| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 5503200065 | Doc | 34.3% | CN | US | 2025-05-12 |

| 5505100040 | Doc | 55.0% | CN | US | 2025-05-12 |

| 5509410090 | Doc | 64.0% | CN | US | 2025-05-12 |

| 5509516000 | Doc | 65.6% | CN | US | 2025-05-12 |

| 6217909085 | Doc | 52.1% | CN | US | 2025-05-12 |

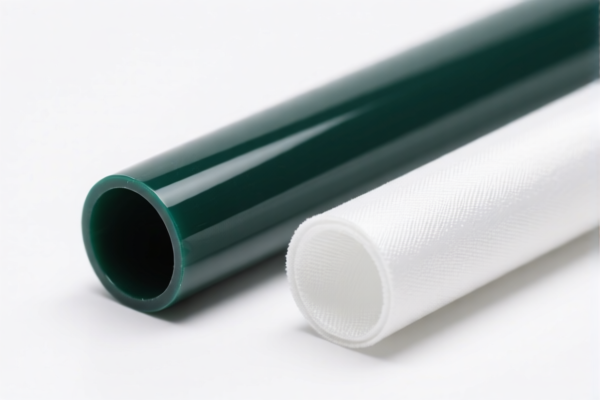

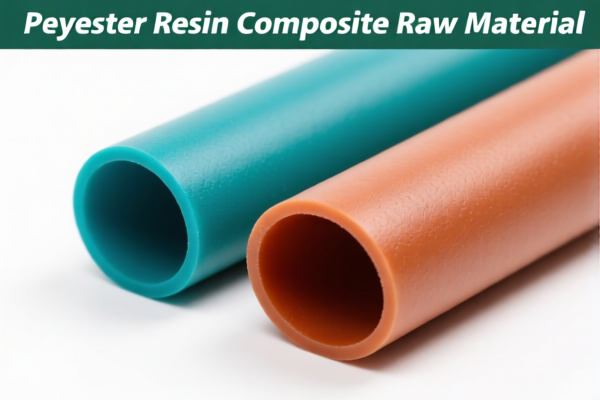

Here is the structured analysis and customs compliance information for the Polyester Resin Composite Raw Material based on the provided HS codes and tax details:

📌 HS CODE: 5503200065

Product Description: Polyester Short Fiber Composite Material

Total Tax Rate: 34.3%

- Base Tariff Rate: 4.3%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties: Not applicable

- Key Note: No additional tariffs currently, but a significant increase will apply after April 11, 2025.

- Action Required: Verify the exact composition and confirm if it falls under this category.

📌 HS CODE: 5505100040

Product Description: Polyester Fiber Mixed Regenerated Material

Total Tax Rate: 55.0%

- Base Tariff Rate: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties: Not applicable

- Key Note: High tax burden due to additional tariffs.

- Action Required: Confirm if the product is indeed a mixed regenerated material and not a different type of fiber.

📌 HS CODE: 5509410090

Product Description: Composite Polyester Yarn

Total Tax Rate: 64.0%

- Base Tariff Rate: 9.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties: Not applicable

- Key Note: One of the highest tax rates due to combined base and additional tariffs.

- Action Required: Ensure the product is classified correctly and not misclassified as a different type of yarn.

📌 HS CODE: 5509516000

Product Description: Polyester Blended Composite Yarn

Total Tax Rate: 65.6%

- Base Tariff Rate: 10.6%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties: Not applicable

- Key Note: Highest tax rate among the listed products.

- Action Required: Double-check the composition and confirm the correct HS code classification.

📌 HS CODE: 6217909085

Product Description: Polyester Clothing Accessories

Total Tax Rate: 52.1%

- Base Tariff Rate: 14.6%

- Additional Tariff: 7.5%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties: Not applicable

- Key Note: Moderate tax rate, but will increase significantly after April 11, 2025.

- Action Required: Confirm if the product is classified as an accessory and not a finished garment.

📌 General Recommendations:

- Verify Material Composition: Ensure the product is correctly classified based on its composition and form (e.g., fiber, yarn, fabric, or accessory).

- Check for Certifications: Some products may require specific certifications (e.g., textile certifications, environmental compliance).

- Monitor Tariff Changes: The April 11, 2025 tariff increase applies to all listed products. Plan accordingly for cost implications.

- Consult Customs Broker: For complex or high-value shipments, consult a customs broker or compliance expert to avoid delays or penalties.

Let me know if you need help with HS code verification or customs documentation. Here is the structured analysis and customs compliance information for the Polyester Resin Composite Raw Material based on the provided HS codes and tax details:

📌 HS CODE: 5503200065

Product Description: Polyester Short Fiber Composite Material

Total Tax Rate: 34.3%

- Base Tariff Rate: 4.3%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties: Not applicable

- Key Note: No additional tariffs currently, but a significant increase will apply after April 11, 2025.

- Action Required: Verify the exact composition and confirm if it falls under this category.

📌 HS CODE: 5505100040

Product Description: Polyester Fiber Mixed Regenerated Material

Total Tax Rate: 55.0%

- Base Tariff Rate: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties: Not applicable

- Key Note: High tax burden due to additional tariffs.

- Action Required: Confirm if the product is indeed a mixed regenerated material and not a different type of fiber.

📌 HS CODE: 5509410090

Product Description: Composite Polyester Yarn

Total Tax Rate: 64.0%

- Base Tariff Rate: 9.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties: Not applicable

- Key Note: One of the highest tax rates due to combined base and additional tariffs.

- Action Required: Ensure the product is classified correctly and not misclassified as a different type of yarn.

📌 HS CODE: 5509516000

Product Description: Polyester Blended Composite Yarn

Total Tax Rate: 65.6%

- Base Tariff Rate: 10.6%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties: Not applicable

- Key Note: Highest tax rate among the listed products.

- Action Required: Double-check the composition and confirm the correct HS code classification.

📌 HS CODE: 6217909085

Product Description: Polyester Clothing Accessories

Total Tax Rate: 52.1%

- Base Tariff Rate: 14.6%

- Additional Tariff: 7.5%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties: Not applicable

- Key Note: Moderate tax rate, but will increase significantly after April 11, 2025.

- Action Required: Confirm if the product is classified as an accessory and not a finished garment.

📌 General Recommendations:

- Verify Material Composition: Ensure the product is correctly classified based on its composition and form (e.g., fiber, yarn, fabric, or accessory).

- Check for Certifications: Some products may require specific certifications (e.g., textile certifications, environmental compliance).

- Monitor Tariff Changes: The April 11, 2025 tariff increase applies to all listed products. Plan accordingly for cost implications.

- Consult Customs Broker: For complex or high-value shipments, consult a customs broker or compliance expert to avoid delays or penalties.

Let me know if you need help with HS code verification or customs documentation.

Customer Reviews

No reviews yet.