Found 4 matching results

(CN → US)

| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 5408312030 | Doc | 69.9% | CN | US | 2025-05-12 |

| 3925900000 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3921905050 | Doc | 34.8% | CN | US | 2025-05-12 |

| 3920598000 | Doc | 61.5% | CN | US | 2025-05-12 |

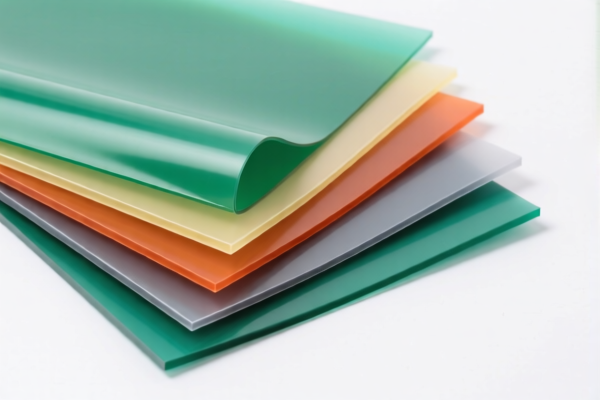

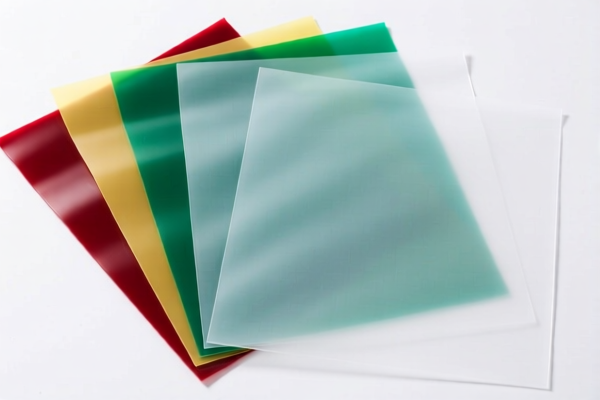

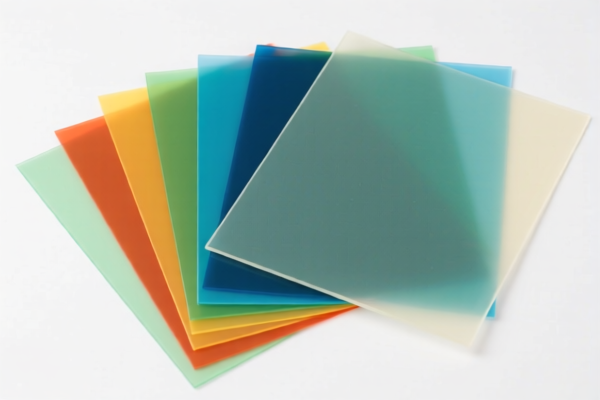

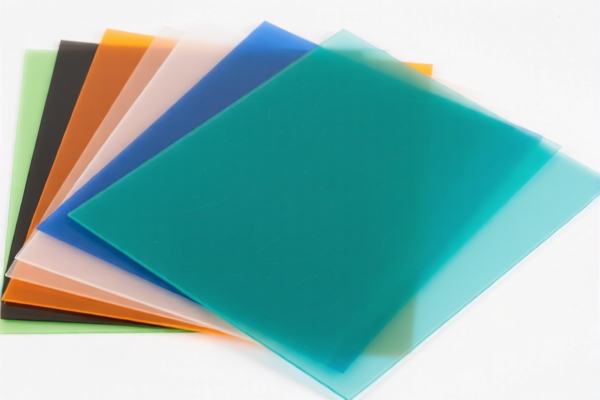

Product Classification and Customs Tariff Analysis for "Polyester Plastic Sheets (Signage)"

Here is the detailed breakdown of the HS codes and associated tariffs for the declared product:

1. HS Code: 5408.31.20.30 – Polyester Fiber Sheets

- Description: Sheets made of polyester fiber.

- Base Tariff Rate: 14.9%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 69.9%

- Notes:

- This classification is suitable if the product is primarily composed of polyester fiber.

- Ensure the product is not classified under a more specific category (e.g., signage or decorative use).

2. HS Code: 3925.90.00.00 – Plastic Sign

- Description: Plastic signage or similar products.

