product is classified under woven fabrics made of polyester fibers, commonly used in automotive interiors.

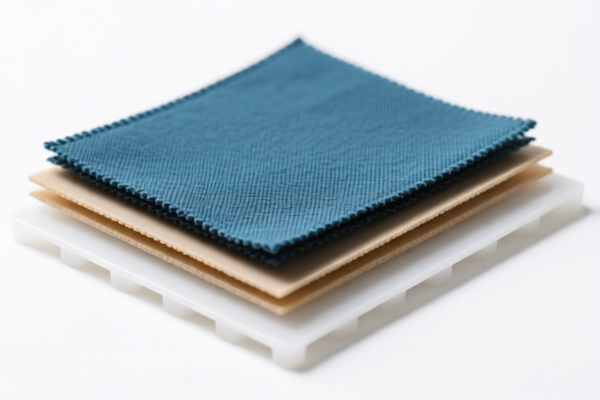

2. HS CODE: 5407694060

Product Description: Automotive interior polyester blended fabric

Total Tax Rate: 63.5%

- Base Tariff: 8.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code applies to polyester blended fabrics used in car interiors, which may include other fibers like cotton or rayon.

3. HS CODE: 5506400000

Product Description: Polypropylene fiber (automotive interior)

Total Tax Rate: 60.0%

- Base Tariff: 5.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This is for polypropylene fibers used in automotive interiors, often used in carpets or trim.

4. HS CODE: 5503400000

Product Description: Polypropylene automotive interior fiber

Total Tax Rate: 59.3%

- Base Tariff: 4.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is for polypropylene fibers specifically used in automotive interiors, possibly with different specifications or processing.

5. HS CODE: 3902900050

Product Description: Polypropylene automotive interior material

Total Tax Rate: 61.5%

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This is for polypropylene-based plastic sheets or materials used in automotive interiors, such as dashboards or panels.

Key Observations and Recommendations:

- Tariff Increase Alert: All products are subject to an additional 30.0% tariff after April 11, 2025. This is a critical date to be aware of for cost planning and compliance.

- Base Tariff Variance: The base tariff varies from 4.3% to 14.9%, depending on the material and product type.

- Material and Certification: Verify the material composition and unit price to ensure correct classification. Some products may require certifications (e.g., REACH, RoHS) for import compliance.

- Documentation: Ensure proper product descriptions, material specifications, and certifications are included in customs documentation to avoid delays or penalties.

Proactive Advice:

- Confirm HS Code: Double-check the HS code based on the exact product description and material composition.

- Monitor Tariff Dates: Keep track of the April 11, 2025 deadline to adjust pricing or seek alternative suppliers if needed.

- Consult Customs Broker: For complex or high-value shipments, consider engaging a customs broker to ensure full compliance and avoid unexpected costs.

Let me know if you need help with HS code verification or customs documentation. Product Classification and Customs Tariff Analysis for Polyester Plastic Sheets (Automotive Interior)

Here is the detailed breakdown of the HS codes and associated tariffs for the declared product:

1. HS CODE: 5408312090

Product Description: Polyester fiber automotive interior fabric

Total Tax Rate: 69.9%

- Base Tariff: 14.9%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This product is classified under woven fabrics made of polyester fibers, commonly used in automotive interiors.

2. HS CODE: 5407694060

Product Description: Automotive interior polyester blended fabric

Total Tax Rate: 63.5%

- Base Tariff: 8.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code applies to polyester blended fabrics used in car interiors, which may include other fibers like cotton or rayon.

3. HS CODE: 5506400000

Product Description: Polypropylene fiber (automotive interior)

Total Tax Rate: 60.0%

- Base Tariff: 5.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This is for polypropylene fibers used in automotive interiors, often used in carpets or trim.

4. HS CODE: 5503400000

Product Description: Polypropylene automotive interior fiber

Total Tax Rate: 59.3%

- Base Tariff: 4.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is for polypropylene fibers specifically used in automotive interiors, possibly with different specifications or processing.

5. HS CODE: 3902900050

Product Description: Polypropylene automotive interior material

Total Tax Rate: 61.5%

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This is for polypropylene-based plastic sheets or materials used in automotive interiors, such as dashboards or panels.

Key Observations and Recommendations:

- Tariff Increase Alert: All products are subject to an additional 30.0% tariff after April 11, 2025. This is a critical date to be aware of for cost planning and compliance.

- Base Tariff Variance: The base tariff varies from 4.3% to 14.9%, depending on the material and product type.

- Material and Certification: Verify the material composition and unit price to ensure correct classification. Some products may require certifications (e.g., REACH, RoHS) for import compliance.

- Documentation: Ensure proper product descriptions, material specifications, and certifications are included in customs documentation to avoid delays or penalties.

Proactive Advice:

- Confirm HS Code: Double-check the HS code based on the exact product description and material composition.

- Monitor Tariff Dates: Keep track of the April 11, 2025 deadline to adjust pricing or seek alternative suppliers if needed.

- Consult Customs Broker: For complex or high-value shipments, consider engaging a customs broker to ensure full compliance and avoid unexpected costs.

Let me know if you need help with HS code verification or customs documentation.

Customer Reviews

No reviews yet.