| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 5408330510 | Doc | 74.6% | CN | US | 2025-05-12 |

| 5515910010 | Doc | 67.0% | CN | US | 2025-05-12 |

| 5408329010 | Doc | 70.0% | CN | US | 2025-05-12 |

| 5408311000 | Doc | 67.0% | CN | US | 2025-05-12 |

| 6204433010 | Doc | 52.4% | CN | US | 2025-05-12 |

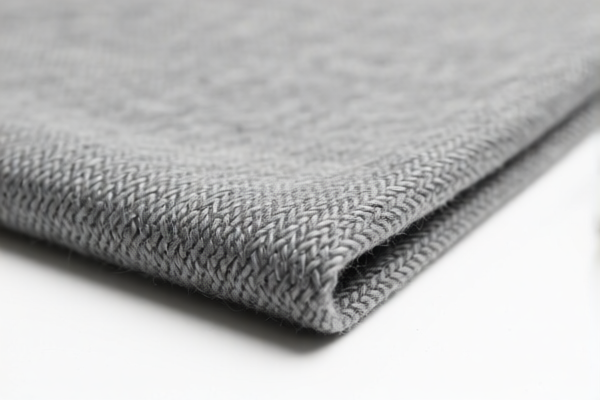

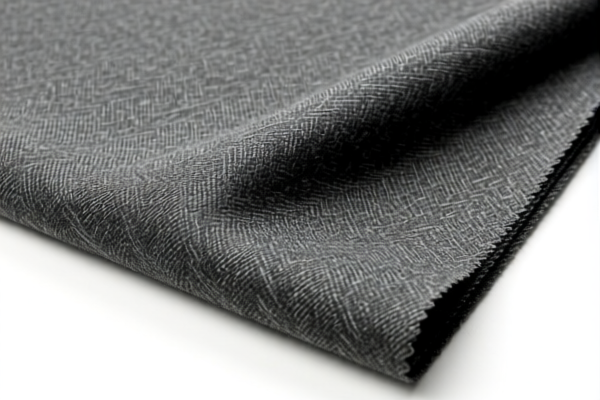

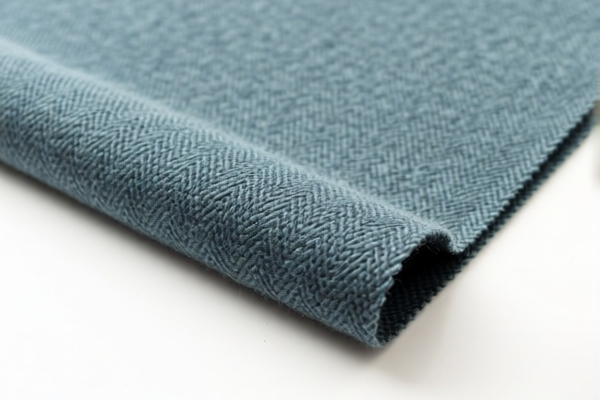

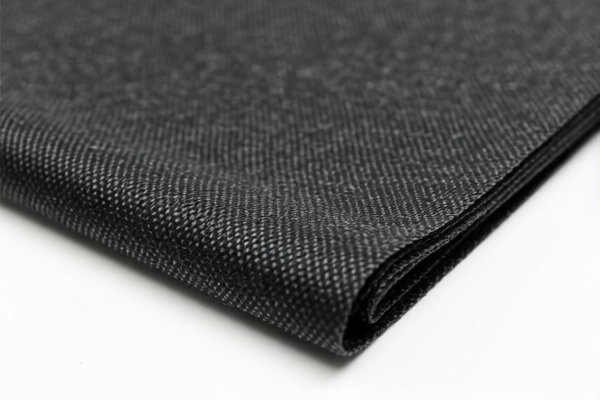

Product Name: Polyester/Viscose Blended Combed Wool Woven Fabric

Classification Analysis and Tax Information:

- HS CODE: 5408.33.05.10

- Applicable to: Wool/polyester blended woven fabric where polyester content is 36% or more.

- Total Tax Rate: 74.6%

- Base Tariff: 19.6%

- Additional Tariff: 25.0%

- Special Tariff after April 2, 2025: 30.0%

-

Note: This is the most likely HS code for your product, assuming the polyester content is 36% or more and the fabric is woven.

-

Other Possible HS Codes:

-

5515.91.00.10 – For polyester/acrylic blended woven fabric.

- Total Tax Rate: 67.0%

- Base Tariff: 12.0%

- Additional Tariff: 25.0%

- Special Tariff after April 2, 2025: 30.0%

- Note: Not applicable if the fabric contains wool or viscose.

