| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3907995050 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3907290000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3908902000 | Doc | 55.0% | CN | US | 2025-05-12 |

| 3902900010 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3902100000 | Doc | 61.5% | CN | US | 2025-05-12 |

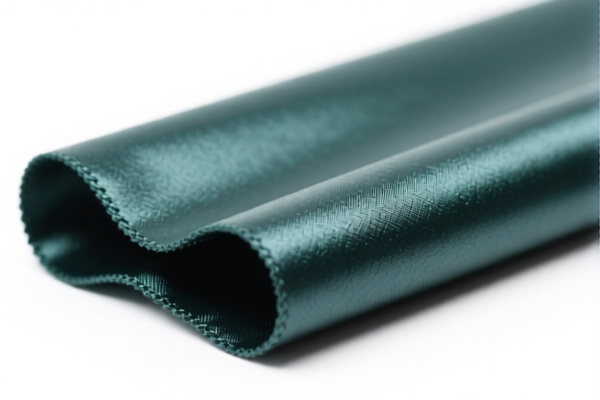

Product Name: Polyester Resin Enhanced Raw Material

Classification HS Code: Based on the provided data, the product may fall under several HS codes depending on the specific type of resin and its composition. Below is a structured analysis of the relevant HS codes and their associated tariff rates.

🔍 HS Code Classification Overview

- HS Code 3907995050

- Description: Polyester resin plasticizer, classified under "Other polyesters" in Chapter 3907.

- Tariff Details:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Total Tax Rate: 61.5%

-

HS Code 3907290000

- Description: Polyether resin reinforced material, classified under "Other polyethers" in Chapter 3907.

- Tariff Details:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Total Tax Rate: 61.5%

-

HS Code 3907400000

- Description: Polycarbonate resin reinforced composite, classified under polyesters in Chapter 3907.

- Tariff Details:

- Base Tariff: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Total Tax Rate: 60.8%

-

HS Code 3902900010

- Description: Polybutene resin reinforced material, classified under polyolefins in Chapter 3902.

- Tariff Details:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Total Tax Rate: 61.5%

-

HS Code 3902100000

- Description: Polypropylene (PP) resin reinforced material, classified under polyolefins in Chapter 3902.

- Tariff Details:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

⚠️ Important Notes and Alerts

-

April 11, 2025 Special Tariff:

A 30.0% additional tariff will be applied to all the above HS codes after April 11, 2025. This is a time-sensitive policy and must be considered in your customs planning. -

Anti-Dumping Duties:

If the product contains iron or aluminum components, additional anti-dumping duties may apply. These are not included in the base or additional tariffs listed above and require further verification.

📌 Proactive Advice for Importers

-

Verify Material Composition:

Confirm the exact chemical composition and whether the product is in primary form or reinforced composite. This will determine the correct HS code. -

Check Unit Price and Certification:

Ensure that the unit price and certifications (e.g., REACH, RoHS, etc.) are in compliance with import regulations. -

Consult Customs Broker:

For complex classifications, especially if the product contains multiple components, it is advisable to consult a customs broker or classification expert to avoid misclassification penalties. -

Monitor Tariff Updates:

Stay updated on tariff changes, especially the April 11, 2025 deadline, to avoid unexpected costs.

Let me know if you need help determining the most accurate HS code for your specific product.

Product Name: Polyester Resin Enhanced Raw Material

Classification HS Code: Based on the provided data, the product may fall under several HS codes depending on the specific type of resin and its composition. Below is a structured analysis of the relevant HS codes and their associated tariff rates.

🔍 HS Code Classification Overview

- HS Code 3907995050

- Description: Polyester resin plasticizer, classified under "Other polyesters" in Chapter 3907.

- Tariff Details:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Total Tax Rate: 61.5%

-

HS Code 3907290000

- Description: Polyether resin reinforced material, classified under "Other polyethers" in Chapter 3907.

- Tariff Details:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Total Tax Rate: 61.5%

-

HS Code 3907400000

- Description: Polycarbonate resin reinforced composite, classified under polyesters in Chapter 3907.

- Tariff Details:

- Base Tariff: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Total Tax Rate: 60.8%

-

HS Code 3902900010

- Description: Polybutene resin reinforced material, classified under polyolefins in Chapter 3902.

- Tariff Details:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Total Tax Rate: 61.5%

-

HS Code 3902100000

- Description: Polypropylene (PP) resin reinforced material, classified under polyolefins in Chapter 3902.

- Tariff Details:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

⚠️ Important Notes and Alerts

-

April 11, 2025 Special Tariff:

A 30.0% additional tariff will be applied to all the above HS codes after April 11, 2025. This is a time-sensitive policy and must be considered in your customs planning. -

Anti-Dumping Duties:

If the product contains iron or aluminum components, additional anti-dumping duties may apply. These are not included in the base or additional tariffs listed above and require further verification.

📌 Proactive Advice for Importers

-

Verify Material Composition:

Confirm the exact chemical composition and whether the product is in primary form or reinforced composite. This will determine the correct HS code. -

Check Unit Price and Certification:

Ensure that the unit price and certifications (e.g., REACH, RoHS, etc.) are in compliance with import regulations. -

Consult Customs Broker:

For complex classifications, especially if the product contains multiple components, it is advisable to consult a customs broker or classification expert to avoid misclassification penalties. -

Monitor Tariff Updates:

Stay updated on tariff changes, especially the April 11, 2025 deadline, to avoid unexpected costs.

Let me know if you need help determining the most accurate HS code for your specific product.

Customer Reviews

No reviews yet.