| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 5408312030 | Doc | 69.9% | CN | US | 2025-05-12 |

| 3920620090 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3920490000 | Doc | 60.8% | CN | US | 2025-05-12 |

| 3921125000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3924905650 | Doc | 40.9% | CN | US | 2025-05-12 |

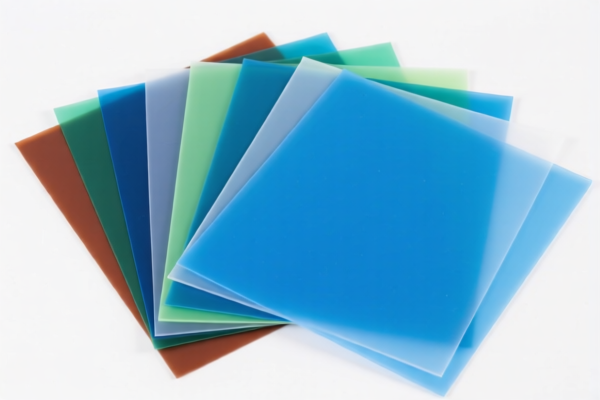

Product Classification and Customs Duty Analysis for Polyester Plastic Sheets (Advertising Use)

Below is a detailed breakdown of the HS codes and associated customs duties for polyester plastic sheets used in advertising, based on the provided data:

✅ HS CODE: 5408312030

Product Description: Polyester fiber advertising plastic sheets

Total Tax Rate: 69.9%

- Base Tariff Rate: 14.9%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This is the highest tax rate among the listed options.

- Proactive Advice: If this is the most suitable classification, consider verifying the exact composition and intended use to ensure correct classification.

✅ HS CODE: 3920620090

Product Description: PET plastic advertising material

Total Tax Rate: 59.2%

- Base Tariff Rate: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: Lower base rate compared to 5408312030, but still subject to the same additional and special tariffs.

- Proactive Advice: Confirm if the product is primarily PET-based and not mixed with other materials.

✅ HS CODE: 3920490000

Product Description: PVC decorative plastic sheets

Total Tax Rate: 60.8%

- Base Tariff Rate: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: Slightly higher base rate than 3920620090.

- Proactive Advice: Ensure the product is not classified under a more specific code (e.g., 3921125000 or 3924905650).

✅ HS CODE: 3921125000

Product Description: PVC decorative plastic sheets

Total Tax Rate: 61.5%

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: Higher base rate than 3920490000.

- Proactive Advice: Confirm if the product is specifically for decorative use and not for industrial or construction purposes.

✅ HS CODE: 3924905650

Product Description: PVC decorative plastic sheets

Total Tax Rate: 40.9%

- Base Tariff Rate: 3.4%

- Additional Tariff: 7.5%

- Special Tariff after April 11, 2025: 30.0%

- Note: This is the lowest total tax rate among the listed options.

- Proactive Advice: This may be the most cost-effective classification if the product fits the description. Verify the exact specifications and intended use.

📌 Important Notes:

- April 11, 2025 Special Tariff: All listed HS codes are subject to an additional 30.0% tariff after this date. This is a time-sensitive policy and must be considered in cost planning.

- Anti-dumping duties: Not explicitly mentioned in the data, but always verify if applicable based on the product's origin and material.

- Certifications: Ensure the product meets any required certifications (e.g., environmental, safety, or import compliance) depending on the destination country.

- Material Verification: Confirm the exact composition (e.g., PET, PVC, polyester fiber) and intended use (advertising, decorative, etc.) to ensure correct HS code classification.

🛠️ Action Steps for Importers:

- Verify the exact material and composition of the product.

- Confirm the intended use (e.g., advertising, decoration, industrial).

- Check if the product is subject to any additional duties (e.g., anti-dumping, special tariffs).

- Ensure all required documentation and certifications are in place.

- Consider the impact of the April 11, 2025 special tariff on your import costs.

Let me know if you need help with HS code verification or customs documentation. Product Classification and Customs Duty Analysis for Polyester Plastic Sheets (Advertising Use)

Below is a detailed breakdown of the HS codes and associated customs duties for polyester plastic sheets used in advertising, based on the provided data:

✅ HS CODE: 5408312030

Product Description: Polyester fiber advertising plastic sheets

Total Tax Rate: 69.9%

- Base Tariff Rate: 14.9%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This is the highest tax rate among the listed options.

- Proactive Advice: If this is the most suitable classification, consider verifying the exact composition and intended use to ensure correct classification.

✅ HS CODE: 3920620090

Product Description: PET plastic advertising material

Total Tax Rate: 59.2%

- Base Tariff Rate: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: Lower base rate compared to 5408312030, but still subject to the same additional and special tariffs.

- Proactive Advice: Confirm if the product is primarily PET-based and not mixed with other materials.

✅ HS CODE: 3920490000

Product Description: PVC decorative plastic sheets

Total Tax Rate: 60.8%

- Base Tariff Rate: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: Slightly higher base rate than 3920620090.

- Proactive Advice: Ensure the product is not classified under a more specific code (e.g., 3921125000 or 3924905650).

✅ HS CODE: 3921125000

Product Description: PVC decorative plastic sheets

Total Tax Rate: 61.5%

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: Higher base rate than 3920490000.

- Proactive Advice: Confirm if the product is specifically for decorative use and not for industrial or construction purposes.

✅ HS CODE: 3924905650

Product Description: PVC decorative plastic sheets

Total Tax Rate: 40.9%

- Base Tariff Rate: 3.4%

- Additional Tariff: 7.5%

- Special Tariff after April 11, 2025: 30.0%

- Note: This is the lowest total tax rate among the listed options.

- Proactive Advice: This may be the most cost-effective classification if the product fits the description. Verify the exact specifications and intended use.

📌 Important Notes:

- April 11, 2025 Special Tariff: All listed HS codes are subject to an additional 30.0% tariff after this date. This is a time-sensitive policy and must be considered in cost planning.

- Anti-dumping duties: Not explicitly mentioned in the data, but always verify if applicable based on the product's origin and material.

- Certifications: Ensure the product meets any required certifications (e.g., environmental, safety, or import compliance) depending on the destination country.

- Material Verification: Confirm the exact composition (e.g., PET, PVC, polyester fiber) and intended use (advertising, decorative, etc.) to ensure correct HS code classification.

🛠️ Action Steps for Importers:

- Verify the exact material and composition of the product.

- Confirm the intended use (e.g., advertising, decoration, industrial).

- Check if the product is subject to any additional duties (e.g., anti-dumping, special tariffs).

- Ensure all required documentation and certifications are in place.

- Consider the impact of the April 11, 2025 special tariff on your import costs.

Let me know if you need help with HS code verification or customs documentation.

Customer Reviews

No reviews yet.