-

5408.32.90.10 – For man-made fiber filament blended woven fabric (e.g., polyester/acrylic).

- Total Tax Rate: 70.0%

- Base Tariff: 15.0%

- Additional Tariff: 25.0%

- Special Tariff after April 2, 2025: 30.0%

- Note: Not applicable if the fabric contains wool or viscose.

-

5408.31.10.00 – For wool/polypropylene blended woven fabric.

- Total Tax Rate: 67.0%

- Base Tariff: 12.0%

- Additional Tariff: 25.0%

- Special Tariff after April 2, 2025: 30.0%

- Note: Not applicable if the fabric contains viscose.

-

6204.43.30.10 – For women's clothing made of synthetic fibers (e.g., dresses).

- Total Tax Rate: 52.4%

- Base Tariff: 14.9%

- Additional Tariff: 7.5%

- Special Tariff after April 2, 2025: 30.0%

- Note: This is for finished products, not fabric. Not applicable for raw fabric classification.

✅ Proactive Advice:

- Verify Material Composition: Confirm the exact percentage of polyester and viscose in the fabric. If polyester is 36% or more, then HS CODE 5408.33.05.10 is the correct classification.

- Check Unit Price and Certification: If the fabric is being imported for commercial use, ensure you have the necessary documentation (e.g., composition certificates, origin certificates).

- Be Aware of Tariff Changes: The special tariff of 30% will apply after April 2, 2025. If your import is scheduled after this date, the total tax rate will increase significantly.

- Consider Anti-Dumping Duties: If the fabric contains iron or aluminum components (unlikely in this case), additional anti-dumping duties may apply. However, this is not relevant for textile fabrics.

📌 Summary:

- Recommended HS Code: 5408.33.05.10

- Total Tax Rate: 74.6% (19.6% base + 25% additional + 30% special after April 2, 2025)

-

Action Required: Confirm fabric composition and prepare documentation for customs clearance. Product Name: Polyester/Viscose Blended Combed Wool Woven Fabric

Classification Analysis and Tax Information: -

HS CODE: 5408.33.05.10

- Applicable to: Wool/polyester blended woven fabric where polyester content is 36% or more.

- Total Tax Rate: 74.6%

- Base Tariff: 19.6%

- Additional Tariff: 25.0%

- Special Tariff after April 2, 2025: 30.0%

-

Note: This is the most likely HS code for your product, assuming the polyester content is 36% or more and the fabric is woven.

-

Other Possible HS Codes:

-

5515.91.00.10 – For polyester/acrylic blended woven fabric.

- Total Tax Rate: 67.0%

- Base Tariff: 12.0%

- Additional Tariff: 25.0%

- Special Tariff after April 2, 2025: 30.0%

- Note: Not applicable if the fabric contains wool or viscose.

-

5408.32.90.10 – For man-made fiber filament blended woven fabric (e.g., polyester/acrylic).

- Total Tax Rate: 70.0%

- Base Tariff: 15.0%

- Additional Tariff: 25.0%

- Special Tariff after April 2, 2025: 30.0%

- Note: Not applicable if the fabric contains wool or viscose.

-

5408.31.10.00 – For wool/polypropylene blended woven fabric.

- Total Tax Rate: 67.0%

- Base Tariff: 12.0%

- Additional Tariff: 25.0%

- Special Tariff after April 2, 2025: 30.0%

- Note: Not applicable if the fabric contains viscose.

-

6204.43.30.10 – For women's clothing made of synthetic fibers (e.g., dresses).

- Total Tax Rate: 52.4%

- Base Tariff: 14.9%

- Additional Tariff: 7.5%

- Special Tariff after April 2, 2025: 30.0%

- Note: This is for finished products, not fabric. Not applicable for raw fabric classification.

✅ Proactive Advice:

- Verify Material Composition: Confirm the exact percentage of polyester and viscose in the fabric. If polyester is 36% or more, then HS CODE 5408.33.05.10 is the correct classification.

- Check Unit Price and Certification: If the fabric is being imported for commercial use, ensure you have the necessary documentation (e.g., composition certificates, origin certificates).

- Be Aware of Tariff Changes: The special tariff of 30% will apply after April 2, 2025. If your import is scheduled after this date, the total tax rate will increase significantly.

- Consider Anti-Dumping Duties: If the fabric contains iron or aluminum components (unlikely in this case), additional anti-dumping duties may apply. However, this is not relevant for textile fabrics.

📌 Summary:

- Recommended HS Code: 5408.33.05.10

- Total Tax Rate: 74.6% (19.6% base + 25% additional + 30% special after April 2, 2025)

- Action Required: Confirm fabric composition and prepare documentation for customs clearance.

Customer Reviews

No reviews yet.