| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3920632000 | Doc | 60.8% | CN | US | 2025-05-12 |

| 3920632000 | Doc | 60.8% | CN | US | 2025-05-12 |

| 3920632000 | Doc | 60.8% | CN | US | 2025-05-12 |

| 3920690000 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3920631000 | Doc | 59.2% | CN | US | 2025-05-12 |

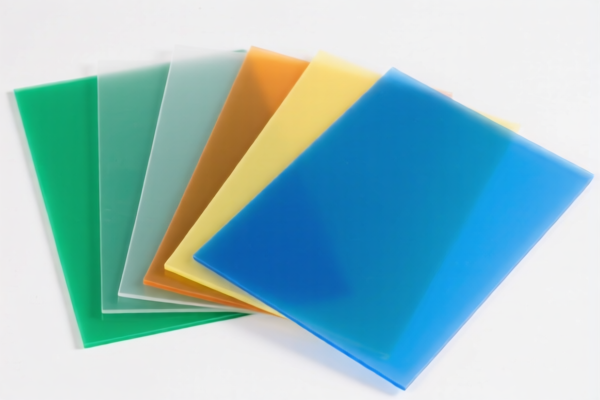

Product Name: Polyester Plastic Sheets (Non-cellular, Unreinforced)

HS CODE: 3920632000 (Primary Code)

Alternative HS CODEs: 3920631000, 3920690000

🔍 HS Code Classification Overview

- HS CODE 3920632000

- Description: Polyester plastic sheets (non-cellular, unreinforced)

- Total Tax Rate: 60.8%

-

Breakdown:

- Base Tariff: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE 3920631000

- Description: Unreinforced polyester plastic sheets

- Total Tax Rate: 59.2%

-

Breakdown:

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE 3920690000

- Description: Polyester plastic sheets (non-laminated)

- Total Tax Rate: 59.2%

- Breakdown:

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

⚠️ Key Tax Rate Changes (April 11, 2025)

- All three HS codes will see an increase in the additional tariff from 25.0% to 30.0% after April 11, 2025.

- This is a time-sensitive policy, so importers must plan accordingly to avoid unexpected costs.

📌 Proactive Advice for Importers

- Verify Material Specifications: Ensure the product is indeed non-cellular, unreinforced, and non-laminated to match the correct HS code.

- Check Unit Price and Quantity: Tariff calculations may vary based on the value and volume of the goods.

- Certifications Required: Confirm if any customs documentation or certifications (e.g., material safety, origin, etc.) are needed for compliance.

- Monitor Tariff Updates: Stay informed about tariff changes post-April 11, 2025, as this could significantly impact your import costs.

📊 Summary Table for Comparison

| HS Code | Description | Base Tariff | Additional Tariff | Special Tariff (after 2025.4.11) | Total Tax Rate |

|---|---|---|---|---|---|

| 3920632000 | Polyester plastic sheets (non-cellular, unreinforced) | 5.8% | 25.0% | 30.0% | 60.8% |

| 3920631000 | Unreinforced polyester plastic sheets | 4.2% | 25.0% | 30.0% | 59.2% |

| 3920690000 | Polyester plastic sheets (non-laminated) | 4.2% | 25.0% | 30.0% | 59.2% |

If you need help determining the correct HS code for your specific product or want to calculate estimated import costs, feel free to provide more details.

Product Name: Polyester Plastic Sheets (Non-cellular, Unreinforced)

HS CODE: 3920632000 (Primary Code)

Alternative HS CODEs: 3920631000, 3920690000

🔍 HS Code Classification Overview

- HS CODE 3920632000

- Description: Polyester plastic sheets (non-cellular, unreinforced)

- Total Tax Rate: 60.8%

-

Breakdown:

- Base Tariff: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE 3920631000

- Description: Unreinforced polyester plastic sheets

- Total Tax Rate: 59.2%

-

Breakdown:

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE 3920690000

- Description: Polyester plastic sheets (non-laminated)

- Total Tax Rate: 59.2%

- Breakdown:

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

⚠️ Key Tax Rate Changes (April 11, 2025)

- All three HS codes will see an increase in the additional tariff from 25.0% to 30.0% after April 11, 2025.

- This is a time-sensitive policy, so importers must plan accordingly to avoid unexpected costs.

📌 Proactive Advice for Importers

- Verify Material Specifications: Ensure the product is indeed non-cellular, unreinforced, and non-laminated to match the correct HS code.

- Check Unit Price and Quantity: Tariff calculations may vary based on the value and volume of the goods.

- Certifications Required: Confirm if any customs documentation or certifications (e.g., material safety, origin, etc.) are needed for compliance.

- Monitor Tariff Updates: Stay informed about tariff changes post-April 11, 2025, as this could significantly impact your import costs.

📊 Summary Table for Comparison

| HS Code | Description | Base Tariff | Additional Tariff | Special Tariff (after 2025.4.11) | Total Tax Rate |

|---|---|---|---|---|---|

| 3920632000 | Polyester plastic sheets (non-cellular, unreinforced) | 5.8% | 25.0% | 30.0% | 60.8% |

| 3920631000 | Unreinforced polyester plastic sheets | 4.2% | 25.0% | 30.0% | 59.2% |

| 3920690000 | Polyester plastic sheets (non-laminated) | 4.2% | 25.0% | 30.0% | 59.2% |

If you need help determining the correct HS code for your specific product or want to calculate estimated import costs, feel free to provide more details.

Customer Reviews

No reviews yet.