| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3907995050 | Doc | 61.5% | CN | US | 2025-05-12 |

| 5601220091 | Doc | 61.3% | CN | US | 2025-05-12 |

| 5507000000 | Doc | 60.0% | CN | US | 2025-05-12 |

| 5507000000 | Doc | 60.0% | CN | US | 2025-05-12 |

| 5405006000 | Doc | 60.8% | CN | US | 2025-05-12 |

Product Classification and Customs Tariff Analysis for Polyester Resin for Fiber

Below is the detailed breakdown of the HS codes and associated tariffs for the declared product "Polyester Resin for Fiber":

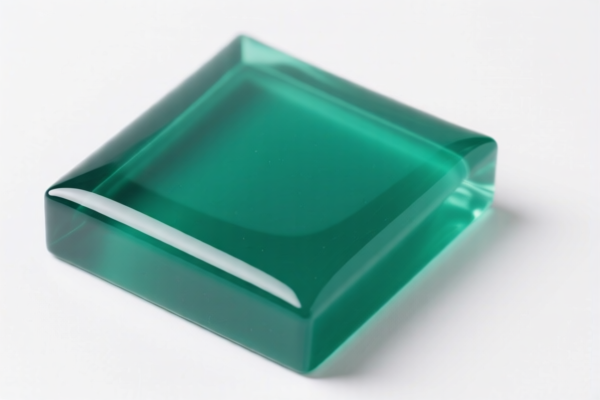

🔍 HS CODE: 3907995050

Product Description: Fiber-grade polyester resin

Total Tax Rate: 61.5%

Tariff Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Key Notes:

- This code is specific to fiber-grade polyester resin, which is used in the production of synthetic fibers.

- The April 11, 2025 special tariff is a significant increase, so monitor the import date to avoid unexpected costs.

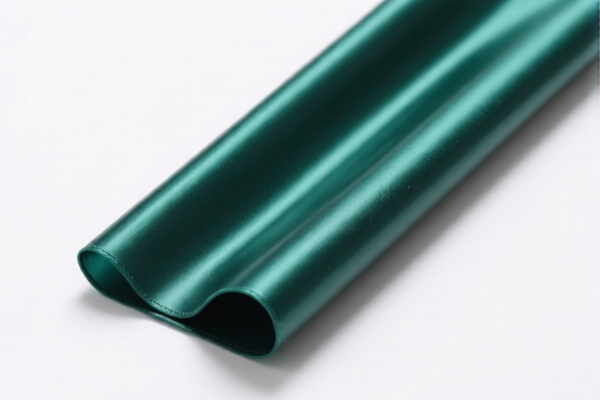

🔍 HS CODE: 5601220091

Product Description: Polyester fiber (textile use)

Total Tax Rate: 61.3%

Tariff Breakdown:

- Base Tariff: 6.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Key Notes:

- This code is for polyester fiber used in textiles.

- The April 11, 2025 special tariff applies here as well. Ensure product specifications align with this classification.

🔍 HS CODE: 5507000000

Product Description:

- Sub-Category 1: Textile-use polyester fiber

- Sub-Category 2: Apparel-use polyester fiber

Total Tax Rate: 60.0%

Tariff Breakdown:

- Base Tariff: 5.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Key Notes:

- This code is used for both textile and apparel applications.

- The April 11, 2025 special tariff applies to both subcategories.

- Verify the end-use of the fiber to ensure correct classification.

🔍 HS CODE: 5405006000

Product Description: Polyester fiber for construction use

Total Tax Rate: 60.8%

Tariff Breakdown:

- Base Tariff: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Key Notes:

- This code is for polyester fiber used in construction.

- The April 11, 2025 special tariff applies here too.

- Check the intended application of the fiber to ensure proper classification.

📌 Proactive Advice for Importers:

- Verify Material Specifications: Ensure the product is correctly classified based on its end-use (e.g., textile, apparel, construction).

- Check Unit Price and Quantity: Tariff calculations may vary based on import value and quantity.

- Review Required Certifications: Some products may require technical documentation, origin certificates, or compliance with environmental standards.

- Monitor April 11, 2025 Deadline: If importing after this date, be prepared for higher tariffs.

- Consult Customs Broker: For complex classifications or large shipments, seek professional customs advice to avoid delays or penalties.

Let me know if you need help with certification requirements or customs documentation for any of these HS codes. Product Classification and Customs Tariff Analysis for Polyester Resin for Fiber

Below is the detailed breakdown of the HS codes and associated tariffs for the declared product "Polyester Resin for Fiber":

🔍 HS CODE: 3907995050

Product Description: Fiber-grade polyester resin

Total Tax Rate: 61.5%

Tariff Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Key Notes:

- This code is specific to fiber-grade polyester resin, which is used in the production of synthetic fibers.

- The April 11, 2025 special tariff is a significant increase, so monitor the import date to avoid unexpected costs.

🔍 HS CODE: 5601220091

Product Description: Polyester fiber (textile use)

Total Tax Rate: 61.3%

Tariff Breakdown:

- Base Tariff: 6.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Key Notes:

- This code is for polyester fiber used in textiles.

- The April 11, 2025 special tariff applies here as well. Ensure product specifications align with this classification.

🔍 HS CODE: 5507000000

Product Description:

- Sub-Category 1: Textile-use polyester fiber

- Sub-Category 2: Apparel-use polyester fiber

Total Tax Rate: 60.0%

Tariff Breakdown:

- Base Tariff: 5.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Key Notes:

- This code is used for both textile and apparel applications.

- The April 11, 2025 special tariff applies to both subcategories.

- Verify the end-use of the fiber to ensure correct classification.

🔍 HS CODE: 5405006000

Product Description: Polyester fiber for construction use

Total Tax Rate: 60.8%

Tariff Breakdown:

- Base Tariff: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Key Notes:

- This code is for polyester fiber used in construction.

- The April 11, 2025 special tariff applies here too.

- Check the intended application of the fiber to ensure proper classification.

📌 Proactive Advice for Importers:

- Verify Material Specifications: Ensure the product is correctly classified based on its end-use (e.g., textile, apparel, construction).

- Check Unit Price and Quantity: Tariff calculations may vary based on import value and quantity.

- Review Required Certifications: Some products may require technical documentation, origin certificates, or compliance with environmental standards.

- Monitor April 11, 2025 Deadline: If importing after this date, be prepared for higher tariffs.

- Consult Customs Broker: For complex classifications or large shipments, seek professional customs advice to avoid delays or penalties.

Let me know if you need help with certification requirements or customs documentation for any of these HS codes.

Customer Reviews

No reviews yet.