| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3907915000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3907914000 | Doc | 60.8% | CN | US | 2025-05-12 |

| 3907995050 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3909505000 | Doc | 61.3% | CN | US | 2025-05-12 |

| 3907995050 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3824100000 | Doc | 61.0% | CN | US | 2025-05-12 |

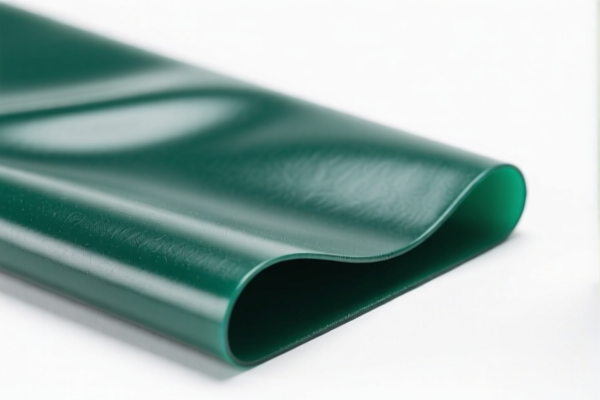

Product Classification: Polyester Resin Corrosion Resistant Raw Material

HS CODEs and Tax Information Overview:

- HS CODE: 3907915000

- Description: Corrosion-resistant unsaturated polyester resin, classified under HS CODE 39079090.

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This code is suitable for unsaturated polyester resins with corrosion resistance properties.

-

HS CODE: 3907914000

- Description: Corrosion-resistant unsaturated polyester resin, classified under HS CODE 39079000.

- Total Tax Rate: 60.8%

- Breakdown:

- Base Tariff: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: Slightly lower base tariff compared to 3907915000.

-

HS CODE: 3907995050

- Description: Heat-resistant polyester resin raw material, classified under HS CODE 39079090.

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This code applies to heat-resistant polyester resins, not just corrosion-resistant ones.

-

HS CODE: 3909505000

- Description: Polyurethane resin raw material, classified under HS CODE 3909.

- Total Tax Rate: 61.3%

- Breakdown:

- Base Tariff: 6.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This is for polyurethane resins, not polyester resins.

-

HS CODE: 3824100000

- Description: Casting corrosion-resistant resin, classified under HS CODE 3824.

- Total Tax Rate: 61.0%

- Breakdown:

- Base Tariff: 6.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This is for resins used in casting applications with corrosion resistance.

Key Notes and Recommendations:

-

April 11, 2025 Special Tariff:

A 30.0% additional tariff will be imposed on all the above HS codes after April 11, 2025. This is a time-sensitive policy and should be considered in cost planning. -

Anti-Dumping Duties:

No specific anti-dumping duties are mentioned for these HS codes, but it is advisable to check the latest customs announcements for any updates. -

Certifications and Documentation:

- Verify the material composition and technical specifications to ensure correct HS code classification.

- Confirm if certifications (e.g., safety, environmental compliance) are required for import.

-

Ensure accurate unit pricing and product description for customs declaration.

-

Proactive Action:

If your product is used in specialized applications (e.g., aerospace, chemical processing), consider consulting a customs broker or a classification expert to confirm the most accurate HS code and avoid delays in customs clearance. Product Classification: Polyester Resin Corrosion Resistant Raw Material

HS CODEs and Tax Information Overview: -

HS CODE: 3907915000

- Description: Corrosion-resistant unsaturated polyester resin, classified under HS CODE 39079090.

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This code is suitable for unsaturated polyester resins with corrosion resistance properties.

-

HS CODE: 3907914000

- Description: Corrosion-resistant unsaturated polyester resin, classified under HS CODE 39079000.

- Total Tax Rate: 60.8%

- Breakdown:

- Base Tariff: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: Slightly lower base tariff compared to 3907915000.

-

HS CODE: 3907995050

- Description: Heat-resistant polyester resin raw material, classified under HS CODE 39079090.

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This code applies to heat-resistant polyester resins, not just corrosion-resistant ones.

-

HS CODE: 3909505000

- Description: Polyurethane resin raw material, classified under HS CODE 3909.

- Total Tax Rate: 61.3%

- Breakdown:

- Base Tariff: 6.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This is for polyurethane resins, not polyester resins.

-

HS CODE: 3824100000

- Description: Casting corrosion-resistant resin, classified under HS CODE 3824.

- Total Tax Rate: 61.0%

- Breakdown:

- Base Tariff: 6.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This is for resins used in casting applications with corrosion resistance.

Key Notes and Recommendations:

-

April 11, 2025 Special Tariff:

A 30.0% additional tariff will be imposed on all the above HS codes after April 11, 2025. This is a time-sensitive policy and should be considered in cost planning. -

Anti-Dumping Duties:

No specific anti-dumping duties are mentioned for these HS codes, but it is advisable to check the latest customs announcements for any updates. -

Certifications and Documentation:

- Verify the material composition and technical specifications to ensure correct HS code classification.

- Confirm if certifications (e.g., safety, environmental compliance) are required for import.

-

Ensure accurate unit pricing and product description for customs declaration.

-

Proactive Action:

If your product is used in specialized applications (e.g., aerospace, chemical processing), consider consulting a customs broker or a classification expert to confirm the most accurate HS code and avoid delays in customs clearance.

Customer Reviews

No reviews yet.