| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3907995050 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3907995050 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3920690000 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3920690000 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3902900010 | Doc | 61.5% | CN | US | 2025-05-12 |

Product Classification and Customs Tariff Analysis for Polyester Resin Raw Materials and Related Products

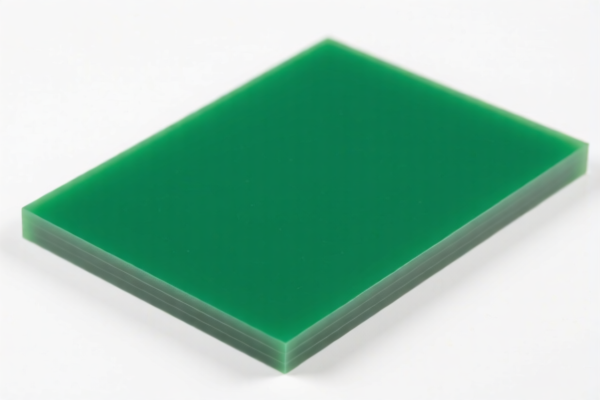

HS CODE: 3907995050

Product Description:

- Polyester Resin Raw Material

- Polyester Resin Granules Raw Material

Tariff Breakdown:

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

Key Notes:

- This code applies to raw materials used in the production of polyester resins, including granules.

- The high total tax rate is due to the combination of base, additional, and special tariffs.

- Alert: The 30.0% special tariff applies after April 11, 2025 — ensure compliance with updated regulations if importing after this date.

Proactive Advice:

- Confirm the exact chemical composition and form (e.g., powder, granules) of the raw material to ensure correct classification.

- Check if any specific certifications (e.g., REACH, RoHS) are required for import.

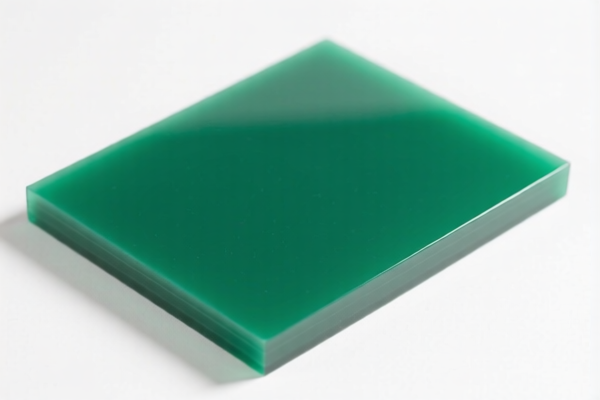

HS CODE: 3920690000

Product Description:

- Polyester Resin Plastic Sheet

- Polyester Board

Tariff Breakdown:

- Base Tariff Rate: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 59.2%

Key Notes:

- This code applies to finished polyester resin sheets or boards, typically used in industrial or construction applications.

- The base tariff is lower than for raw materials, but the additional and special tariffs still contribute significantly to the total tax.

- Alert: The 30.0% special tariff applies after April 11, 2025 — ensure compliance with updated regulations if importing after this date.

Proactive Advice:

- Verify the product’s end-use and whether it falls under any preferential trade agreements.

- Confirm the product’s thickness, composition, and intended application to avoid misclassification.

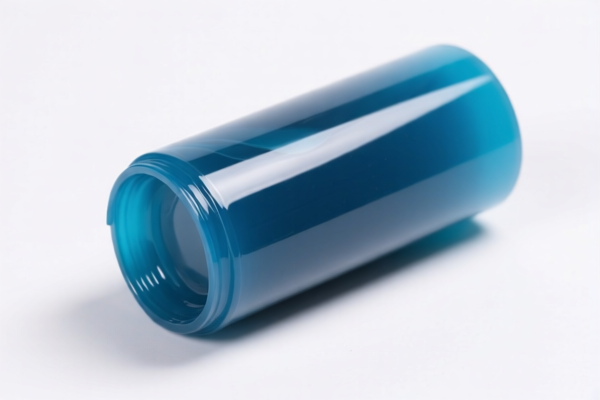

HS CODE: 3902900010

Product Description:

- Polybutene Resin Sheet Raw Material

Tariff Breakdown:

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

Key Notes:

- This code applies to raw materials used in the production of polybutene resin sheets.

- The tax structure is similar to that of polyester resin raw materials.

- Alert: The 30.0% special tariff applies after April 11, 2025 — ensure compliance with updated regulations if importing after this date.

Proactive Advice:

- Confirm the exact chemical name and form of the raw material.

- Check if the product is subject to any anti-dumping or countervailing duties.

General Recommendations:

- Verify Material Specifications: Ensure the product description matches the HS code classification.

- Check for Certifications: Some products may require specific documentation (e.g., Material Safety Data Sheets, import licenses).

- Monitor Tariff Updates: The 30.0% special tariff after April 11, 2025 is a critical date — plan accordingly.

- Consult a Customs Broker: For complex or high-value imports, professional assistance is recommended to avoid delays or penalties. Product Classification and Customs Tariff Analysis for Polyester Resin Raw Materials and Related Products

HS CODE: 3907995050

Product Description:

- Polyester Resin Raw Material

- Polyester Resin Granules Raw Material

Tariff Breakdown:

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

Key Notes:

- This code applies to raw materials used in the production of polyester resins, including granules.

- The high total tax rate is due to the combination of base, additional, and special tariffs.

- Alert: The 30.0% special tariff applies after April 11, 2025 — ensure compliance with updated regulations if importing after this date.

Proactive Advice:

- Confirm the exact chemical composition and form (e.g., powder, granules) of the raw material to ensure correct classification.

- Check if any specific certifications (e.g., REACH, RoHS) are required for import.

HS CODE: 3920690000

Product Description:

- Polyester Resin Plastic Sheet

- Polyester Board

Tariff Breakdown:

- Base Tariff Rate: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 59.2%

Key Notes:

- This code applies to finished polyester resin sheets or boards, typically used in industrial or construction applications.

- The base tariff is lower than for raw materials, but the additional and special tariffs still contribute significantly to the total tax.

- Alert: The 30.0% special tariff applies after April 11, 2025 — ensure compliance with updated regulations if importing after this date.

Proactive Advice:

- Verify the product’s end-use and whether it falls under any preferential trade agreements.

- Confirm the product’s thickness, composition, and intended application to avoid misclassification.

HS CODE: 3902900010

Product Description:

- Polybutene Resin Sheet Raw Material

Tariff Breakdown:

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

Key Notes:

- This code applies to raw materials used in the production of polybutene resin sheets.

- The tax structure is similar to that of polyester resin raw materials.

- Alert: The 30.0% special tariff applies after April 11, 2025 — ensure compliance with updated regulations if importing after this date.

Proactive Advice:

- Confirm the exact chemical name and form of the raw material.

- Check if the product is subject to any anti-dumping or countervailing duties.

General Recommendations:

- Verify Material Specifications: Ensure the product description matches the HS code classification.

- Check for Certifications: Some products may require specific documentation (e.g., Material Safety Data Sheets, import licenses).

- Monitor Tariff Updates: The 30.0% special tariff after April 11, 2025 is a critical date — plan accordingly.

- Consult a Customs Broker: For complex or high-value imports, professional assistance is recommended to avoid delays or penalties.

Customer Reviews

No reviews yet.