| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3907995050 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3907992000 | Doc | 55.0% | CN | US | 2025-05-12 |

| 3909505000 | Doc | 61.3% | CN | US | 2025-05-12 |

| 5402620000 | Doc | 62.5% | CN | US | 2025-05-12 |

| 3907995050 | Doc | 61.5% | CN | US | 2025-05-12 |

Product Classification and Customs Duty Analysis for Polyester Resin High Temperature Resistant Raw Material

Below is the detailed breakdown of the HS codes and associated customs duties for the declared product:

✅ HS CODE: 3907995050

Product Description:

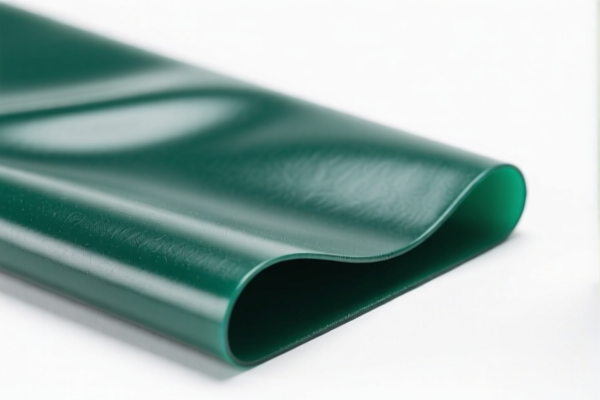

- High-temperature resistant polyester resin raw material, classified under HS code 39079090, as a primary form of polyester resin.

Tariff Summary:

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Key Notes:

- This code is repeated in the input, but the classification and tax details remain consistent.

✅ HS CODE: 3907992000

Product Description:

- Thermoplastic polyester resin raw material, classified under HS code 3907.99.00.00, as a thermoplastic liquid crystal aromatic polyester copolymer.

Tariff Summary:

- Total Tax Rate: 55.0%

- Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Key Notes:

- Lower base tariff compared to 3907995050, but the additional and special tariffs are the same.

✅ HS CODE: 3909505000

Product Description:

- Polyurethane resin raw material, classified under HS code 3909, as a primary form of amino resins, phenolic resins, and polyurethanes.

Tariff Summary:

- Total Tax Rate: 61.3%

- Breakdown:

- Base Tariff: 6.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Key Notes:

- Slightly lower base tariff than 3907995050, but overall tax rate is very similar.

✅ HS CODE: 5402620000

Product Description:

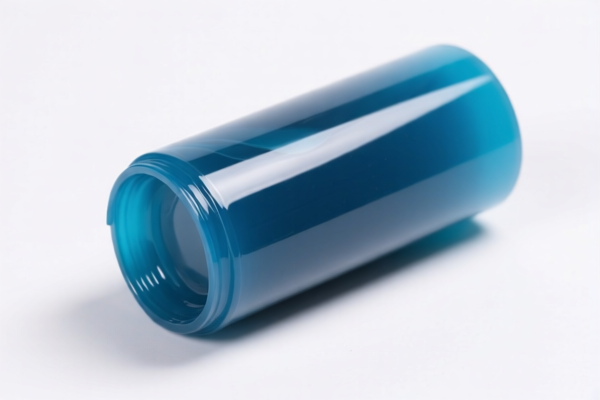

- High-temperature resistant polyester filament, classified under HS code 5402620000, as polyester fiber yarn.

Tariff Summary:

- Total Tax Rate: 62.5%

- Breakdown:

- Base Tariff: 7.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Key Notes:

- This is a fiber product, not a resin raw material, but may be relevant if the product is in yarn form.

📌 Important Alerts and Recommendations:

- April 11, 2025 Special Tariff:

-

All listed HS codes will be subject to an additional 30.0% tariff after April 11, 2025. This is a critical date to note for import planning.

-

Anti-Dumping Duties:

-

No specific anti-dumping duties are mentioned for this product category in the provided data. However, it is advisable to verify if any anti-dumping measures apply to polyester resins or related materials.

-

Certifications and Documentation:

-

Ensure that the product is correctly classified and that all necessary documentation (e.g., material specifications, origin certificates) is in place to avoid delays or penalties.

-

Verify Material and Unit Price:

- Confirm the exact chemical composition and form of the resin (e.g., whether it is a thermoplastic, thermoset, or modified polyester) to ensure correct HS code selection.

📌 Proactive Advice:

- Double-check the HS code with customs authorities or a qualified customs broker to ensure compliance.

- Monitor policy updates after April 11, 2025, as the special tariff may affect cost structures.

- Consider alternative materials or sourcing strategies if the high tariff rate poses a significant cost burden.

Let me know if you need help with HS code verification or customs documentation. Product Classification and Customs Duty Analysis for Polyester Resin High Temperature Resistant Raw Material

Below is the detailed breakdown of the HS codes and associated customs duties for the declared product:

✅ HS CODE: 3907995050

Product Description:

- High-temperature resistant polyester resin raw material, classified under HS code 39079090, as a primary form of polyester resin.

Tariff Summary:

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Key Notes:

- This code is repeated in the input, but the classification and tax details remain consistent.

✅ HS CODE: 3907992000

Product Description:

- Thermoplastic polyester resin raw material, classified under HS code 3907.99.00.00, as a thermoplastic liquid crystal aromatic polyester copolymer.

Tariff Summary:

- Total Tax Rate: 55.0%

- Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Key Notes:

- Lower base tariff compared to 3907995050, but the additional and special tariffs are the same.

✅ HS CODE: 3909505000

Product Description:

- Polyurethane resin raw material, classified under HS code 3909, as a primary form of amino resins, phenolic resins, and polyurethanes.

Tariff Summary:

- Total Tax Rate: 61.3%

- Breakdown:

- Base Tariff: 6.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Key Notes:

- Slightly lower base tariff than 3907995050, but overall tax rate is very similar.

✅ HS CODE: 5402620000

Product Description:

- High-temperature resistant polyester filament, classified under HS code 5402620000, as polyester fiber yarn.

Tariff Summary:

- Total Tax Rate: 62.5%

- Breakdown:

- Base Tariff: 7.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Key Notes:

- This is a fiber product, not a resin raw material, but may be relevant if the product is in yarn form.

📌 Important Alerts and Recommendations:

- April 11, 2025 Special Tariff:

-

All listed HS codes will be subject to an additional 30.0% tariff after April 11, 2025. This is a critical date to note for import planning.

-

Anti-Dumping Duties:

-

No specific anti-dumping duties are mentioned for this product category in the provided data. However, it is advisable to verify if any anti-dumping measures apply to polyester resins or related materials.

-

Certifications and Documentation:

-

Ensure that the product is correctly classified and that all necessary documentation (e.g., material specifications, origin certificates) is in place to avoid delays or penalties.

-

Verify Material and Unit Price:

- Confirm the exact chemical composition and form of the resin (e.g., whether it is a thermoplastic, thermoset, or modified polyester) to ensure correct HS code selection.

📌 Proactive Advice:

- Double-check the HS code with customs authorities or a qualified customs broker to ensure compliance.

- Monitor policy updates after April 11, 2025, as the special tariff may affect cost structures.

- Consider alternative materials or sourcing strategies if the high tariff rate poses a significant cost burden.

Let me know if you need help with HS code verification or customs documentation.

Customer Reviews

No reviews yet.