| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3907995050 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3902900010 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3907290000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3911902500 | Doc | 61.1% | CN | US | 2025-05-12 |

| 3907995050 | Doc | 61.5% | CN | US | 2025-05-12 |

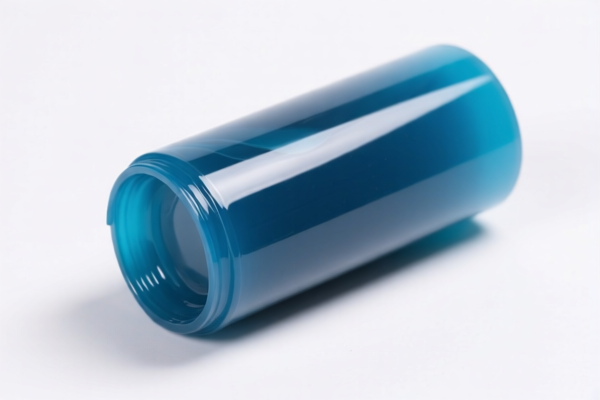

Product Classification and Customs Duty Analysis for Polyester Resin Low Volatility Raw Material

✅ HS CODE: 3907995050

Product Description: Polyester Resin Raw Material (Low Volatility)

Classification Summary:

- Falls under HS CODE 3907995050, which is part of the "Other polyesters" category under 3907.90.90.

- This code applies to primary forms of polyester resins, including low volatility raw materials.

📊 Tariff Breakdown

- Base Tariff Rate: 6.5%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tariff Rate: 61.5%

⚠️ Important Notes

- April 11, 2025 Special Tariff: A 30% additional tariff will be applied after April 11, 2025. Ensure your import timeline is aligned with this policy.

- No Anti-Dumping Duties: No specific anti-dumping duties are currently applicable for this product category.

- Certifications Required: Confirm if any technical specifications, safety data sheets (SDS), or environmental compliance documents are required for customs clearance.

📌 Proactive Advice

- Verify Material Specifications: Ensure the product is indeed in primary form (not processed or modified) to maintain correct classification.

- Check Unit Price: Confirm the unit price and quantity for accurate duty calculation.

- Consult Customs Broker: For large shipments or complex product formulations, consider engaging a customs broker for detailed compliance checks.

📌 Alternative HS CODEs for Similar Products

- 3902900010 – Polybutene Resin (Low Flow)

- 3907290000 – Polyether Resin (Low Molecular Weight)

- 3911902500 – Aromatic Resin (Low Volatility) – Tariff: 61.1%

📌 Summary of Key Differences

| HS CODE | Product Type | Total Tariff | Notes |

|---|---|---|---|

| 3907995050 | Polyester Resin (Low Volatility) | 61.5% | Applies to primary polyester resins |

| 3911902500 | Aromatic Resin | 61.1% | Contains aromatic monomers |

If you have further details on the product’s chemical structure or intended use, I can provide a more tailored classification and compliance strategy. Product Classification and Customs Duty Analysis for Polyester Resin Low Volatility Raw Material

✅ HS CODE: 3907995050

Product Description: Polyester Resin Raw Material (Low Volatility)

Classification Summary:

- Falls under HS CODE 3907995050, which is part of the "Other polyesters" category under 3907.90.90.

- This code applies to primary forms of polyester resins, including low volatility raw materials.

📊 Tariff Breakdown

- Base Tariff Rate: 6.5%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tariff Rate: 61.5%

⚠️ Important Notes

- April 11, 2025 Special Tariff: A 30% additional tariff will be applied after April 11, 2025. Ensure your import timeline is aligned with this policy.

- No Anti-Dumping Duties: No specific anti-dumping duties are currently applicable for this product category.

- Certifications Required: Confirm if any technical specifications, safety data sheets (SDS), or environmental compliance documents are required for customs clearance.

📌 Proactive Advice

- Verify Material Specifications: Ensure the product is indeed in primary form (not processed or modified) to maintain correct classification.

- Check Unit Price: Confirm the unit price and quantity for accurate duty calculation.

- Consult Customs Broker: For large shipments or complex product formulations, consider engaging a customs broker for detailed compliance checks.

📌 Alternative HS CODEs for Similar Products

- 3902900010 – Polybutene Resin (Low Flow)

- 3907290000 – Polyether Resin (Low Molecular Weight)

- 3911902500 – Aromatic Resin (Low Volatility) – Tariff: 61.1%

📌 Summary of Key Differences

| HS CODE | Product Type | Total Tariff | Notes |

|---|---|---|---|

| 3907995050 | Polyester Resin (Low Volatility) | 61.5% | Applies to primary polyester resins |

| 3911902500 | Aromatic Resin | 61.1% | Contains aromatic monomers |

If you have further details on the product’s chemical structure or intended use, I can provide a more tailored classification and compliance strategy.

Customer Reviews

No reviews yet.