- Base Tariff Rate: 5.3%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.3%

- Notes:

- This is the most appropriate classification if the product is intended for signage use.

- Confirm that the product is not classified under a more specific category (e.g., 3921.90.50.50 for decorative use).

3. HS Code: 3921.90.50.50 – Plastic Sheet for Home Decoration

- Description: Plastic sheets used for home decoration.

- Base Tariff Rate: 4.8%

- Additional Tariff (General): 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 34.8%

- Notes:

- This classification is suitable if the product is intended for decorative purposes.

- The general additional tariff is 0%, which may be due to preferential trade agreements or exemptions.

4. HS Code: 3920.59.80.00 – Plastic Sheet for Home Decoration

- Description: Plastic sheets for home decoration (alternative classification).

- Base Tariff Rate: 6.5%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

- Notes:

- This is another possible classification for decorative plastic sheets.

- The higher base tariff compared to 3921.90.50.50 may be due to different product specifications or origin.

Key Considerations and Recommendations:

- Material Verification: Confirm the exact composition of the product (e.g., 100% polyester, mixed materials, or with additives).

- Intended Use: Clarify whether the product is for signage, decoration, or general use, as this will influence the correct HS code.

- Unit Price and Certification: Check if the product requires any certifications (e.g., safety, environmental compliance) based on the HS code and destination country.

- Tariff Changes After April 11, 2025: Be aware that all classifications will face an additional 30% tariff after this date, significantly increasing the total tax burden.

- Anti-Dumping Duties: Not applicable for plastic products unless specifically targeted by trade policies (not indicated here).

Proactive Advice:

- Double-check the product description and intended use to ensure the most accurate HS code is applied.

- Consult with a customs broker or trade compliance expert if the product is complex or if you are unsure about the classification.

- Monitor any updates to trade policies after April 11, 2025, as they may affect your import costs significantly. Product Classification and Customs Tariff Analysis for "Polyester Plastic Sheets (Signage)"

Here is the detailed breakdown of the HS codes and associated tariffs for the declared product:

1. HS Code: 5408.31.20.30 – Polyester Fiber Sheets

- Description: Sheets made of polyester fiber.

- Base Tariff Rate: 14.9%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 69.9%

- Notes:

- This classification is suitable if the product is primarily composed of polyester fiber.

- Ensure the product is not classified under a more specific category (e.g., signage or decorative use).

2. HS Code: 3925.90.00.00 – Plastic Sign

- Description: Plastic signage or similar products.

- Base Tariff Rate: 5.3%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.3%

- Notes:

- This is the most appropriate classification if the product is intended for signage use.

- Confirm that the product is not classified under a more specific category (e.g., 3921.90.50.50 for decorative use).

3. HS Code: 3921.90.50.50 – Plastic Sheet for Home Decoration

- Description: Plastic sheets used for home decoration.

- Base Tariff Rate: 4.8%

- Additional Tariff (General): 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 34.8%

- Notes:

- This classification is suitable if the product is intended for decorative purposes.

- The general additional tariff is 0%, which may be due to preferential trade agreements or exemptions.

4. HS Code: 3920.59.80.00 – Plastic Sheet for Home Decoration

- Description: Plastic sheets for home decoration (alternative classification).

- Base Tariff Rate: 6.5%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

- Notes:

- This is another possible classification for decorative plastic sheets.

- The higher base tariff compared to 3921.90.50.50 may be due to different product specifications or origin.

Key Considerations and Recommendations:

- Material Verification: Confirm the exact composition of the product (e.g., 100% polyester, mixed materials, or with additives).

- Intended Use: Clarify whether the product is for signage, decoration, or general use, as this will influence the correct HS code.

- Unit Price and Certification: Check if the product requires any certifications (e.g., safety, environmental compliance) based on the HS code and destination country.

- Tariff Changes After April 11, 2025: Be aware that all classifications will face an additional 30% tariff after this date, significantly increasing the total tax burden.

- Anti-Dumping Duties: Not applicable for plastic products unless specifically targeted by trade policies (not indicated here).

Proactive Advice:

- Double-check the product description and intended use to ensure the most accurate HS code is applied.

- Consult with a customs broker or trade compliance expert if the product is complex or if you are unsure about the classification.

- Monitor any updates to trade policies after April 11, 2025, as they may affect your import costs significantly.

Customer Reviews

No reviews yet.